Global military spending climbed to a record $2.4 trillion last year...

Global military spending climbed to a record $2.4 trillion last year...

That's up 7% from 2022... the fastest increase in more than a decade. It's also the first time since 2009 that spending increased in all five of the world's geographical regions.

This shouldn't come as a surprise. Military spending has been ramping up for years... dating back to when former President Donald Trump started urging NATO allies to increase their military budgets.

Recently, the uptick in spending has been driven by major global conflicts, like the ongoing wars in Ukraine and Israel and even China's saber-rattling against Taiwan.

Overall, global defense spending made up more than 2% of the world's economic output in 2023.

Ukraine was the eighth-largest spender, with a 51% increase from 2022. Israel, the 15th-largest spender, upped its spending 24%. And while China "only" increased spending 6% by comparison, it allocated nearly $300 billion to its military... making it the second-largest spender behind the U.S.

America still spends more on defense than the next nine countries combined. Last year, its defense spending came in at $916 billion – more than triple what China spends.

Today, we'll dive into how the U.S. defense industry is performing... and whether there's much opportunity for investors to get involved.

Geopolitical uncertainty is leading to more reliance on the U.S...

Geopolitical uncertainty is leading to more reliance on the U.S...

Ever since World War II, our nation has been the clear global economic and military superpower.

As we said earlier, the U.S. spends more on defense than the next nine countries combined.

It has a top-notch global and homeland surveillance system, an unparalleled arsenal, and roughly 750 military bases around the world.

It has also been the world's largest arms dealer for decades... with a 42% share of the global arms market.

None of that is going to change any time soon.

Still, some folks are calling for a multipolar geopolitical landscape... where a country like China rises up to rival America's dominance.

So far, that hasn't happened.

China only supplies 6% of the world's arms exports. It's the fourth-largest weapon exporter behind France and Russia, which each supply about 11% of exports.

At 42% of the market, the U.S. is the biggest arms dealer by far. Between the periods of 2014 to 2018 and 2019 to 2023, U.S. arms exports grew 17%. China's decreased by 5%.

In other words, China has a long way to go before it rivals the U.S. in military dominance.

U.S. aerospace and defense (A&D) is only expected to get more profitable...

U.S. aerospace and defense (A&D) is only expected to get more profitable...

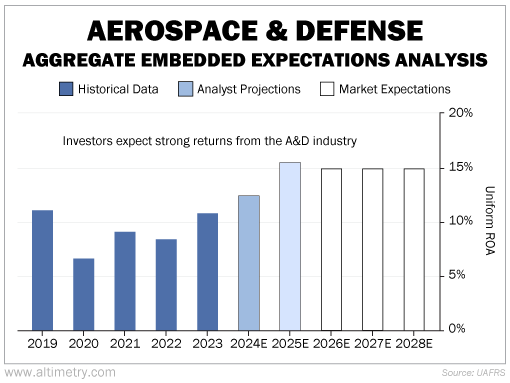

We can see this through our aggregate Embedded Expectations Analysis ("EEA") framework.

Our aggregate EEA starts with the average stock price of all U.S. A&D companies. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well U.S. A&D companies have to perform in the future to be worth what the market is paying for them today.

As you can see, A&D profitability has averaged roughly 9% over the past five years. Uniform return on assets ("ROA") for the industry topped 11% last year and is expected to rise above 15% by 2025.

Take a look...

Profitability in the A&D industry moves in cycles. And over the past 20 years, the cycles have been getting stronger...

If industry profitability hits 15% in 2025, that would be a new cycle high.

Considering today's heightened geopolitical tensions and the fact that the U.S. remains the world's largest arms dealer, that's a likely scenario.

However, based on these projections, it seems investors already understand most of the opportunity...

So if you're looking to buy into this industry, choose your stocks carefully. A lot of the upside may already be priced in.

Regards,

Joel Litman

June 3, 2024

Global military spending climbed to a record $2.4 trillion last year...

Global military spending climbed to a record $2.4 trillion last year...