Joel's note: The Altimetry offices are closed on Monday for Presidents' Day, so look for the next Altimetry Daily Authority on Tuesday, February 16. Also, for those who celebrate, we wish you a happy Lunar New Year today!

It can be hard to avoid mania in the investing world...

It can be hard to avoid mania in the investing world...

In the growth stage of a bull market, emotionally driven events can easily ensnare investors. People have a tendency to bypass rational decision-making and simply follow what others are doing. It's a classic case of "keeping up with the Joneses."

About a hundred years ago, there was a popular comic strip featuring the McGinis family. It ran in a New York newspaper for 25 years.

Few recall the fictitious McGinis family. However, almost everyone can name their neighbors... the Jones family. The McGinis' excessive concern with their neighbors is the origin of the well-known phrase: "Keeping up with the Joneses."

That desperation to keep up is what pushes irrational behavior. It now has a new name: "FOMO," or a "fear of missing out."

In the February 2 Altimetry Daily Authority, we discussed the events around the stock of video-game retailer GameStop (GME), the resulting short squeeze, and the incredible frenzy that sent its valuation far beyond anything remotely rational.

As we said, this kind of mania is rooted in reality. GME shares were overly shorted, and the company has some fundamentals that could bring some optimism for the firm's future.

However, a rise from $20 per share to the $500 range was driven heavily by investor mania. And folks on discussion site Reddit's WallStreetBets forum had a lot to do with this kicking off.

It might surprise you... but I was a member of WallStreetBets prior to the GameStop mania. Some posts in that forum can be insightful.

However, with what happened to GME shares and in other areas of the market, many investors are scrambling to just chase what's going up – whether it's a stock or a cryptocurrency. Some folks are just trying to keep up with others. FOMO is kicking in – fear of missing out on a chance to make a lot of money.

Frankly, right now, there's a lot of market activity that simply isn't based on the fundamentals of a particular underlying security. A certain mania kicks in.

If you feel like your trades are becoming emotional instead of rational, there's a way to combat this...

Take a break.

Finding some peace amid all the madness gives you time to regroup. Stay cool under fire and don't blindly follow the herd. Pause before you act. Meditate. Remember what matters in the long term.

This will help you avoid the emotional aspects of trading, decision-making at work, or anything else in your life. Learn to pause and gain some peacefulness for those moments in the day... you'll be better for it in the long run by filtering out some of the "noise."

One way to avoid getting caught up in the mania-driven trends is to invest for the long term...

One way to avoid getting caught up in the mania-driven trends is to invest for the long term...

Investors who do this are able to stay calm, as they can ignore the short-term waves that swamp a day trader.

Another solution is to focus on investing in the broader market instead of individual stocks, unless you feel you have a competitive advantage in knowing which stocks really have the opportunity to outpace the market because of their fundamentals.

This is the strategy I regularly recommend to folks who want to invest, but may not have the time to analyze individual companies and stocks. For them, passive investing in the broad market wins in the long term over active investing.

Even asset-management firms take advantage of this strategy...

Even asset-management firms take advantage of this strategy...

Since the Great Recession in 2008, one company has built a dominating franchise in passive investing. It's the firm investors turn to when they want to "buy the market."

Multinational investment-management firm BlackRock (BLK) is a powerhouse in the exchange-traded fund ("ETF") space. ETFs are an easy, "one click" way investors can get involved in the market for cheap... and BlackRock offers many of these funds covering all kinds of asset classes.

