Insurance companies have been struggling with losses...

Insurance companies have been struggling with losses...

The story sounds familiar to anyone who has been following the news over the past few months.

The financial sector has been grappling with big "mark to market" losses on their fixed-income investments as interest rates surge.

This is what brought regional banks like Silicon Valley Bank, Signature Bank, and First Republic to failure back in March. People ran to withdraw their deposits, and banks had to sell assets at big losses. They couldn't keep up with demand for withdrawals.

Now, the market is concerned about another big buyer of bonds... insurance companies.

It's understandable that people are worried. At first glance, it seems like the same scenario with different actors. If banks went bankrupt for these fixed-income investments, other companies holding similar assets could as well.

But investors focusing on this story are missing the point. According to J. Patrick Gallagher Jr., the CEO of risk management company Arthur J. Gallagher (AJG), folks are overlooking one key factor... inflation.

The headlines are fixated on the potential risks. But Gallagher highlights that inflation and rising interest rates can benefit insurance companies.

In fact, as we'll discuss today, this is exactly the recipe they need to make huge sums of money.

As interest rates rise, insurance companies can actually be highly profitable...

As interest rates rise, insurance companies can actually be highly profitable...

That's because they have a few key differences from banks.

First of all, traditional concerns about mark-to-market losses carry little weight for insurance companies.

Banks like SVB and First Republic collapsed because they had to sell their investments at a loss to fulfill customer requests. As those losses mounted, more customers ran to take out their funds.

Insurance companies always hold debt to maturity. That means they don't care what happens to interest rates in the near term. There's no chance of a "run" on insurance companies that forces them to sell investments at steep losses.

Even better, as insurance companies get more premiums to invest, they benefit from high interest rates. They can invest those premiums into securities with higher yields.

And high inflation means many insurance companies have more money coming in. Property values have soared, so premiums on assets like homes and vehicles are higher. That means underwriting revenue is up as well.

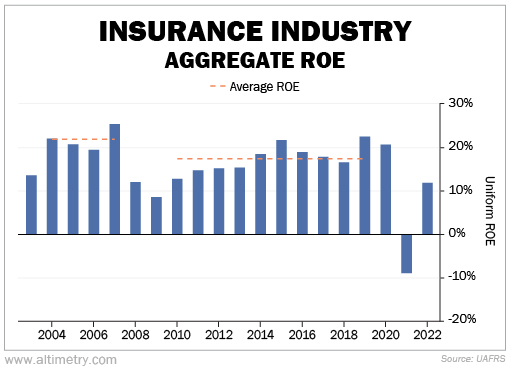

The insurance industry's aggregate Uniform return on equity ("ROE") backs this up. Take a look at the following chart. It shows the average Uniform ROE for U.S.-listed insurance companies since 2003.

The industry average fell from 22% in the mid-2000s to 17% in the 2010s... as interest rates fell to nearly 0% after the Great Recession.

Check it out...

The industry makes less money when interest rates are lower. So a return to higher interest rates should be a clear good sign.

But the market still fears that insurance is headed for a revival of the bank crisis...

But the market still fears that insurance is headed for a revival of the bank crisis...

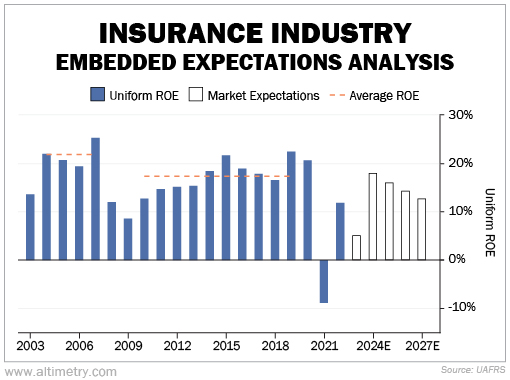

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use the current share price for companies across the insurance industry to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the industry) has to perform to justify the market's "bet" (the current price).

The market predicts that by 2027, the insurance industry's aggregate Uniform ROE will be even lower than it was during the 2010s – when the interest rates were incredibly low.

See for yourself...

In short, the market expects worse times ahead for the insurance industry... not better.

And that bearish sentiment on insurance presents a golden opportunity for investors...

And that bearish sentiment on insurance presents a golden opportunity for investors...

Insurance companies stand to benefit from today's economic conditions. They'll leverage interest income and the surge in inflation to bolster profitability.

And with the Federal Reserve hinting at further rate hikes, insurance companies are positioned to thrive.

The market thinks the setup in insurance is like regional banks all over again. Investors will continue to punish insurance stocks... pushing valuations far lower than they should be.

Folks who zero in on that untapped potential will reap substantial rewards when the industry proves the market wrong.

Regards,

Rob Spivey

July 11, 2023

Insurance companies have been struggling with losses...

Insurance companies have been struggling with losses...