Many investors are concerned about the long-term effects of the coronavirus outbreak on financial markets...

Many investors are concerned about the long-term effects of the coronavirus outbreak on financial markets...

In yesterday's Altimetry Daily Authority, I discussed the direct impact of the coronavirus on my global travel over the past week. The disruption brought two things to the forefront:

- How much more the world is interconnected today than ever before, and

- How important it is to remember that first and foremost, "The first wealth is health"

While those two facts are both at the top of my mind, many of our institutional and individual investor clients have still repeatedly asked us about the potential macroeconomic impacts of the outbreak.

A recent piece by market-research firm CB Insights lines up with much of what we've been telling clients: Specifically, the impact of an outbreak like this can be severe... but transitory.

CB Insights looked at several prior outbreaks, in particular SARS and Zika. The analysis explained that during the period of the outbreaks, venture capital funding rates in the affected region dropped dramatically. But once the health situation improved and the outbreak was contained, the funding rates rebounded aggressively – making up for any short-term drops.

We've repeatedly highlighted the same thing to clients. Depending on how severe the outbreak is, it could have negative short-term impacts... But that impact is likely to be transitory from a stock market perspective.

Artificial intelligence ('AI') isn't here to steal your job...

Artificial intelligence ('AI') isn't here to steal your job...

I recently read a survey stating that 27% of American professionals across all age ranges fear that their job will be eliminated within five years due to AI.

Interestingly, the survey showed a connection between higher salary and lower fear, and that not all industries had the same level of concern.

Advertising and marketing professionals felt the least secure, with 45% citing fear of obsolescence in the near future. They were closely trailed by business support and logistics (42%), automotive (37%), and transportation and delivery (35%) workers.

Only time will tell... but these figures feel high. Even among the most automatable industries and jobs, it's difficult to completely eliminate the work of a human.

Many tasks can be made more efficient through the use of technology and AI, but efficiency allows us to improve our crafts.

While Jeopardy's big winner Ken Jennings jokes that he's likely to be the first person to lose his job to AI after famously losing to IBM's (IBM) Watson computer system, a recent interview with both Jennings and fellow Jeopardy champion Brad Rutter showed why the opposite might be true.

You see, AI is called "artificial intelligence" because in many ways it "learns" in the same way humans learn – through experience.

If you watch early clips of Watson playing Jeopardy, it was quite comical listening to the answers it came up with. It struggled with context and pattern recognition, which could lead to some horribly wrong responses.

After playing for many years, Watson was able to take on the best human players and win. In their interview, Jennings and Rutter reflect on the experience – saying that Watson actually taught them to play better as well.

This is one example of how AI can actually enhance the way we work and solve problems rather than replace human workers. And there may be no better example of AI and humans complementing each other than in the medical field...

With its massive amounts of data and quick response times, AI can help doctors and surgeons better serve their patients. Meanwhile, given how situational medicine can be, people can provide context and creative decision-making far in excess than what a computer could.

When the two forces work together, patient outcomes are better than they would be with humans or technology alone.

Today, one company that has been trailblazing this connection is medical-devices firm Intuitive Surgical (ISRG).

In 2000, the company created the da Vinci Surgical System to help doctors achieve better outcomes in urological surgeries.

Since its entry to the market, the da Vinci has helped with hundreds of thousands of minimally invasive procedures across a number of categories by providing several robotic arms that can be controlled by a human operator.

By itself, the system would be completely inoperable... But in the hands of a capable surgeon, it can provide precision and stability to an operation.

Despite the clear value of the system in the operating room, it doesn't appear to have translated to value for Intuitive Surgical investors.

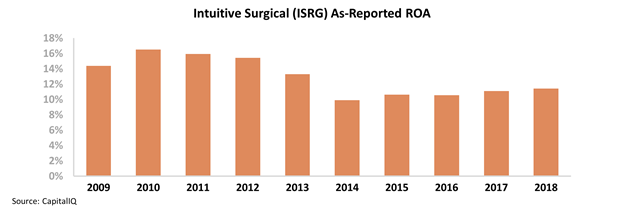

Over the past decade, Intuitive Surgical has enjoyed moderate returns. Its as-reported return on assets ("ROA") has ranged between 10% and 16% – just slightly above corporate averages. Furthermore, since 2013, returns have remained near the low end of that range.

We have highlighted medical companies in the past... Many of which have enjoyed massive returns thanks to the U.S. medical system. So for a business that combines value-add technology and medical equipment to only have average returns doesn't seem logical...

This is because it's wrong. In fact, the as-reported accounting numbers significantly understate Intuitive Surgical's actual returns...

The da Vinci System is a huge source of revenue, and the company has been able to substantially grow the cash on its balance sheet in recent years. Traditional accounting metrics punish businesses for keeping a large cash balance, which is unintuitive.

Under Uniform Accounting, we can adjust for inconsistencies and misleading practices like the treatment of excess cash, stock option expense, and research and development (R&D) costs to showcase a company's real returns.

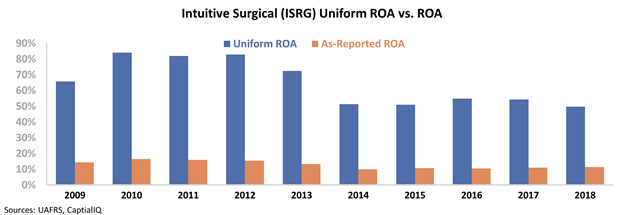

After making the proper adjustments, we can see that Intuitive Surgical's Uniform ROA is nearly five times higher than its as-reported returns... and has been for the past decade. Take a look...

The company's returns have actually ranged between 50% and 84%, which is more consistent with a tech-enabled medical company.

Evidently, the combination of humans and machines isn't just beneficial for patients... but for investors as well. And as you can see with Intuitive Surgical, it may not be possible to see this connection with as-reported data alone.

Regards,

Joel Litman

February 7, 2020

Many investors are concerned about the long-term effects of the coronavirus outbreak on financial markets...

Many investors are concerned about the long-term effects of the coronavirus outbreak on financial markets...