The market just doesn't trust small caps...

The market just doesn't trust small caps...

Ever since President Trump's "Liberation Day" announcements, investors have been punishing U.S. stocks.

The S&P 500 is down nearly 5% versus 3% for the rest of the world. The tech-heavy Nasdaq dropped about 4%, too.

To find the real damage, though, you have to think much smaller...

Since the tariff war officially kicked off at the start of April, the small-cap Russell 2000 Index has plunged 8%.

Small caps are getting particularly savaged because they seem most at risk. These companies are thought to have thinner margins and less pricing power than their large-cap counterparts.

And in the event of a recession, they're supposed to be more economically sensitive.

But investors are jumping to conclusions. They're not stopping to consider another important point – small-cap stocks aren't that exposed to the tariff war...

While we're confident the U.S. will be fine, we understand why investors are fleeing the S&P 500...

While we're confident the U.S. will be fine, we understand why investors are fleeing the S&P 500...

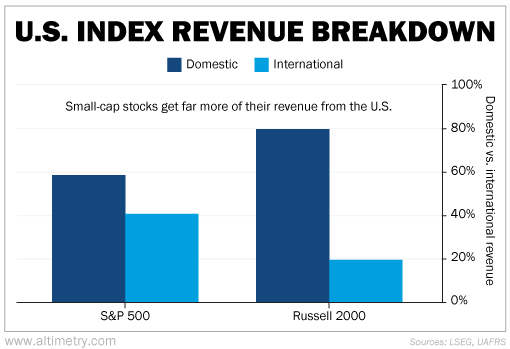

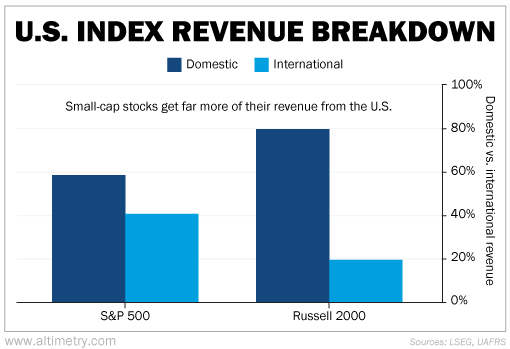

About 40% of the index's revenue is international. In the short term, tariff tit-for-tat battles will threaten that money.

But the same can only be said for about 20% of revenue generated by Russell 2000 constituents. About three-quarters of these tiny companies have little to no international exposure at all.

Check it out...

That means the Russell 2000 is insulated from the short-term pain of lost revenue due to rising tariff barriers.

These small businesses also tend to have simpler supply chains. In most cases, they don't operate at a large-enough scale to outsource well.

And they generally aren't selling as much product internationally... So they keep things closer to home.

In an era where offshoring was king, that meant thinner margins. Manufacturing domestically is more expensive, on average.

That said, since these businesses tend to stick to U.S. shores, their materials won't get more expensive in a tariff war.

Despite their differences, Russell and S&P 500 constituents have one very important factor in common...

Despite their differences, Russell and S&P 500 constituents have one very important factor in common...

They benefit from being part of the U.S. economy.

Small caps enjoy the same dominant universe of innovation and profits. And as we covered yesterday, U.S. corporate profitability towers over the rest of the world.

Tariffs help keep foreign competition out of the U.S. So they make domestic companies more competitive.

The more Trump's "Liberation Day" announcements come to pass, the greater the benefit small-cap stocks will see in the short term... with less international exposure than their larger counterparts.

Regards,

Rob Spivey

April 15, 2025

The market just doesn't trust small caps...

The market just doesn't trust small caps...