The corporate tides have changed overnight...

The corporate tides have changed overnight...

We made it through the worst of the pandemic without a ton of bankruptcies. While a lot of small businesses went down early on, public companies weren't too badly hurt.

For a while, it looked like things were finally starting to stabilize. Companies reported record profits as lockdowns ended.

We saw some much-needed goodwill in recent months. But now, interest rates are climbing and gross domestic product is tightening. It seems the brief reprieve is over.

And it looks like the first company to succumb to the pain is cosmetics company Revlon (REV).

Revlon has made its mark on generations of people. It has been a dominant makeup brand for the past 90 years.

But Revlon hasn't kept up with the times...

But Revlon hasn't kept up with the times...

It has been unable to adjust to a younger market.

Brands with a strong celebrity and social media presence are gobbling up market share – like pop star Rihanna's Fenty Beauty and reality TV star Kylie Jenner's Kylie Cosmetics.

Revlon has struggled to adapt to changing consumer habits and marketing strategies. And that may have hurt it. The company primarily sells its cosmetics through middleman suppliers, like drugstores and cosmetics counters.

So-called "indie" brands and newer cosmetics companies have cut through this process. They sell direct to consumers through online stores and Instagram links.

For Revlon, all of this has been compounded by supply-chain delays and decades of debt...

Majority shareholder and businessman Ron Perelman saddled the company with large acquisitions over the years... most recently cosmetics brand Elizabeth Arden, which it bought for $870 million in 2016. Revlon estimates its debt is between $1 billion and $10 billion.

The company has navigated these waters before. But it seems like the past few decades of bad business moves have finally caught up to it.

Perelman was able to swoop in and save the day at the beginning of the pandemic. That doesn't look likely this time.

Using our Credit Cash Flow Prime ("CCFP") analysis, we can see if there were any warning signs...

Using our Credit Cash Flow Prime ("CCFP") analysis, we can see if there were any warning signs...

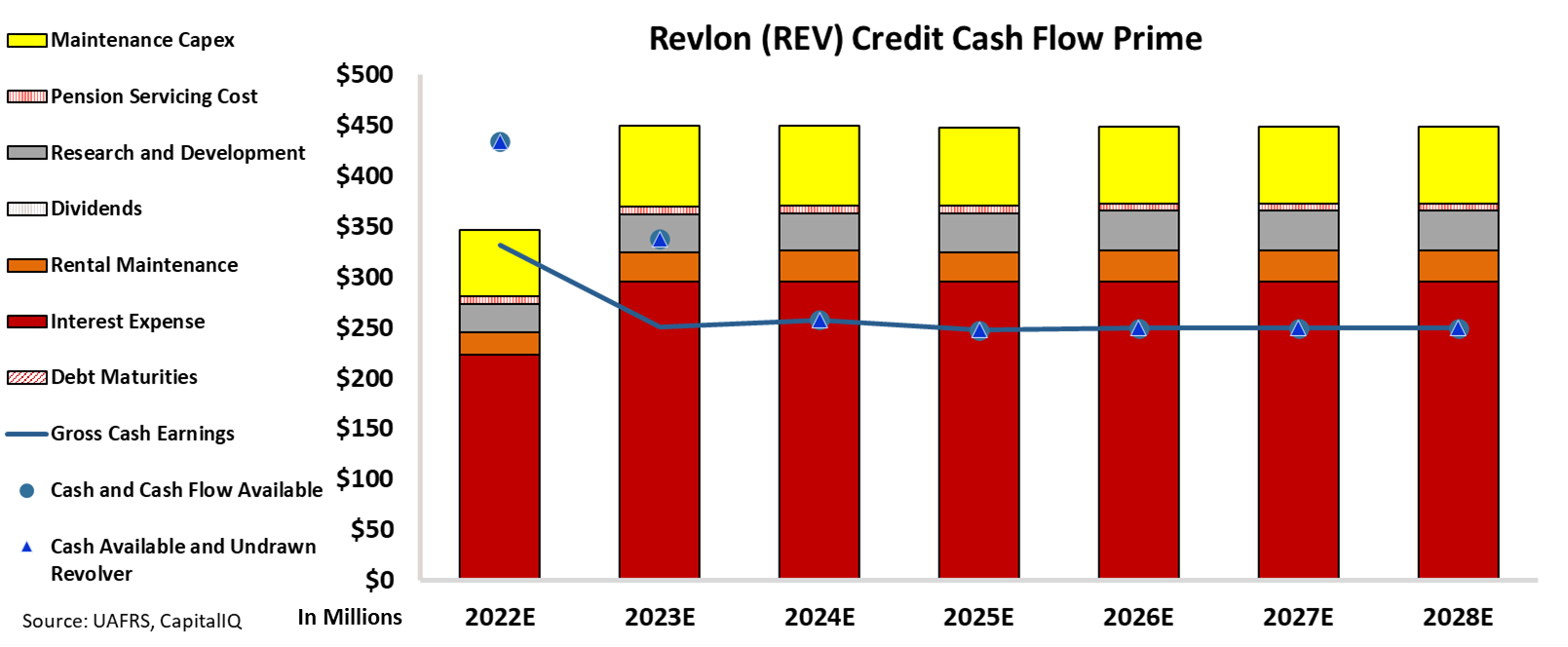

Wall Street loves to use simple ratio analysis to understand if a company is underwater (and by how much). But at Altimetry, we have a different, clearer method. The CCFP shows us cash flows and debt obligations together so we can see how strong corporate balance sheets really are.

In the following chart, the stacked bars represent Revlon's obligations each year through 2028. Then, we compare these obligations to its cash flow (the blue line), as well as the cash on hand at the beginning of each period (the blue dots) and available cash and undrawn revolver (the blue triangles).

Revlon's CCFP analysis shows that the company won't be able to meet its operating obligations starting in 2023.

As you can see, Revlon will struggle to pay off the interest on its considerable debt. And that's before accounting for reduced cash flows as competition continues to reduce demand for the company's products.

Our CCFP analysis clearly shows that Revlon doesn't have the capital it needs to manage its interest obligations... let alone invest in necessary changes to the business.

It's no surprise then that the company's huge debt load spelled disaster as more competitors entered the cosmetics space. And with interest rates going up, Revlon has been unable to refinance.

However, Revlon's collapse isn't a signal of what's to come for the rest of 2022...

The company's bankruptcy shows that businesses need to adapt to the ever-changing market. If they don't, they'll flounder. But it's not a sign of a market contagion.

As we highlighted last week, most companies don't have this much debt on their balance sheets. These next few months will serve only to fell the weakest companies behind the curve.

Best,

Joel Litman

July 5, 2022