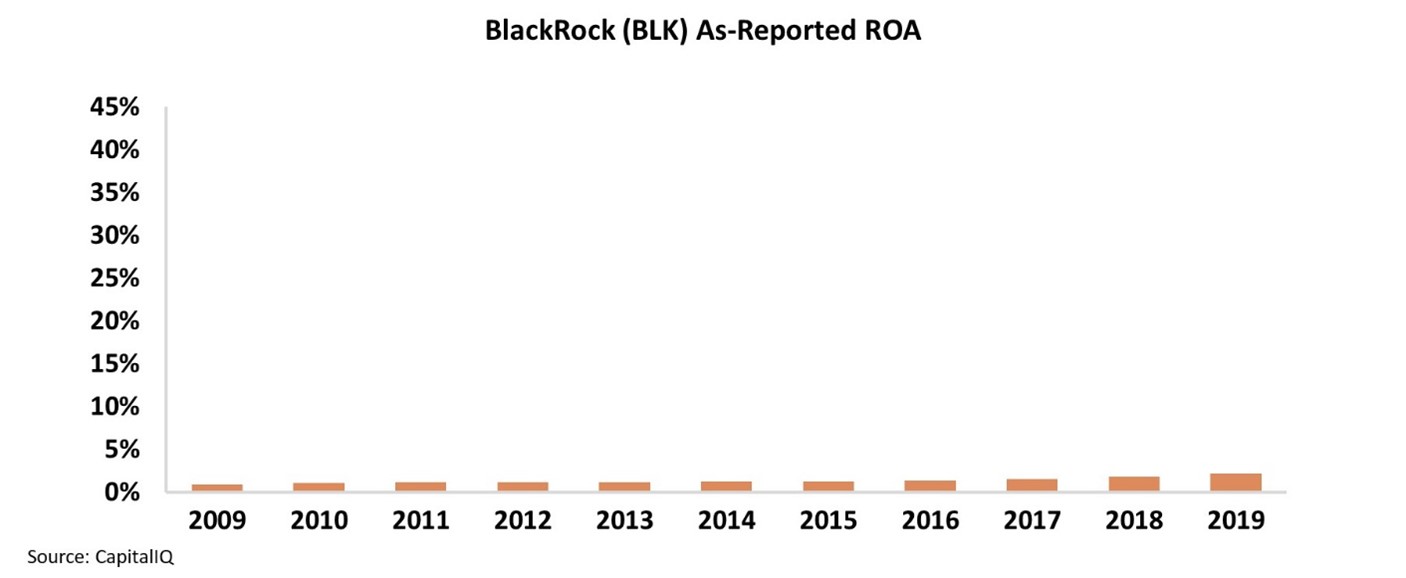

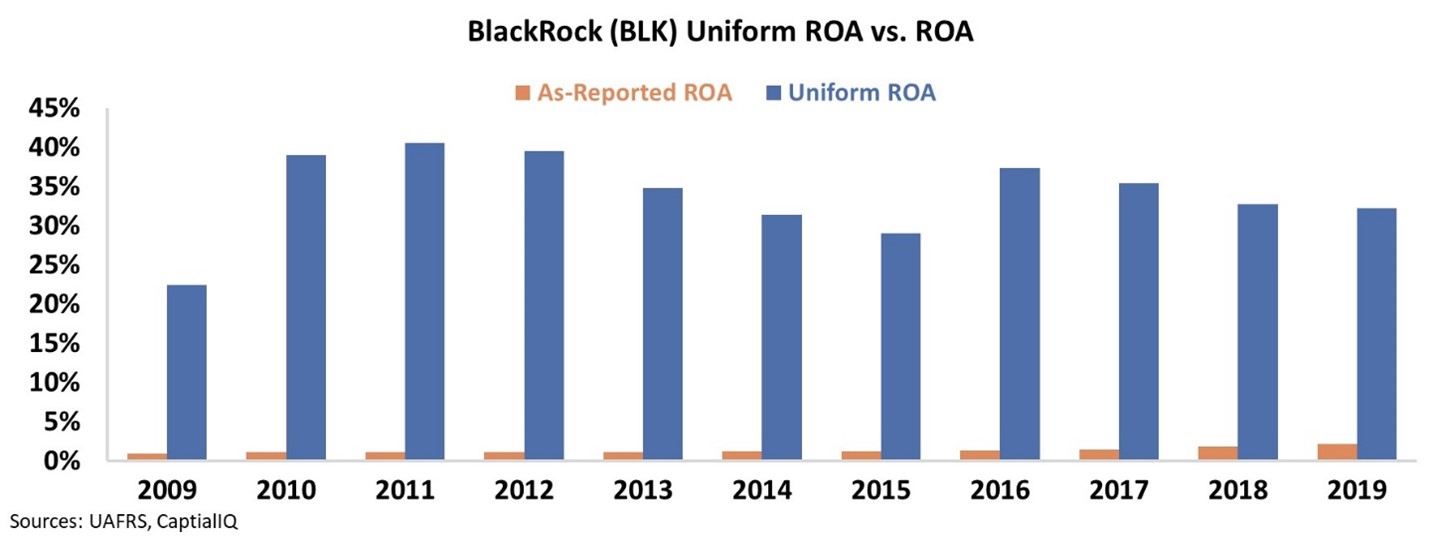

And yet, BlackRock's big presence in the passive investing marketplace doesn't appear to have been a profitable strategy. Based on as-reported accounting metrics, BlackRock posted a measly 2% return on assets ("ROA") in 2019... and profitability has been consistently low since 2009. Take a look...

In reality, this below-average ROA is just noise from bad accounting...

In reality, this below-average ROA is just noise from bad accounting...

By using Uniform Accounting – which adjusts for items such as goodwill, interest expense, and other GAAP distortions – we can understand BlackRock's real profitability...

After we make these adjustments, we can see that BlackRock's Uniform ROA is actually 35%... and has hit peaks of 41% since 2009.

Looking at the cleaned-up Uniform Accounting data, it becomes clear that BlackRock is able to generate considerable earnings power.

This is thanks to BlackRock's ability to dominate in the ETF business. Additionally, the company is able to distribute new funds into its existing network of clients who are constantly looking for ways to gain exposure to new investing strategies in a simple, low-cost way without taking an active approach.

BlackRock has continued to win by being the supplier to rational investors in sometimes irrational markets... and Uniform Accounting shows it.

Regards,

Joel Litman

February 12, 2021

It can be hard to avoid mania in the investing world...

It can be hard to avoid mania in the investing world...