When you're walking through the aisles of your local grocery store or shopping online, it's easy to think of prices as static...

When you're walking through the aisles of your local grocery store or shopping online, it's easy to think of prices as static...

Despite this, thanks to monetary policy from the U.S. Federal Reserve and the nature of growing demand, prices climb slowly but steadily each year.

This phenomenon – often misunderstood or complicated by analysts – is inflation. Over the past few months, fears of inflation have been stoked by pundits, and speculation about future price climbs has meant it has taken over headlines once again.

For example, the replacement value of a home, or how much it would cost to rebuild it with similar materials, has climbed by 20% year over year – highlighting the immense scarcity of lumber, screws, and fastenings.

Executives at snack and beverage giant Coca-Cola (KO) are telling investors they will have to raise the price of a Coke in the near future. Burrito chain Chipotle Mexican Grill (CMG) has bumped up the prices of its menu across the board, citing input costs climbing.

Even the steady, dependable, and sensitive-to-price-change industry of consumer goods is forced into action. Procter & Gamble (PG) is raising the price of many products across its sizable portfolio.

Tracking these kind of home goods and more is the Consumer Price Index, which rose by 5% in May. Meanwhile, the change in the Producer Price Index – tracking the rate at which companies have seen the price of their inputs rise – was even more severe earlier this year... It jumped 6% in April.

With supply chains stretched, it makes sense inflation is at its worst the further back investors look in the chain...

With supply chains stretched, it makes sense inflation is at its worst the further back investors look in the chain...

This is why in China – the world's factory – the inflation rate is even more worrying. Input inflation in the country was a full-throated 9% in May, the largest jump in thirteen years.

Back across the Pacific, the sudden move higher in inflation has seen a lot of demand for political reform around the minimum wage and a lack of willing employees to work minimum-wage jobs.

The last time the minimum wage was set in 2009, it was locked in at $7.25. However, due to the inflation that has peaked over the past few years, $7.25 today is only worth $5.78 in 2009 dollars, or 20% less.

Other than this year, inflation has been low and steady. These huge swings in purchasing power are why inflation has a huge number of consequences in economics, politics, and the stock market.

So... will inflation hit your portfolio?

So... will inflation hit your portfolio?

As regular Altimetry Daily Authority readers know, we've covered inflation numerous times here.

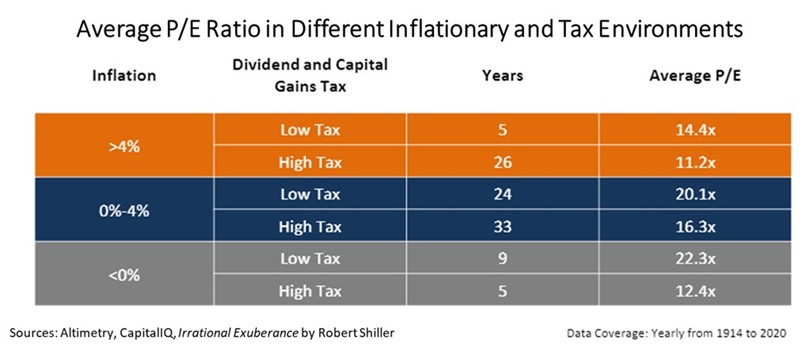

Back in April, we broke down how inflation levels directly affect investors' returns. At higher inflation rates, money is worth less in the future than it is today. As investors put their money away to get a return at a later date, all else being equal, valuations have to be cheaper in a higher-inflation environment to earn the same returns.

This means the price-to-earnings (P/E) ratio of the market will settle at a different level if the long-term inflation rate changes.

The key concept here is 'long term'...

The key concept here is 'long term'...

The Fed and many economists believe this period of inflation is driven by supply chain issues and heightened demand as the economy reopens. This means the rate should return to normal after 2021.

Meanwhile, CEO Darius Adamczyk of industrial conglomerate Honeywell (HON) believes inflation "is here and it is probably a lot more pronounced [than] people think."

Even though inflation will mean nominal profits grow faster, if they grow faster at a lower P/E ratio, it will significantly hold back stock gains.

As you can see in the table below, if high rates of inflation above 4% are here to stay, P/E ratios will plummet from roughly 20 times all of the way down to around 14 times.

However, if this inflation proves to be transitory, then the markets will be unaffected and can stay near P/E ratio levels of around 20 times. For inflation to batter valuations, it needs to consistently depress the value of the dollar over the next few years.

For now, investors should by no means panic and sell out of the market on fears of inflation destroying their portfolios. Right now, there's little evidence that inflation is here to stay for the long haul.

However, investors should be aware of potential risks that could develop over the next year. We'll be keeping a careful eye out here at Altimetry Daily Authority... And if inflation looks to be more permanent, we'll let readers know.

Regards,

Joel Litman

July 12, 2021

P.S. No matter what stories are dominating headlines, in Altimetry's Hidden Alpha, we're using our Uniform Accounting analysis to find big opportunities from the market's mispricing of stocks due to distorted GAAP metrics.

In the July issue, we've just found a company that's innovating and growing in a way that gives it a huge competitive advantage over its peers. The market doesn't realize it yet, but the stock is primed for massive upside ahead. Learn more about Hidden Alpha – and how to gain instant access to our latest recommendation – right here.

When you're walking through the aisles of your local grocery store or shopping online, it's easy to think of prices as static...

When you're walking through the aisles of your local grocery store or shopping online, it's easy to think of prices as static...