President Joe Biden wants the U.S. to be No. 1 in infrastructure again...

President Joe Biden wants the U.S. to be No. 1 in infrastructure again...

But some folks are worried we can't afford it.

The U.S. currently ranks 13th in the world for infrastructure quality. In his State of the Union address last month, the president doubled down on his goal to get our infrastructure back on top.

He's doing this primarily through the Bipartisan Infrastructure Law. It directs more than half a trillion dollars toward spending on new roads, bridges, buildings, and other projects to modernize U.S. infrastructure.

But it's not just that $500 billion is a lot of money to find in a constantly tight budget. All this spending could also keep inflation higher for longer.

Pockets of inflation are already popping up. In 2022, the price of construction costs outpaced general inflation. And as Biden's infrastructure plan gets underway, some people fear that's only the beginning.

Whatever happens, one thing is certain... Investments in construction and engineering (C&E) are about to ramp up.

Today, we'll take a look at the C&E industry as a whole – and market expectations specifically – to understand if there's an opportunity to get in early.

C&E spending has been on the rise for years...

C&E spending has been on the rise for years...

Money is flowing to the C&E companies that are doing the building for these new projects.

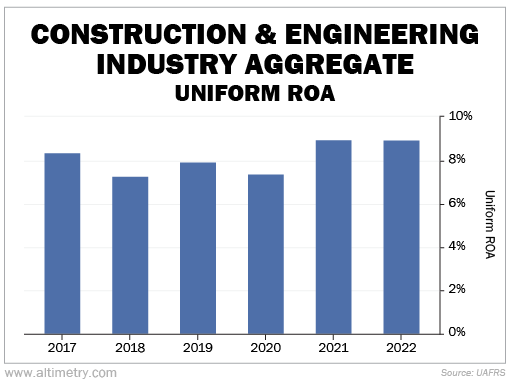

The industry's aggregate Uniform return on assets ("ROA") used to average about 8%. It jumped to 9% almost as soon as Biden signed the infrastructure law in 2021.

Take a look...

Infrastructure spending is on the rise. That's reflected in the returns of C&E companies.

We don't think this trend will falter anytime soon. But we still have to compare our expectations to the market's to determine if there's an investment opportunity.

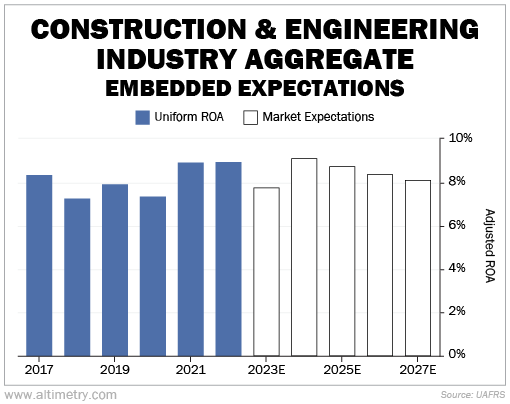

We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at the current stock prices of C&E companies. From there, we can calculate what the market expects from these companies' future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well the industry has to perform in the future to be worth what the market is paying for it today.

Investors think Biden's infrastructure spending bump will be short lived. They expect C&E ROAs to fade back to recent averages. Take a look...

As you can see, investors don't anticipate a shift in the C&E industry. They don't think the infrastructure bill will lead to higher returns.

The market is missing the infrastructure bill entirely...

The market is missing the infrastructure bill entirely...

This is a huge missed opportunity. Biden is hard at work to get the U.S. back to the No. 1 spot for infrastructure. If he succeeds, the C&E industry will continue to benefit.

Of course, some companies will do better than others. But C&E stocks as a whole should perform well for the next several years.

Don't be surprised if this industry records higher growth and higher returns than the market expects. This mismatch could mean a lot of upside for opportunistic investors.

Regards,

Rob Spivey

March 1, 2023

President Joe Biden wants the U.S. to be No. 1 in infrastructure again...

President Joe Biden wants the U.S. to be No. 1 in infrastructure again...