Last week, we talked about telecom giant AT&T's (T) latest transformative strategy shift...

Last week, we talked about telecom giant AT&T's (T) latest transformative strategy shift...

The company is combining its WarnerMedia business with Discovery (DISCA) and creating a new, spun-out entity. The deal could produce a streaming giant.

It's not the only deal the company has unwound in the past decade. The company also decided to sell a portion of its DirectTV and other U-verse cable assets in February and then spin out the business.

These two transactions are an admission on AT&T's part that its effort to build a content and cable business as an extension of its telecoms business was an error.

While this might feel like a reckoning to AT&T, investors predicted this when the company first made both transactions. The jokes about AT&T making the same mistake AOL did when it acquired Time Warner in the dot-com bubble are too easy to make.

AT&T doesn't care about looking like a fool as it admits how much value it destroyed with both transactions. The company is attempting to lower its debt load.

The WarnerMedia transaction alone should let AT&T pay down roughly $43 billion in debt.

The company wants to de-lever its balance sheet. It has been piling on debt to finance booming capital expenditures in the race to 5G.

The 5G rollout is capital-intensive. For AT&T to have any chance to beat out the competition, it can't slow down investment, so it took on more and more debt.

In January alone, the big players in the space spent roughly $80 billion buying more 5G spectrum capabilities. AT&T, Verizon (VZ), and T-Mobile (TMUS) all also promptly issued tens of billions of dollars in debt to pay for it.

AT&T's motivation in the transaction is an important reminder to equity investors who may just be focused on upside if AT&T is one of the "winners" in the 5G battle. Even if it ends up with the best network, if its debts mean it can't profit from that victory, it's all for naught.

That de-levering will be important if the company is going to be able to invest...

That de-levering will be important if the company is going to be able to invest...

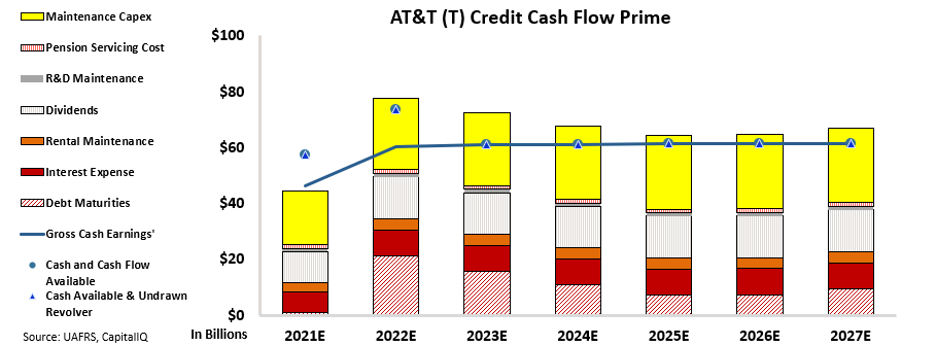

Our Credit Cash Flow Prime ("CCFP") analysis can get to the heart of AT&T's true credit risk and if it plans to have a budget for all that capital expenditure ("capex").

In the chart below, the stacked bars represent the company's obligations each year for the next five years. We compare these obligations against cash flow (blue line) as well as the cash on hand at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

Considering the sizeable capex needs, AT&T's cash flows and cash on hand didn't match obligations before the transaction. AT&T didn't have the money to invest like it wanted to in 5G.

In most cases, when companies have a cash flow shortfall like this, one way to resolve the problem is by reducing its capex – relieving stress on cash flows to meet such high obligations.

But in AT&T's case, its capex is nonnegotiable. The company can't afford to cut its capex, as it will lose to its competitors in the 5G rollout.

And consider that the cash flow shortfall shown above is $37 billion over the next seven years.

Investors might wonder if the $37 billion shortfall was the only value AT&T was focused on, rather than getting the most value for the business when it agreed to sell WarnerMedia in a structured way. It should bring in $43 billion to pay down debt.

Whatever it says about the company's prior errors, this transaction puts AT&T in a position to invest how it wants to for the next five-plus years.

Now investors must hope that its investment in 5G has more success than its DirecTV or Time Warner acquisitions. Given AT&T's track record, we won't be holding our breath.

Regards,

Rob Spivey

June 8, 2021

Last week,

Last week,