Everyone's favorite video-conferencing company continues to come under pressure...

Everyone's favorite video-conferencing company continues to come under pressure...

Zoom Video Communications (ZM) was an early superstar of the conversion of the global workforce to the world of working from home ("WFH").

ZM shares closed 2019 at $68 and were moving steadily higher into 2020. Then in the midst of the rolling announcement of lockdowns and WFH orders in the U.S. and across the globe, shares spiked to $160 on March 23. After some volatility in recent weeks, they've since moved even higher.

Over that same time frame, Zoom's user base ballooned from less than 10 million users to over 300 million.

But this hasn't come without significant growing pains. With users not responsibly using their personal Zoom accounts and posting them for people to easily find, the world of "zoombombings" and security issues became a real problem. Corporate security staff became more and more concerned.

Zoom had been particularly popular with organizations focused on security. Unlike offerings like Google Hangouts' video calls, Zoom was HIPAA-compliant and was viewed as being more secure. Now, those zoombomings and other issues have called this into question, and led to a wave of organizations banning Zoom – including financial-services firm Bank of America (BAC), tech company Ericsson (ERIC), and automaker Daimler after last week.

Due to these issues and its nosebleed valuations, Zoom doesn't look like one of the long-term winners in the wake of the societal shifts from the coronavirus pandemic.

But other businesses will be winners...

In our upcoming May issue of Altimetry's Hidden Alpha – publishing next Monday – we'll share all the details. Our "Your Home, Your Castle" theme highlights some of the companies that we expect to benefit in the long run from the shift we're seeing in how people will interact with the world after the pandemic recedes.

The reality is that things like working from home, spending more time entertaining yourself at home, and ordering things at home instead of going out for them are all trends that the pandemic and its aftereffects have supercharged. The world is structurally changing... and certain companies will emerge as key winners from this shift.

You won't want to miss the businesses we've identified as part of Your Home, Your Castle... Learn more about a subscription to Hidden Alpha right here.

Yesterday, we shared the story of a business partnering with a larger 'Goliath'...

Yesterday, we shared the story of a business partnering with a larger 'Goliath'...

In Tuesday's Altimetry Daily Authority, we analyzed what went wrong with Internet travel company Expedia's (EXPE) decision to rely on Google – now Alphabet (GOOGL) – to turbocharge its distribution in its early days as a company.

As a reminder, Expedia used Google's distribution capabilities to reach a lot of customers quickly. It was immediately successful – Expedia's Uniform return on assets ("ROA") peaked at a robust 77% in 2005.

But the company was still in a weaker position than Google, which was the real owner of Expedia's clients.

In fact, Google saw just how much value it was providing to Expedia... and it decided to put itself in the ring...

Over the next decade-plus, Google reached out directly to its customers and competed with Expedia in search results. Long story short, Expedia's Uniform ROA has fallen in almost each year since, including reaching just 11% in 2019.

This story is a powerful warning sign to companies wanting to partner with strong competitors that could easily step in and take the business for themselves.

By doing so, a business like Expedia essentially allowed Google to get paid while it learned how to compete.

We've seen other companies who have refused to partner with Google early, and they've basically challenged Google to do what it does.

One great example is the popular review website and app Yelp (YELP).

Yelp doesn't rely on Google for any distribution needs, and has instead relied on its own "network effect" to maintain its dominant position.

Google can easily replicate many parts of Yelp's business. It has the same ability to post business contact information, directions, and local recommendations.

However, it has never been able to replicate the network effect that Yelp has built...

This is a concept where something becomes more valuable the more people use it. For example, telephones wouldn't be useful or valuable if there was only one...instead, each additional phone means you have more reasons to use one.

Social networks work in the same way, where their value is derived from the number of users they have.

While not technically a social network, Yelp gets its network effect from a similar phenomenon...

People go to Yelp versus Google or elsewhere for reviews because Yelp has more review data. Not only does this make aggregate ratings more useful, but Yelp can then turn around and use that data to make better recommendations for its users.

Additionally, Yelp has consistently found ways to add new features to make it even harder to switch platforms. You can now make reservations and order directly from some restaurants on Yelp, and the company has even developed reward programs for leaving reviews.

