It's no secret that we're bullish on the U.S. economy...

It's no secret that we're bullish on the U.S. economy...

If you've been following our analysis in Altimetry Daily Authority for the past year or more, you've heard all about the supply-chain supercycle. In short, we're in the midst of a wave of investment in U.S. infrastructure as we bring our supply chains closer to home.

However, regular readers also know that we've written about the Federal Reserve's efforts to cool down the economy. It's doing this primarily by hiking interest rates in the hope of lowering inflation and raising unemployment.

Supply-chain investment and the Fed's rate hikes are undeniable truths about today's economic environment. And yet, one astute subscriber – Kevin from Lafayette, Indiana – noticed that the two seem at odds with each other.

As he asked us recently...

How could the new return to ["Build America"] to alleviate supply-chain disruptions interfere with the natural tendency of employment to decline during a recession?

And how might that play into the Fed's plan to cause a (mild?) recession (with employment disruptions) in order to defeat inflation?

This is a fantastic question. It brings to mind our recent essay about why it's important to consider unintended consequences.

More investment in U.S. infrastructure will cause massive ripple effects. It will lead to new job opportunities and unprecedented innovation. It'll be unlike anything we've seen recently.

The supply-chain supercycle is going to fast-track U.S. corporate investments... and by extension, the economy.

However, all changes to the economy have unintended consequences. This time is no different. Today, we'll examine what those outcomes could mean for the Fed's employment targets.

Employment will prosper... in certain industries.

Employment will prosper... in certain industries.

Kevin is exactly right that we expect the supply-chain supercycle to bolster employment levels in the U.S.

However, it's not as simple as saying there will be "higher employment." It's important to think about where that employment will occur.

