Once Apple (AAPL) sinks its claws into you, you're all but trapped...

Once Apple (AAPL) sinks its claws into you, you're all but trapped...

Your Apple Watch links up to your music library... and allows you to read and respond to iMessages. It's easy to sync content between your MacBook and iPad, which can also act as a second screen.

And don't even consider ditching your iPhone for an Android. Those green text bubbles would turn you into an outcast... barring you from group chats and subjecting you to jokes about subpar emojis.

Apple has more than 2 billion products in circulation today. It has spent decades building out a seamless ecosystem. And for many of its users, the hassle of setting up a new phone, a new computer, and learning a new system is just not worth it.

The tech titan doesn't dominate the scene because its products are that much better. (I'll leave that debate to the Apple-versus-PC fanatics.) Instead, it has locked in years of strong returns because for most consumers, the cost of switching is simply too high.

The idea of leaving would give most folks a migraine. They'd rather stay in Apple's ecosystem than endure that pain... even if it means paying a premium for new products every few years.

As I'll explain today, Apple is a prime example of a business with a key competitive advantage... but it's not the only one.

Competitive advantages are your investing 'secret weapon'...

Competitive advantages are your investing 'secret weapon'...

A lot of times, investors get too caught up in the minutiae. They want to know "how a company makes money"... So they focus on why its products or widgets are slightly better than its competitors'.

But having slightly better products isn't always what makes a company sing...

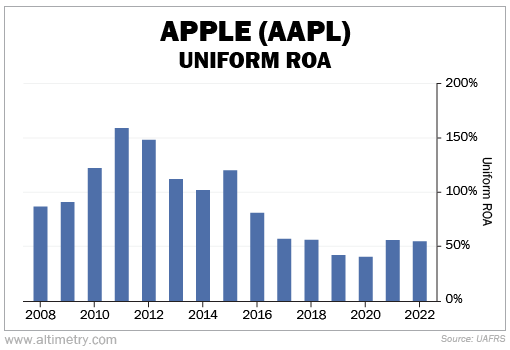

For instance, Apple's Uniform return on assets ("ROA") has been above 40%, year in and year out, for the past decade and a half. That's more than triple the corporate average.

Take a look...

If you believe that Apple's dominance is because its products are that much better... the company would need to stay ahead of its competitors in terms of innovation. It's the only way it could keep churning out those high returns.

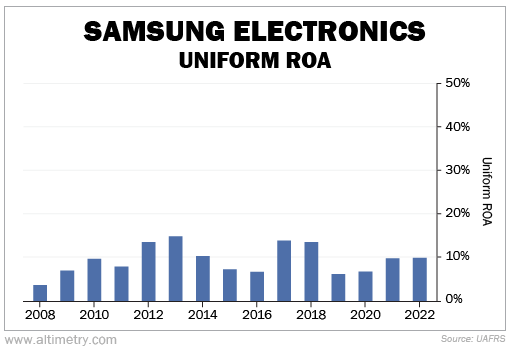

But its biggest competitor in the phone market, Samsung, often introduces tools even earlier than Apple...

Samsung was the first to introduce wireless charging. It was first to let users run two apps at the same time. And it was first to use the universal USB-C charging for its devices.

Yet without the powerful ecosystem that Apple has created, Samsung's returns just aren’t as high. Its Uniform ROA has never surpassed 15%...

You might even argue Apple's key strengths lie in its brand. If people started questioning how Apple products define their own aesthetic, its ROA would crater...

The reality is that both innovation and brand recognition have given Apple a boost over the years. But they're not the primary way it keeps its returns high. As I already explained, that honor goes to switching costs.

Apple's ecosystem may not have been how it got those returns 15 years ago... but it's how it keeps them now.

Competitive advantage is also how we found an opportunity in Lam Research (LRCX) back in 2016...

Competitive advantage is also how we found an opportunity in Lam Research (LRCX) back in 2016...

Lam Research is a pretty boring business. It sells parts and components that help chipmakers make their chips. It doesn't even make the chips itself.

It sounds like something just about anybody could do. And as a result, we would've expected its Uniform ROA to be average... somewhere between 6% and 12%.

But in late 2016, we saw that returns were on pace to surpass 20% for the second year in a row.

Normally, we would've cast this aside as a short-term boost. Semiconductors are cyclical, so we might have chalked it up to a spike in demand.

But we did some more digging... And we found Lam had something more powerful. The company had the best parts for making high-quality memory chips. And it had numerous patents to protect those tools. (Today, that number sits at more than 11,000.)

In other words, nobody else could compete with its parts.

That intellectual-property protection gave us confidence in Lam Research's long-term returns. We recommended it to our institutional investors in December 2016... and closed it in mid-2021 for a 490% gain.

In February 2020, we also recommended Lam Research in our Altimetry's Hidden Alpha monthly advisory. Subscribers who followed our advice secured a 112% gain in less than a year and a half.

Competitive advantage is so important that these days, we're using AI to identify it. Our system categorizes companies to better understand how they generate strong returns... so we can find the next Lam Research in the making.

You don't need a high-tech machine-learning system to start looking for competitive advantages...

You don't need a high-tech machine-learning system to start looking for competitive advantages...

It certainly doesn't hurt, of course. But the main idea is simple enough.

To identify competitive advantage, you have to determine how a company really makes money.

One of the best ways to determine competitive advantage is by looking at all competitors... to find what sets a particular company apart. You might notice it's much larger, which could indicate it has better economies of scale. Or perhaps it has intellectual-property protections like Lam Research.

That's step one. The second step is to focus on how long that competitive advantage will last... and how strong it is.

Most investors spend their time understanding what a company does. But that's not how you get an edge in the markets.

Instead, spend the bulk of your time looking for a competitive advantage. That's how you transform the speed and quality of your idea generation.

Regards,

Rob Spivey

November 3, 2023

Once Apple (AAPL) sinks its claws into you, you're all but trapped...

Once Apple (AAPL) sinks its claws into you, you're all but trapped...