As regular Altimetry Daily Authority readers know, bear markets don't happen without credit issues...

As regular Altimetry Daily Authority readers know, bear markets don't happen without credit issues...

In October, we wrote about how the drop in the cost to borrow for U.S. corporations meant companies were able to refinance debt in 2019 that they hadn't been able to in 2018.

The refinancing of near-term debt maturities eliminates the risk of a credit crunch – and therefore eliminates any real risk of a recession and bear market.

Late last week, Bloomberg published an article about the continued strong demand for U.S. corporate credit from international buyers. The U.S. is one of the few developed markets that doesn't have significant debt with negative yields, so money continues to flow in.

That international investment flowing to U.S. corporations is likely to keep interest rates low and will allow them to cheaply refinance their debt. Until that changes, we're not worried about a bear market as we head into 2020.

When most people hear insider trading, they think of seedy figures like Jordan Belfort...

When most people hear insider trading, they think of seedy figures like Jordan Belfort...

Before he was caught, Belfort – the subject of Martin Scorsese's Wolf of Wall Street – famously orchestrated "pump and dump," get-rich-quick schemes.

The term "insiders" refers to any individual who has information that is not yet public knowledge. This comes in one of two forms...

An insider trader like Belfort orchestrated the initial public offerings ("IPOs") of companies but gave stock to his acquaintances. After the IPO, he would then spread positive messaging about the stock, wouldn't allow investors to sell, and then got rid of all his acquaintances' holdings, so that he and his friends profited before the stock fell back down.

The other type of insider is operating completely legally. I'm talking about executive management of publicly traded companies who buy and sell stock in their company only when they are allowed to, based on their company bylaws.

This type of transaction is known as insider buying and selling, and it's a useful tool for measuring both the individual company and broader economic trends.

Insiders can sell their equity for a wide variety of reasons. As management is paid primarily through their stock-compensation program, management might be selling to raise cash to buy a new vacation home or pay for their kids' college tuition.

They could also be selling to further diversify their portfolio, or because they believe the stock may go down. Because of the various possible reasons, it's not useful to view insider selling as a strong signal to close out of a stock in your portfolio.

However, excluding options execution, insiders generally only buy shares of a company for one reason: They think the stock will go up. Management legally buying shares is a power signal that they believe that the stock price will rise in the near future.

In late 2018, as CNBC and Bloomberg talked about the possibility of a recession, we pointed to factors such as the strong credit market and low margin debt as signals that showed the bull run was not yet over. Another strong signal that showed fundamental market strength was insider activity during 2018.

During market downturns, management tends to act as value buyers. If there is a stock market correction and their stock plummets, management has a choice to make...

If they believe the company is under shaky financial footing, they might hold or try to sell. However, if management believes that the business is strong, they'll purchase their stock at a discount.

Therefore, on aggregate, insider buying is a powerful signal. If the ratio of insider buying rises sharply during a correction, then management generally believes the business still has plenty of potential upside.

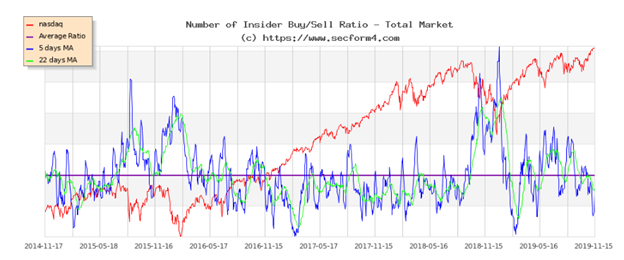

We have access to the data behind this phenomenon over the past few market corrections. In the following chart, the red line represents the Nasdaq's returns over time. The purple dividing line is the average ratio of insider buying to selling. The blue line is the five-day moving average for the insider buying to selling ratio...

As you can see, when the Nasdaq has dipped over the past five years, insider buying has spiked. As the markets fell in 2015 and in 2018, management teams saw a great opportunity in the stock market, as the underlying fundamentals of their businesses had not changed.

It was one of the many reasons that we were telling our institutional clients to buy the dip during both periods.

As the Nasdaq has trended higher of late, insider trading has fallen off. As management no longer sees an opportunity to buy stock at a discount, the five- and 20-day moving averages have dropped below their long-term averages.

During the next downturn, look to the insiders... If they fail to purchase their stock, it might be time to start taking CNBC seriously. However, if they start buying once again, maybe you should as well...

Regards,

Joel Litman

December 30, 2019

As regular Altimetry Daily Authority readers know, bear markets don't happen without credit issues...

As regular Altimetry Daily Authority readers know, bear markets don't happen without credit issues...