AI momentum has started to fade, and investors are worried the peak is already over...

AI momentum has started to fade, and investors are worried the peak is already over...

For example, AI standout Microsoft (MSFT) has dropped about 10% from its June high. Data-center server provider Super Micro Computer (SMCI) is down nearly 50% since peaking in March.

Investors have started talking about a "rotation" out of AI... and into cheaper and smaller stocks. And they're right that some of the most popular opportunities are far too expensive today.

However, plenty of companies helping the AI boom are still performing well.

Today, we'll look at one tech giant that has been quietly winning more AI business... and the market hasn't realized it.

IBM (IBM) has grown into a huge, tech-specialized consulting practice...

IBM (IBM) has grown into a huge, tech-specialized consulting practice...

Even if AI spending slows down, companies are committed to adopting it. Just last month, AI stole the spotlight in IBM's second-quarter earnings.

AI bookings surged past $2 billion since mid-2023... doubling the numbers from earlier in the year. About three-fourths of those bookings come from AI consulting.

So IBM is gaining a lot of influence in the space. It has been transitioning from a legacy hardware giant to a key player in high-growth software and AI services.

This strategy led to a 7% revenue boost for IBM's software unit, outpacing analyst expectations. And while the consulting segment saw a slight dip, overall revenue for the quarter grew 2% year over year... reaching $15.8 billion.

IBM has also been on something of an AI buying spree recently.

It picked up cloud-computing automation specialist HashiCorp... and Apptio, which created an AI tool to help companies make tech-spending decisions.

In short, IBM's commitment to AI seems less like a fluke... and more like the beginning of the trend.

In short, IBM's commitment to AI seems less like a fluke... and more like the beginning of the trend.

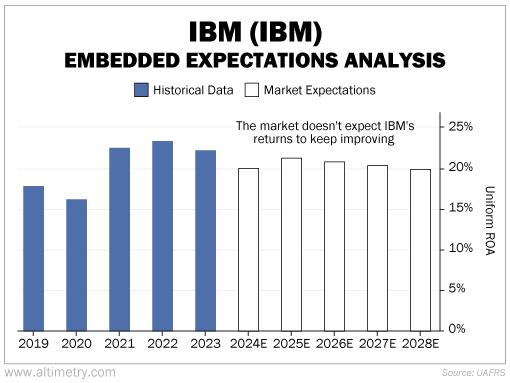

And yet, investors aren't treating it that way. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

IBM's Uniform return on assets ("ROA") has been trending higher in recent years. However, investors expect that growth to ease... with returns retreating to 20% by 2028.

Take a look...

In short, investors aren't paying much attention to IBM's improved AI bookings. They're treating it like any old tech story that has played itself out.

IBM is a great example of an AI player that's still flying under the radar...

IBM is a great example of an AI player that's still flying under the radar...

Many folks don't immediately link IBM with cutting-edge AI. And that makes it a promising investment today.

The company has been quietly making moves in this space. It should continue to outperform relative to expectations.

Investors have to get more picky in this industry. You can't buy any business that throws around the words "artificial intelligence"... and expect to get rich quick. However, there are still opportunities in lesser-known AI beneficiaries.

As more people catch on to IBM's strategy, its under-the-radar status might not last much longer.

Regards,

Joel Litman

August 20, 2024

P.S. While a fearful Main Street sold AI, energy, and even gold stocks earlier this month... Wall Street was buying them up at a discount.

And it gets worse. Based on what I'm seeing, investors are now playing a rigged game.

In short, the stock market is changing in ways you might not believe. Some of the world's smartest investors are already moving their money.

It's all part of a bigger story that most folks aren't being told about... And it's time to protect yourself. Click here for next steps.

AI momentum has started to fade, and investors are worried the peak is already over...

AI momentum has started to fade, and investors are worried the peak is already over...