This tech behemoth is a case study in the issues with non-operating cash...

This tech behemoth is a case study in the issues with non-operating cash...

On Tuesday, Apple (AAPL) reported impressive first-quarter earnings for its 2020 fiscal year, sending shares nearly 3% higher for the day. Its market cap broke $1.4 trillion as excited investors reacted to the company's positive outlook.

But another part of Apple's release caught our eyes... The company's cash hoard is now more than $207 billion. Apple has enough cash on hand to buy fellow tech giant Cisco (CSCO), media company Comcast (CMCSA), or financial-services firm Wells Fargo (WFC) outright, depending on the day.

If Apple were to fail in its efforts to move into media, banking, or with its investments in hardware, I suppose buying one of those companies might be a viable solution... considering Apple has almost no operational use for all that cash on the balance sheet.

When a company is as cash-flow strong as Apple is, it doesn't need to maintain such a massive cash balance. If we keep that cash on Apple's balance sheet when analyzing the company, we're really looking at two combined businesses when we're looking at metrics like Uniform return on assets ("ROA").

One is Apple's operating business, which earned an impressive Uniform ROA of 43% last year. The other is the company's cash balance, which earned a less than 3% ROA last year.

Analyzing those two businesses as one, like as-reported metrics do, investors would think Apple was a lower-return business than it really is... or think the company is being disrupted by competition, when it actually isn't. Investors using GAAP financials have a completely wrong understanding of Apple's performance.

Even for one of the largest companies in the world, this is just another example of how the as-reported metrics completely distort investors' understanding of a business.

I often teach at DePaul University in Chicago...

I often teach at DePaul University in Chicago...

And in classes, one of the first examples I use to show the power of Uniform Accounting is comparing firms in the same industry – and the same business – that have different accounting strategies. Two companies I often use as an example to explain how leases impact accounting are UPS (UPS) and FedEx (FDX).

UPS and FedEx are two similar shipping companies with a basic business – delivering packages to customers as quickly as possible. Therefore, it should be easy for analysts to compare these two companies against each other using GAAP accounting. However, a key difference between the two is hidden by as-reported metrics...

In the January 7 Altimetry Daily Authority, we discussed how GAAP accounting misstates operating leases. Historically, operating leases are treated differently than buying property, plant, and equipment (PP&E). Historically, UPS has purchased its assets and FedEx has leased... which means that both companies have underlying differences that aren't captured by GAAP reporting.

And recent changes in accounting to attempt to bring leases onto the balance sheet only make those distortions more problematic instead of resolving the issues.

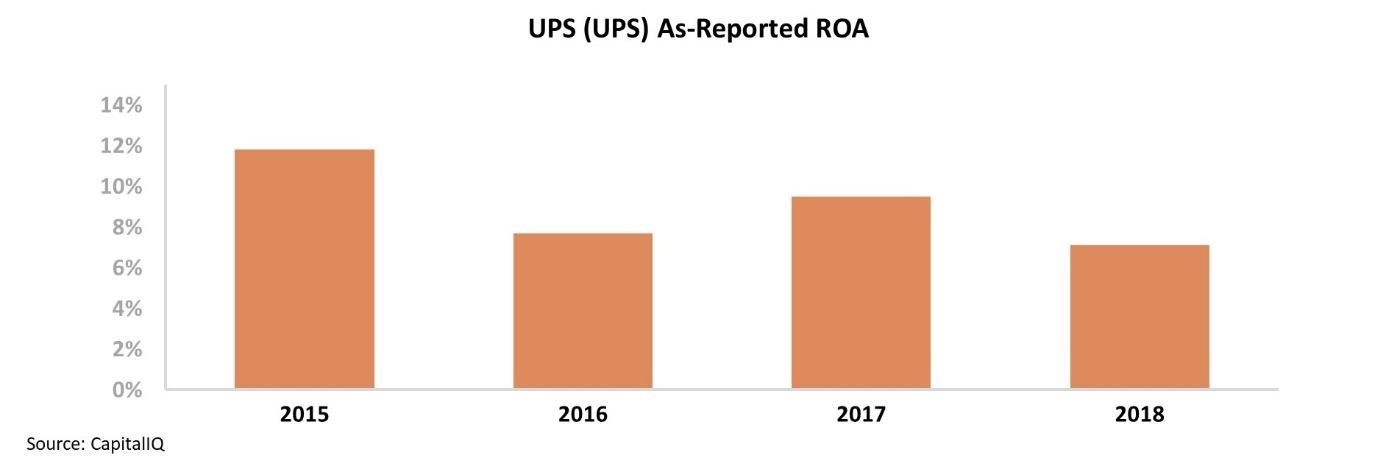

Under as-reported accounting – which fails to capture operating leases effectively – it appears that both companies have seen their ROAs trend in line with each other. Over the past four years, UPS has seen its as-reported ROA erode from 2015 highs...

