Small-cap stocks are falling out of favor fast...

Small-cap stocks are falling out of favor fast...

The Russell 2000 Index has slid almost 20% since peaking in late 2024. Institutional sentiment has soured – and the corporate tone is deteriorating.

According to Bank of America, sentiment from small-cap earnings calls is at its lowest level ever recorded relative to large-cap peers.

Compared with their bigger counterparts' steadier tone, small-cap CEOs are increasingly signaling stress. In some cases, they're pulling back on growth plans entirely.

Pessimism tends to cluster at turning points. And we get it... Things look uncertain for the economy right now. Small companies have less wiggle room. Investors don't trust that they can make it through unscathed.

But the long-term setup for small caps may be brighter than it looks. And certain corners of the index could soon shine.

Tariffs and high rates are painful... but they could reset the playing field...

Tariffs and high rates are painful... but they could reset the playing field...

Small caps are bearing the brunt of the pain. They're more exposed to short-term pressures than their large-cap peers, especially with interest rates still high.

That's because these companies tend to carry more floating-rate debt, run with thinner margins, and lack the global diversification that cushions volatility.

Trade policy isn't helping. The auto parts, transport, capital goods, and component manufacturing sectors make up about 15% of the Russell 2000 combined. And all of these sectors are in the crosshairs of an expanding tariff regime.

The same sectors comprise just 9% of the S&P 500.

Still, it's not all bad news. Some small caps may benefit from exactly the same trends that are causing pain today...

Markets are already preparing for more tariff increases. Domestic producers could gain share under this environment. And that's great news for smaller stocks, which tend to get more revenue from the U.S. than their larger counterparts.

That could be a turning point for sectors that were hit hard by offshoring... or ones that will see a big transformation as we bring production back to the U.S.

Smaller firms have a natural advantage in areas like shipbuilding, infrastructure, defense components, industrial tech, and even specialty materials. They're faster to adapt, closer to end customers, and deeply tied to local supply chains.

And many of those small stocks happen to trade on the Russell 2000.

Despite these tailwinds, investors aren't optimistic about small caps today...

Despite these tailwinds, investors aren't optimistic about small caps today...

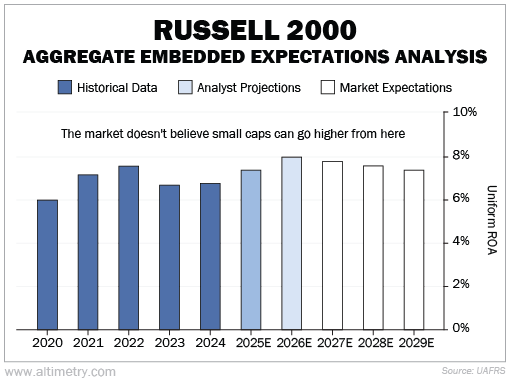

To get a better idea of market sentiment, we turn to our aggregate Embedded Expectations Analysis ("EEA") framework...

We start with the average stock price of all companies in the Russell 2000. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well the Russell 2000 has to perform in the future to be worth what the market is paying for these stocks today.

Longtime subscribers know we also look at near-term Wall Street expectations. Analysts tend to have a pretty good grasp on where companies are headed in the next year or two.

The Russell 2000 has generated Uniform return on assets ("ROA") between 6% and 8% over the past five years. That's pretty weak considering the U.S. corporate average is around 12%.

It's not surprising, though. Small caps struggled during the era of globalization. As that changes, returns should improve. Analysts expect a slight improvement, reaching 8% Uniform ROA by 2026.

Investors aren't buying it. They expect small-cap profitability to stay around 7% through 2029.

Take a look...

The economy is shifting in favor of smaller companies for the first time in years. But the market hasn't caught on yet.

The 'death of small caps' narrative is getting louder... and it's getting lazy...

The 'death of small caps' narrative is getting louder... and it's getting lazy...

Yes, the Russell 2000 is under pressure. But the index doesn't move in lockstep with economic reality – especially not during transition periods like this.

Past recessions and rate cycles show that small caps often lag at inflection points... before dramatically catching up.

While investors worry that small caps will be hit hardest by tariffs, they're ignoring the flip side. These stocks are more U.S. focused. They're in a better position to adapt new technologies before large caps have a chance to catch up.

What matters now is selectivity. Not every small-cap company will make it through this rough patch. Some are overloaded with debt or tied to weakening sectors.

But others are ready to benefit from the next wave of U.S. industrial growth.

You just have to look in the right place.

Regards,

Joel Litman

May 12, 2025

Small-cap stocks are falling out of favor fast...

Small-cap stocks are falling out of favor fast...