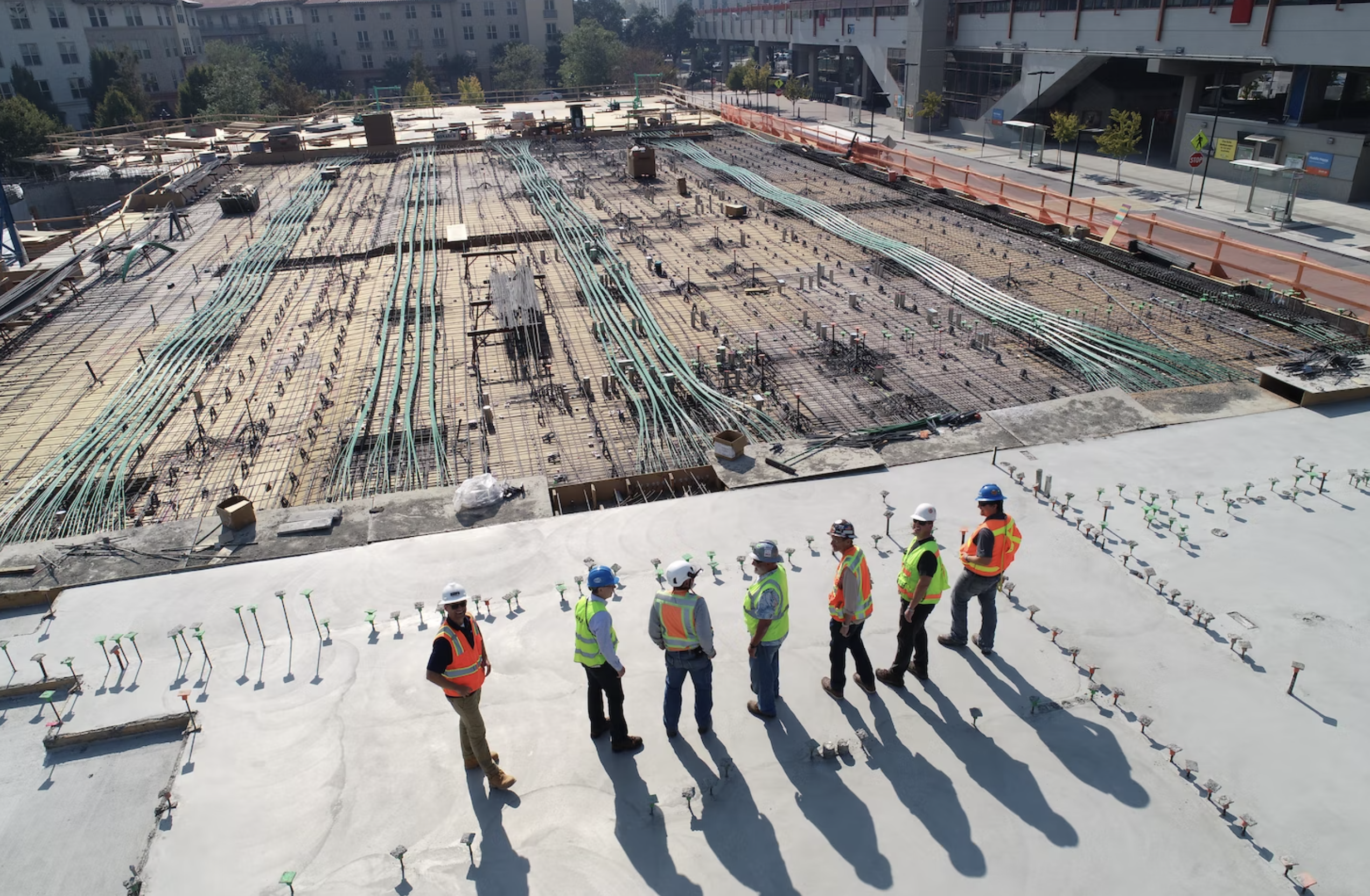

The supply-chain supercycle should have the biggest impact on one area that has struggled for more than two decades – blue-collar workers.

Demand will skyrocket for more factory workers... more maintenance workers for robots... more warehouse workers... more transportation workers... more "Internet of Things" technicians... and that's only scratching the surface.

And it's going to drive a return to a much larger blue-collar movement than we've seen in a while.

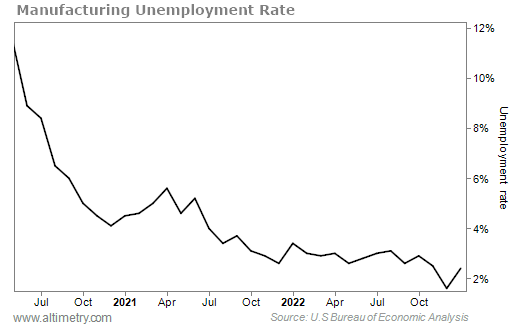

It's already starting to happen. The manufacturing unemployment rate peaked during the height of the pandemic. Since then, it has continued to fall. And we don't think it's going to rise again anytime soon.

Take a look...

This bump in blue-collar employment will counteract unemployment pressures in other sectors, like tech. The U.S. is getting back to the manufacturing roots that made it a global leader.

The supply-chain supercycle is making the Fed's job harder...

The supply-chain supercycle is making the Fed's job harder...

Unfortunately, investment in U.S. infrastructure might keep inflation higher for longer. In simplifying our supply chains and bringing production back to our shores, we'll change how we choose goods and services.

For a long time, the status quo has been to choose products based on the "lowest possible cost only." As production comes home, it will force us to focus on other factors... like the lowest cost in combination with geopolitical stability and local proximity.

This means costs are going to rise. And that's a negative for the inflation battle.

Inflation was at sub-2% levels for most of the past five years. It might not settle down to those levels again for some time.

However, these particular rising costs aren't necessarily bad. They actually spell great news for the U.S. economy. Moderately higher inflation drives economic growth.

Higher inflation will also change the kind of recession we see in the near future...

Higher inflation will also change the kind of recession we see in the near future...

Everyone's favorite "Goldilocks" scenario of low inflation and steady growth isn't going to happen.

The Fed has specific targets for inflation and unemployment. It will likely be comfortable keeping interest rates higher for longer until it hits those targets. That will force us into a modest recession.

Whether you know it best as "Build America" or the supply-chain supercycle, reinvestment in U.S. infrastructure is a significant trend for the economy. It's important to remember there are always unintended consequences... and there's no such thing as a free lunch.

The supply-chain supercycle may keep inflation higher. And it might contribute to a mild recession. On the other hand, it's going to be a driving force when we do return to a bull market.

We expect infrastructure and blue-collar-focused companies to do well in the coming years. And they'll help keep the U.S. economy competitive for decades to come.

Regards,

Joel Litman

February 27, 2023

It's no secret that we're bullish on the U.S. economy...

It's no secret that we're bullish on the U.S. economy...