On New York's Staten Island, one residential street offers particularly stunning views of Manhattan...

On New York's Staten Island, one residential street offers particularly stunning views of Manhattan...

It's lined with million-dollar homes, each one more impressive than the next. Yet they don't belong to Wall Street bankers or corporate moguls.

They're owned by blue-collar millionaires – plumbers, electricians, and carpenters who run successful businesses... They build and maintain structures throughout the five boroughs of New York City.

And they're benefiting from two main catalysts – the huge wave of infrastructure projects in the U.S. (known as the supply-chain supercycle) and big investments by private-equity ("PE") firms.

While not typically associated with manual labor, PE firms quickly pounced on the opportunity... as federally funded projects took off in 2022.

They began approaching certain blue-collar companies with tempting offers... to build major players in the promising skilled-trade industry.

All this translated into huge demand for home-services companies and their suppliers. That led to unprecedented wealth in the overall sector.

So it's no surprise that blue-collar businesses are attracting investors. Yet, as we'll explain today, they'll miss a key opportunity if they stick to the traditional metrics.

The supply-chain supercycle isn't slowing down anytime soon... and neither are PE firms...

The supply-chain supercycle isn't slowing down anytime soon... and neither are PE firms...

The U.S. is experiencing strong economic growth. All you have to do is look at the infrastructure projects launched under the Biden administration...

The Bipartisan Infrastructure Law of 2021 boosted public-infrastructure spending for roads, bridges, and rails. The CHIPS and Science Act of 2022 ramped up the domestic semiconductor industry, powering the artificial-intelligence revolution.

Together, they've generated high demand for materials and services in the blue-collar industry – from both home-services companies (the ones that execute construction projects) and the businesses that supply essential products for those projects (suppliers).

This trend is likely to continue well into the future, especially since both U.S. presidential candidates support infrastructure investments at home.

That's why PE firms have been moving into the skilled-trade sector... acquiring home-services businesses like heating, ventilation, and air conditioning ("HVAC") companies and plumbing businesses, like Arizona-based Rite Way Heating, Cooling, and Plumbing.

PE firms have one broad goal – to boost these companies' profits through larger, consolidated operations. And they're well on their way...

According to market research firm PitchBook, PE companies have purchased around 800 large home-services companies since 2022. (They've also bought many other, smaller businesses.)

These moves have benefitted both the owners and employees of the acquired businesses...

For instance, Redwood Services, a PE-backed home-services company, bought 35 businesses in the past four years alone. It has paid each one around $1 million, on average, for the acquisition.

According to Graham Weaver, founder of PE firm Alpine Investors, technicians at the HVAC companies Alpine acquires typically see a 20% pay increase in the first year.

Altogether, it's clear that blue-collar businesses are in a solid uptrend... And as long as the supply-chain supercycle persists, PE companies will keep consolidating and boosting profits.

Suppliers like Lincoln Electric (LECO) will also benefit...

Suppliers like Lincoln Electric (LECO) will also benefit...

This company designs, manufactures, and markets welding, cutting, and joining products... It supplies key components for large-scale infrastructure projects.

And Lincoln Electric has experienced a sustained boom since 2021. Like home-services companies, it's directly benefiting from the supply-chain supercycle we outlined earlier.

Yet some investors aren't seeing this opportunity. That's largely because as-reported metrics don't reflect the company's true profitability...

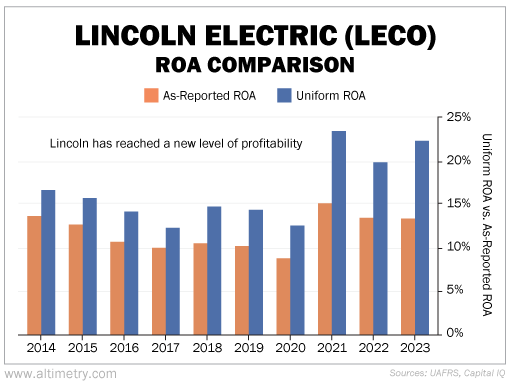

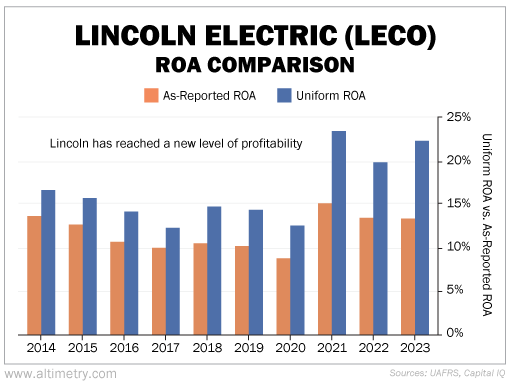

Lincoln Electric's as-reported return on assets ("ROA") ranged from 10% to about 13% before topping out at 15% in 2021... That marked a decade-high for the company.

However, its Uniform ROA is a lot better... It hit, or exceeded, 20% each of the past three years. That's far beyond the 12% corporate average. Take a look...

It's clear that Lincoln Electric's profitability has expanded in line with the supply-chain supercycle.

And as the huge wave of infrastructure investment continues to sweep across the U.S...

Many more blue-collar companies will benefit from this megatrend...

Many more blue-collar companies will benefit from this megatrend...

Infrastructure projects are continuing to ramp up, on the heels of a steady supply-chain supercycle.

That means home-services companies are still in high demand. And PE firms are scrambling to own them, in order to reap the benefits.

As they keep gobbling up the companies that use suppliers' products, businesses like Lincoln Electric will have a field day.

Simply put, they'll have an easier time selling to the larger businesses that execute our nation's big construction projects.

Investors take note... That should keep Lincoln Electric's profitability at a high level… and its stock should follow suit.

Regards,

Joel Litman

October 31, 2024

On New York's Staten Island, one residential street offers particularly stunning views of Manhattan...

On New York's Staten Island, one residential street offers particularly stunning views of Manhattan...