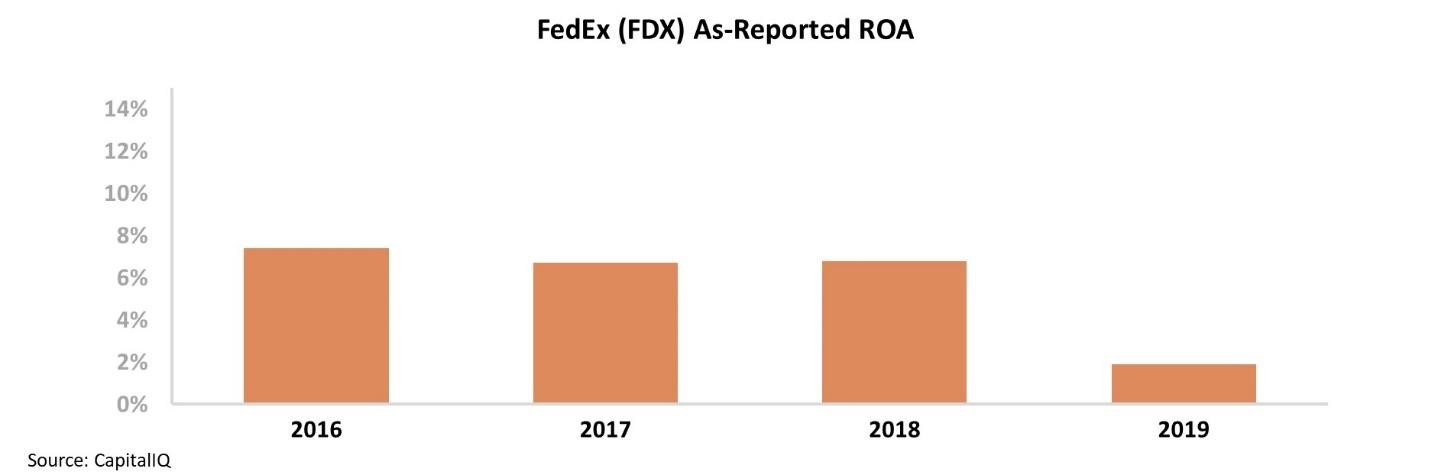

Furthermore, under as-reported metrics, it appears that FedEx has also seen its ROA plummet to all-time lows last year. With a dramatic fall from 6.8% in 2018 to 1.9% in 2019, investors assume that this ROA decline is due to the recent trade war.

Now, with trade concerns receding, investors are confident that FedEx will be able to return its profitability to previous highs. Furthermore, with an as-reported price-to-earnings (P/E) ratio of 13.6, FedEx looks like a clear value buy due to its cheap valuation.

However, this is based on misleading data...