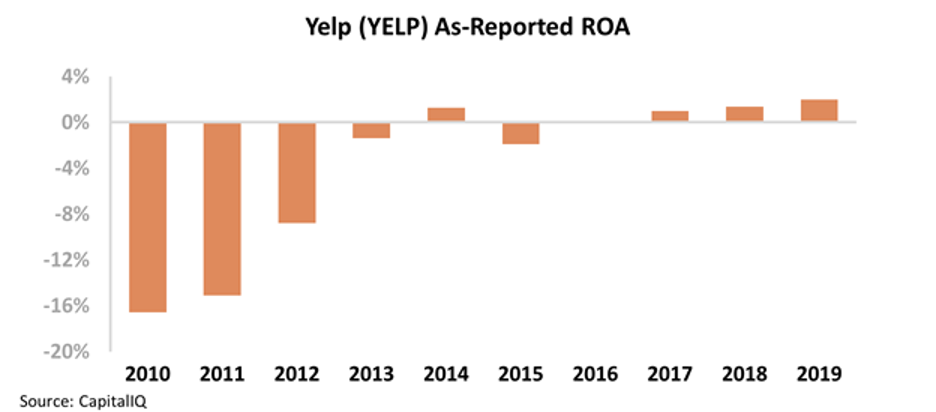

Yelp's choice to build its own network effect sounds like the right choice, but the company's as-reported returns don't really reflect this. In fact, Yelp's as-reported ROA makes it look like the company made a mistake by not looking to grow its network faster.

For the past decade, Yelp's ROA hasn't expanded past 2%, and it has spent many years in negative territory.

Even though Yelp has built an effective network effect, this makes it look as though competitors like Google and even Grubhub (GRUB) have prevented Yelp from capitalizing on its network.

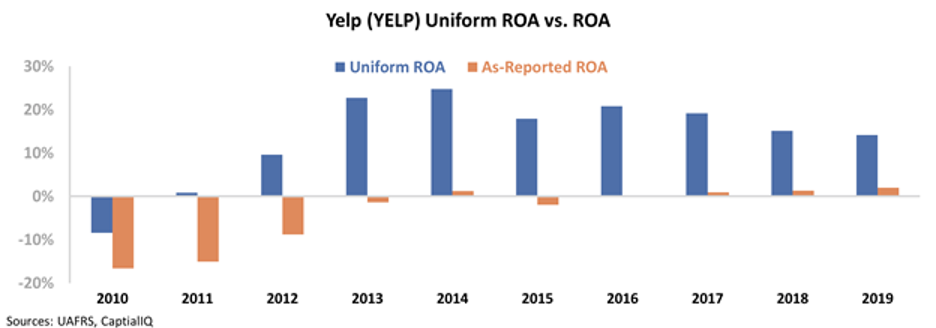

However, as-reported metrics include misleading accounting issues that impact young tech companies like Yelp...

For example, as-reported accounting statements treat non-cash stock options as an expense, which can make returns look weaker than they actually are. After adjusting for issues like stock options, research and development costs, and goodwill, we can see that Yelp has managed to build a profitable network.

In reality, the company's Uniform ROA has expanded to robust levels between 14% and 25% over the past seven years, with some declines recently. Take a look...

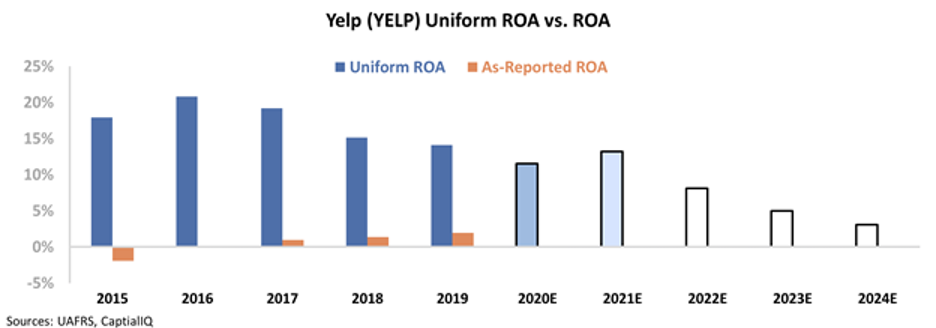

Even still, investors may be too focused on as-reported ROA. The chart below highlights Yelp's historical performance (dark blue bars) versus what Wall Street analysts expect for the next two years (light blue bars) and what investors expect at current stock prices (white bars).

As you can see, investors expect Yelp's Uniform ROA to eventually fall to just 4%, which is incredibly bearish for the company.

With ROA expectations being so low, Yelp doesn't have to do much to see massive upside... So long as the company can maintain its network, its stock could easily double.

Regards,

Joel Litman

April 29, 2020

Everyone's favorite video-conferencing company continues to come under pressure...

Everyone's favorite video-conferencing company continues to come under pressure...