Credit markets are still open, and that's a great sign...

Credit markets are still open, and that's a great sign...

As Bloomberg reported last week, cruise ship operator Carnival (CCL) issued $4 billion in bonds... and $79 billion in investment-grade bond issuances were priced throughout the whole week.

U.S. corporations sold a record number of bonds in the first quarter of this year, approaching $800 billion. Europe has also seen a massive amount of debt issuances, though more of those were at the start of the year.

The robust U.S. corporate-debt market is an important signal to watch. As we've discussed time and time again here in Altimetry Daily Authority, credit destruction leads to a severe recession and a long recovery thereafter. Debtors recovering from defaults and being cash-constrained as they try to reduce leverage when they can't borrow more money is the cause of real economic pain.

While the disruption from the coronavirus pandemic has been shocking and sharp, the fact the credit market is still open and active for issuing debt is a phenomenal indicator. It shows that once we get out the other side of this, things can return back to normal faster than many are expecting.

It's time to check in on insider buying again...

It's time to check in on insider buying again...

In the December 30 Altimetry Daily Authority, we discussed why monitoring how management teams trade their companies' stocks can be a powerful tool to understand corporate sentiment.

Specifically, we explained that corporate management teams tend to become value buyers when they think their companies' stocks have fallen below fair value.

We saw this in late 2018 when many investors were calling for the end of the bull market... management teams kept their conviction and bought these stocks at record levels. Of course, the market quickly rebounded, and many executives had quite a successful payday.

Considering the general uncertainty about the direction of the market, it's a good opportunity today to revisit the world of insider buying. We're in a period of unprecedented volatility, which signals to us that emotions might be getting the better of the market.

Luckily, looking at corporate insider buying can provide us with a much-needed dose of sound logic and long-term thinking.

As legendary money manager Peter Lynch said, "Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

We've parroted this wisdom many times, and it's the same logic we use when evaluating corporate earnings calls. Strong conviction is the only reason for management to be confident or to buy shares.

This is especially true with insider buying. You see, in order to keep things fair, members of management with enough ownership of their company (usually "C-suite" level executives) need to notify the U.S. Securities and Exchange Commission ("SEC") when they plan on buying or selling shares in their company. Specifically, they're required to submit a "Form 4" within two days of buying or selling. This form is then disclosed to the public.

But that's not all... Legally, under Section 16 of the U.S. Exchange Act, corporate management is also restricted from selling stock they've bought for six months after the purchase.

This helps us qualify insider buying as a strong bullish signal.

It means when executives buy shares in their own company, they believe the price is set to rise in the long term – it's undervalued.

SEC Form 4 and the six-month trading block prevent management teams from playing games with their buying and selling.

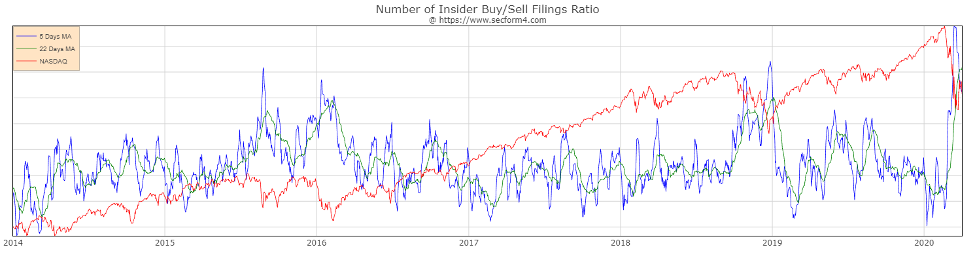

The charts below from SecForm4.com display a ratio of insider buy orders relative to sell orders adjusted for size. When the blue and green lines (showing the five-day and 20-day moving averages of the insider buy/sell ratio, respectively) increase, it means insiders are buying more.

As you can see, since 2014, insiders tend to be strong buyers during pullbacks in the market (shown here as the Nasdaq Composite Index)...

This is because insiders know their companies are being undervalued and that it's a great time to buy – not to panic sell.

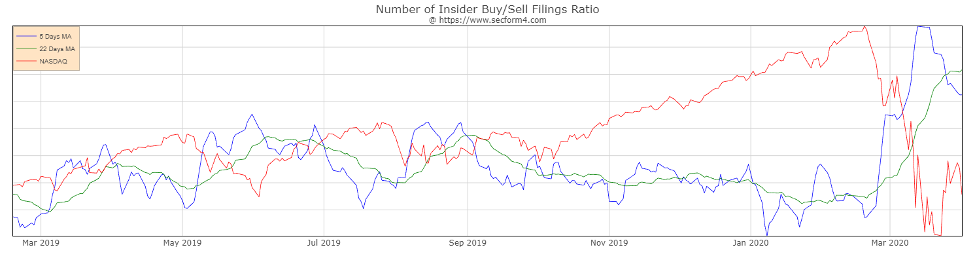

Let's take a closer look at just the past year of insider trading.

You can see here that insider buying has reached historically high levels – even higher than during the oil glut from 2014 to 2016 and the downturn in late 2018...

We see this as a sign that more management teams recognize that the market is overreacting than at any other point over the past five years.

Looking at specific areas of the market, some of the hardest-hit sectors – namely Energy, Real Estate, and Industrials (which includes airlines and other moving and travel-related companies) – have some of the most bullish signals.

It may take more than the minimum six months to see returns stabilize, but management teams across the country have put their money where their mouths are. The fact the people with the best information on their own companies are the most bullish is a great signal for the future of the market.

Regards,

Joel Litman

April 6, 2020

Credit markets are still open, and that's a great sign...

Credit markets are still open, and that's a great sign...