China isn't the model for growth it once was...

China isn't the model for growth it once was...

Recent population statistics show that the country is no longer just aging rapidly... Its population is also shrinking.

For the first time in more than a half-century, China's death rate was greater than its birth rate. China's National Bureau of Statistics reported that its population fell by about 850,000 in 2022.

This decline shows that China's population is shrinking... and fast.

The now-defunct one-child policy and lack of a social safety net are two of the many factors in China's economic structure that are causing this drop.

China got rid of its one-child policy in 2016. It formally passed a three-child limit in 2021. Even so, its birth rate hasn't risen fast enough. The country even tried to fix this issue by removing all child limits last year.

No one is in a rush to have a lot of kids in the country. That's why the Chinese population's median age is skyrocketing. In 1978, it was a bit over 21 years. In 2021, it jumped to 38.4 years... neck and neck with the U.S.'s 38.5 years.

Today, we're diving deep into the population dynamics of the U.S. and China, its closest economic competitor. As we'll explain, anyone who believes that China can surpass the U.S. is just missing the point.

Population age has huge ramifications for how the economy operates...

Population age has huge ramifications for how the economy operates...

Old and falling populations struggle to create economic growth.

It's why Japan – the last country to threaten U.S. supremacy – failed to overtake us after its economy peaked in the late 1980s.

It's also why, as longtime readers know, we're confident U.S. dominance isn't going anywhere.

(We call this "Pax Americana 2100"... a continuation of the economic prosperity that followed World War II.)

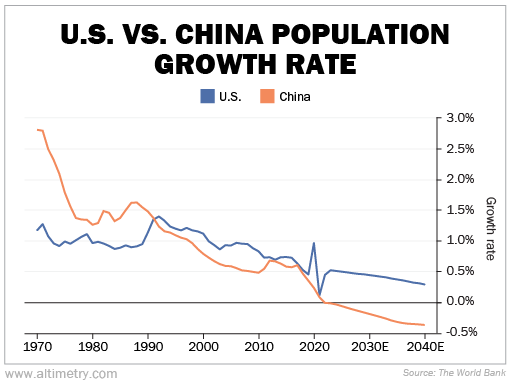

The U.S. population is still growing. And it's growing at a healthy rate. China's population has been decreasing since the 1990s. That decline picked up the pace during the 2010s.

As you can see in the following chart, the World Bank thinks both of these trends will continue.

Take a look...

Even 17 years from now, the U.S. population is expected to keep growing.

Plus, the median age in the U.S. is lower than in many other developed countries worldwide. This includes the U.K. (40.6), France (41.7), and Germany (47.8).

The U.S. also has the most raw materials. It leads the pack in oil production, with 19 million barrels per day in 2021 – almost double that of Saudi Arabia and Russia.

Our corporate innovation dominates over China, too. As of 2020, U.S. companies had $2.4 trillion of useful innovation assets on their balance sheets... versus only $700 billion in China.

And the gap has been growing for years.

By increasing investment in research and development (R&D), U.S. companies are setting the country up for future economic success.

And one of our favorite investment themes drives this point home...

And one of our favorite investment themes drives this point home...

We're talking about the supply-chain supercycle. A massive wave of reinvestment in U.S. infrastructure will lead to a resurgence in blue-collar workers. This return to manufacturing will be transformative.

Industrial jobs are now in more demand than at any other point in the 21st century. That will cause massive ripple effects across the country.

Output will rise. The U.S. will get back to manufacturing – the "bread and butter" that made it the global superpower it is today.

That's why we're so bullish on the U.S. economy here. All of this R&D spend is setting our economy up for decades of innovation dominance. (And that's despite recent struggles in the tech sector.)

Don't lose hope on our innovative industries... In the long term, we think there's a lot of upside for investing in tech.

Today, though, themes like the supply-chain supercycle are set to shine. And right now, we believe manufacturing and industrial companies are full of opportunity.

Regards,

Joel Litman

February 6, 2023

China isn't the model for growth it once was...

China isn't the model for growth it once was...