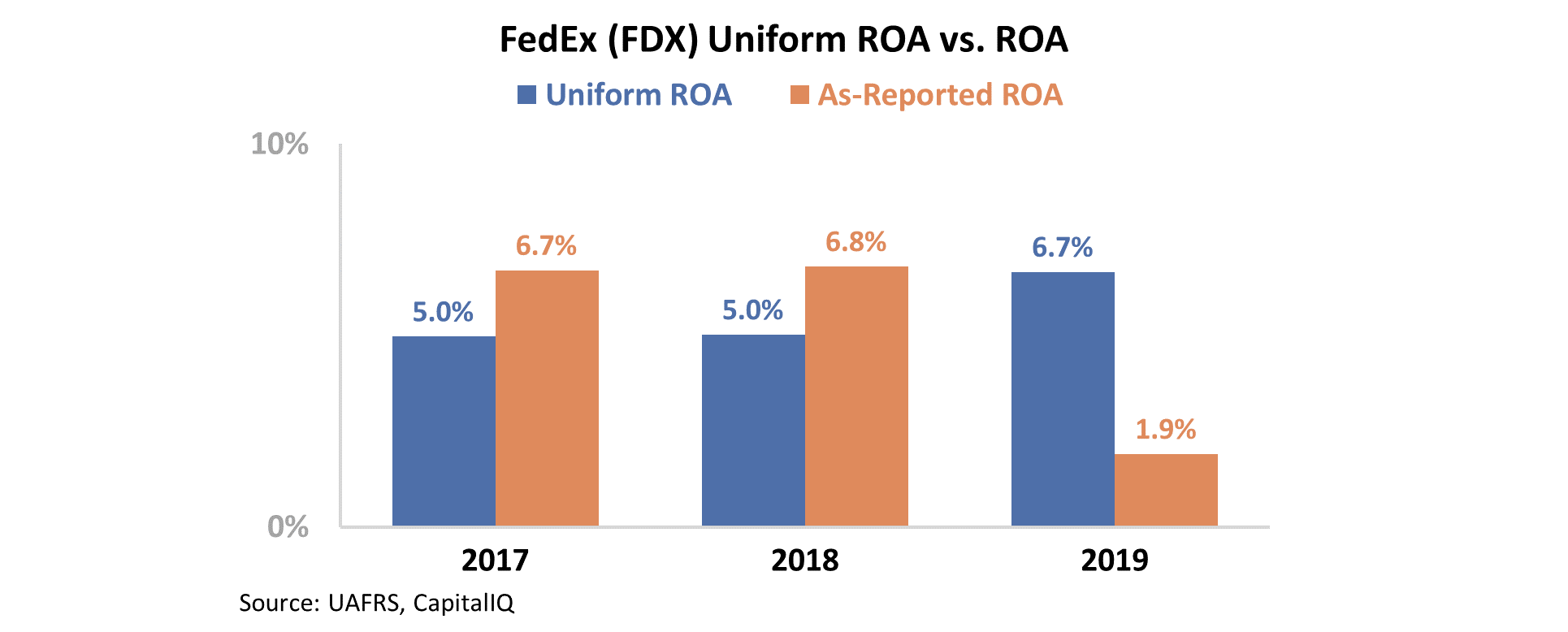

Over the past four years, FedEx has seen its ROA trend upward, not erode like UPS's ROA has. The recent dip is because operating leases were not properly accounted for. This key difference between UPS and FedEx can only be shown clearly using Uniform Accounting.

This operating lease distortion grew massively last year with the introduction of new accounting standards. The Financial Accounting Standards Board ("FASB") – the organization that maintains GAAP accounting – capitalized certain operating leases to the balance sheet. However, these changes only further distort the accounting...

Under these new accounting standards, the life of the lease capitalizations – as well as a one-time charge to pension expense – have sunk as-reported ROA. FedEx's severe drop in as-reported ROA is not due to the trade war, but instead due to this distortion.

Removing these distortions, we can see that instead of returns collapsing in line with those of UPS, FedEx's Uniform metrics have improved. The company's Uniform ROA has risen over the past few years from 5% to 6.7%.

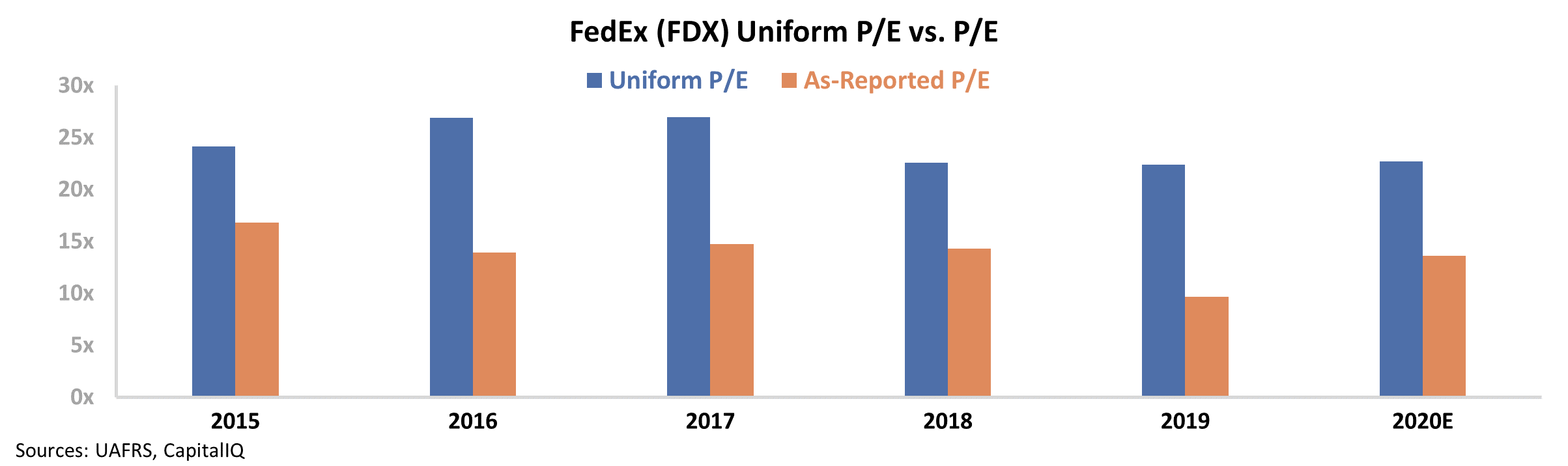

And this directional distortion to FedEx's ROA also has serious implications for the P/E ratio. Since the company's earnings have been so misstated, FedEx appears to be trading at the attractive multiple of 13.6 times. However, under Uniform Accounting, the company is trading at a P/E ratio of 22.7 – right near corporate averages. Take a look...

Due to these GAAP distortions, investors are drawing incorrect conclusions about FedEx. Value investors look for stocks that trade at low P/E ratios due to temporary conditions... and using as-reported metrics, FedEx appears to be a value trader's dream.

In reality, this is a well-performing company with a stock price that reflects its performance. While as-reported metrics cause investors to group FedEx with UPS, those looking for a value trade would be better served looking elsewhere.

Regards,

Joel Litman

January 31, 2020

This tech behemoth is a case study in the issues with non-operating cash...

This tech behemoth is a case study in the issues with non-operating cash...