There's a simple strategy for beating the market...

There's a simple strategy for beating the market...

Just sit in on a congressional subcommittee.

Back in 2021, House Rep. Pat Fallon served on a subcommittee of the House Armed Services Committee. Its job was to oversee the dealmaking process of a $10 billion Pentagon cloud-computing project, for which several tech giants were bidding.

Microsoft (MSFT) looked like a shoo-in to win the whole deal... until the Pentagon decided to cancel the entire contract.

Thankfully for Fallon, he sold up to $250,000 worth of shares two weeks before the news broke.

Rep. Nancy Pelosi came under fire late last year for similar reasons. Her husband invested millions of dollars in chipmakers like Nvidia (NVDA)... while she was voting on the CHIPS Act that would subsidize the industry.

House and Senate members hear a lot of privileged information on the job. They're the ones shaping legislation, voting on spending bills, and crafting regulations that can help – or hurt – certain stocks.

It sounds like a classic case of insider trading. And yet... it's perfectly legal.

The U.S. Securities and Exchange Commission ('SEC') doesn't bar Congress members from acting on the information they're privy to...

The U.S. Securities and Exchange Commission ('SEC') doesn't bar Congress members from acting on the information they're privy to...

What these folks hear in their various subcommittees isn't considered "material nonpublic information" as the SEC defines it.

As long as they report all their trades within 45 days, members of Congress are free to buy and sell whatever stocks they please.

And to nobody's surprise, they consistently beat the market.

Trading-data provider Unusual Whales publishes an annual report on trades from House and Senate members... and their performance.

Since 2020, Congress members have beaten the S&P 500 Index every year. Four members of Congress posted returns above 100% last year. Pelosi booked a 66% return.

So while it might be legal... insiders do have an advantage. We ought to pay attention to what they're doing.

And Congress isn't the only body engaged in legal insider transactions...

And Congress isn't the only body engaged in legal insider transactions...

Corporate executives do the exact same thing.

Nobody knows where a company is going better than its own executives. (At least, in theory.) That's why it can be so valuable to track how executives are trading their own stocks over time.

Like with Congress, company insiders aren't completely free to trade. They have specific "windows" throughout the year when they can buy and sell shares.

Any time that happens, the SEC requires it to be reported in a Form 4. And regular readers know that whenever a company reports a Form 4, it gets posted on secform4.com.

If executives are unloading stock or scrambling to buy more, they might know something investors don't. So secform4.com helps give investors more transparency into what's going on.

It isn't just useful for individual companies, either. It's also a powerful tool to understand the outlook for management teams across the economy.

As we explained last May...

[Secform4.com] not only compiles filings, it also analyzes the results...

The conclusions of these analyses are not surprising most of the time. As a whole, management teams tend to buy stock when it is cheap and sell stock when it is expensive.

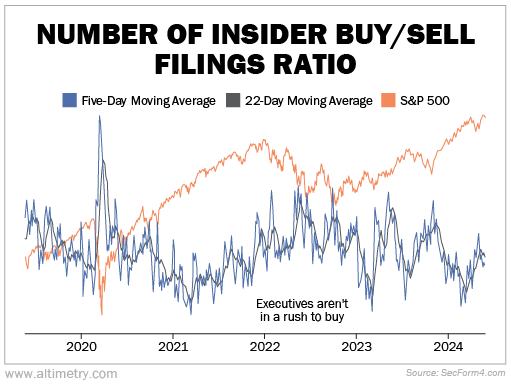

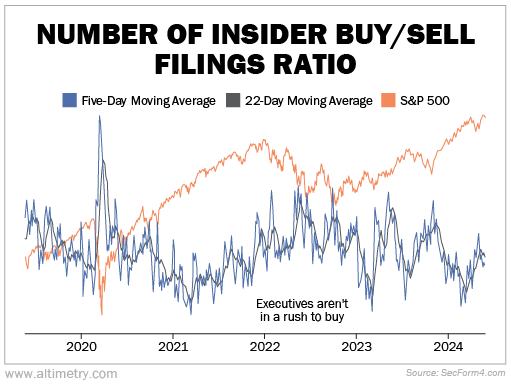

[One of our favorite charts] shows the ratio of daily buy and sell filings from public Form 4 data. A higher ratio means management teams are buying more (and are generally more bullish), and a lower ratio means they are selling more (and are more bearish).

Take a look at the updated chart, which we've recreated below. Executives bought a good amount of stock throughout most of last year. But so far in 2024, insiders haven't been buying much at all.

Back in March, buying slowed to its lowest level since late 2021... shortly before the last time the market peaked.

And while buying has picked back up a bit, it's still well below the average for most of 2022 and 2023.

Take a look…

Insiders tend to be great value investors. When they think their stock is cheap – like in the first few months of the pandemic – they'll buy as much as they can.

And when they think their stock is expensive, they're happy to sell... or wait for a better buying opportunity.

Corporate leadership seems to know something is up...

Corporate leadership seems to know something is up...

Insiders are waiting for a better opportunity... while the broader market is still full steam ahead. This could be a sign that executives think valuations have gotten too high.

Something worse could even be on the horizon.

But while the folks at the top are being cautious, they're not staying out of the market entirely...

No fewer than 62 lawmakers are shifting their money into a new trend – one that could build even more wealth than they already have.

It all dates back to a strange event this past January... when both sides of the aisle came together in a rare moment of solidarity.

What happened earlier this year has the potential to supercharge one specific market sector. U.S. politicians are already taking advantage. And there's still room for you to buy in alongside them.

Our team has been preparing for this massive shift since 2021. Get the specifics right here... including how to access our list of 10 "red flag" stocks that could tank your portfolio.

(One is a former dividend aristocrat... while another is a member of the "Magnificent Seven.")

No matter what you do next, keep in mind – when politicians are moving their money into a certain stock or sector, it's often a flashing green light to capture large gains.

Regards,

Rob Spivey

May 29, 2024

There's a simple strategy for beating the market...

There's a simple strategy for beating the market...