7-Eleven is the most famous company you hardly hear about...

7-Eleven is the most famous company you hardly hear about...

The convenience-store chain has become a noun in its own right... referring to any and all convenience stores in some parts of the U.S. However, it doesn't tend to get much attention from investors or the press.

Neither does its chief competitor, Circle K. The two chains run more than 19,000 locations across the U.S. But they almost never make headlines on Wall Street.

That is, until this past summer...

In mid-August, 7-Eleven confirmed that Circle K parent company Alimentation Couche-Tard (ATD.TO) launched a takeover bid for Seven & i (3382.T), 7-Eleven's Japan-based owner.

7-Eleven's parent company rejected the attempt. So Couche-Tard went back to the drawing board... and upped its offer to $47 billion a few days ago. This time, Seven & i will have to give it more thought.

A potential deal could shake up the whole convenience-retail market. And as we'll explain, it has broader implications for Japanese businesses...

Couche-Tard's first bid accounted for around 80% of its own market cap...

Couche-Tard's first bid accounted for around 80% of its own market cap...

The offer was for a $39 billion nonbinding bid, meaning it was meant to start negotiations. Couche-Tard never meant for it to be the final deal.

As expected, 7-Eleven's parent company turned down the opening offer... saying it fell far below Seven & i's true value.

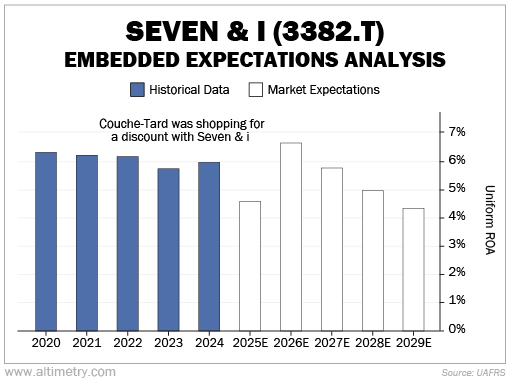

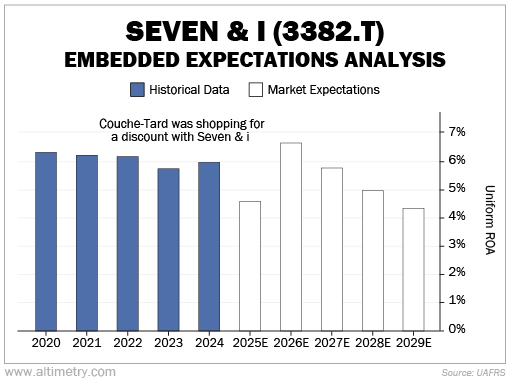

We can see why through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well Seven & i has to perform in the future to be worth what Couche-Tard offered.

Seven & i has generated a steady 6% Uniform return on assets ("ROA") since at least 2020. But at a $39 billion purchase price, Couche-Tard was acting as though it expected returns to fall well below that level.

Take a look...

Couche-Tard was asking for a pretty big discount, considering Seven & i's history of steady 6% returns. With no negative developments or headwinds on the horizon, Uniform ROA is unlikely to fall to 4.5%... which is where Couche-Tard valued it.

No wonder Seven & i's board refused the offer.

The board also knows that Couche-Tard should pay for the company's potential, not its historical performance...

The board also knows that Couche-Tard should pay for the company's potential, not its historical performance...

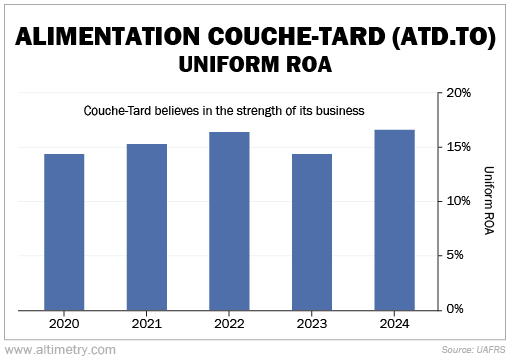

Couche-Tard is by far the more profitable of the two. It's likely interested in acquiring Seven & i because it believes it can improve its business.

The company has averaged a 15% Uniform ROA in the past five years, with very limited deviations.

Check it out...

Couche-Tard wouldn't be trying to acquire Seven & i if it thought it would mean a hit to profitability.

And if it believes it can achieve similar profitability levels with Seven & i's asset base, it should be offering a premium to acquire it.

While we're not surprised Seven & i rejected the initial takeover offer, there's another important story here...

While we're not surprised Seven & i rejected the initial takeover offer, there's another important story here...

Couche-Tard's $39 billion bid was the largest offer for a Japanese firm by a foreign company... ever.

Said another way, Japan is finally "open for business."

It has been next to impossible to take over a Japanese company for decades. Corporate-governance mazes made for an impenetrable wall of defense. But now, smart investors will keep an eye out for bigger opportunities in Japan.

Couche-Tard didn't do itself any favors by starting the negotiation with an awfully low price. Still, it's a step in the right direction.

Japan has been dormant in the merger and acquisition landscape for decades now. That may be changing.

Pay attention to the headlines... If Couche-Tard finds success, it could start a chain reaction of acquisitions in this sleepy market.

Regards,

Joel Litman

October 22, 2024

7-Eleven is the most famous company you hardly hear about...

7-Eleven is the most famous company you hardly hear about...