Here's some perspective on the potential longer-term structural impact of the coronavirus outbreak...

Here's some perspective on the potential longer-term structural impact of the coronavirus outbreak...

Earlier this month, The Economist published an interesting piece about some of the bigger changes we could see in the corporate world as a result of the virus.

As more businesses encourage employees to work from home, companies may become more comfortable with individuals working remotely moving forward. And if productivity improves, we could see greater adoption of this type of work.

It's why businesses like video-conferencing firm Zoom Video Communications (ZM) have seen their stock prices surge... regardless of whether the jump is warranted based on these companies' fundamentals.

This has been a widespread topic in recent weeks, so the comments weren't revolutionary. But the article also pointed out a far more interesting premise:

The second way in which companies are rethinking their business has to do with supply chains. Since the 1980s these have become more complex and global, with large firms now dependent on thousands of suppliers. The embrace of lean manufacturing and just-in-time delivery of components, pioneered by Toyota in the 1970s, has made production more efficient but more vulnerable to disruption, as companies stockpile fewer and fewer necessary materials. The median firm in the S&P 500 carries only 66 days of inventory, and some have far smaller buffers than even that – Apple has just nine days, according to data from Bloomberg.

When natural disasters strike big companies usually get by, shifting production temporarily from afflicted areas to those that are not. But unlike a flood, an earthquake, or even the Sino-American trade war, all of which companies have some experience in planning for, Covid-19 could affect all of a firm's actual and potential subcontractors simultaneously. In such a scenario carrying bigger inventories and having suppliers at home may no longer look wasteful. It may come to be seen as necessary.

It's an interesting question. The potential is likely overstated, just like the potential for companies to sustainably reduce corporate travel is unlikely. People called for this to happen after 9/11 and after the Great Recession, but businesses still value the importance of a face-to-face meeting.

But once the short-term overhangs from the coronavirus outbreak subside, if corporate concerns about supply chains do lead to the building of better redundancies in terms of inventories, this could be a positive factor for the economy.

Companies building up inventories means that they'll purchase more goods from suppliers than they would normally just to get back up and running. And that will directly impact gross domestic product ("GDP"), and also may lead to the need to invest in more capital expenditures ("capex").

If that happens, the inventory buildup could be a counterintuitive surge and benefit for the economy... and for corporate earnings coming out of these volatile times.

The homebuilders continue trading at a discount...

The homebuilders continue trading at a discount...

Since the Great Recession, few industries have been as permanently undervalued. It's understandable – this was one of the hardest-hit sectors of the economy due to its role in the 2008 crisis.

Most homebuilders saw their returns fall to negative levels, and many have struggled to reach previous levels of profitability.

It's partly because Americans aren't as willing to buy large houses as they used to be. Many have chosen to either buy smaller homes, rent, or hold on to the houses they're already living in – meaning there's less demand to go around.

As a result, the stocks for many of the major homebuilders have traded below market averages since the Great Recession.

In the February 25 Altimetry Daily Authority, we highlighted one of these "discount" companies: KB Home (KBH).

It's one of the few homebuilders which mostly makes "starter" homes – smaller houses for first-time buyers and the post-recession crowd.

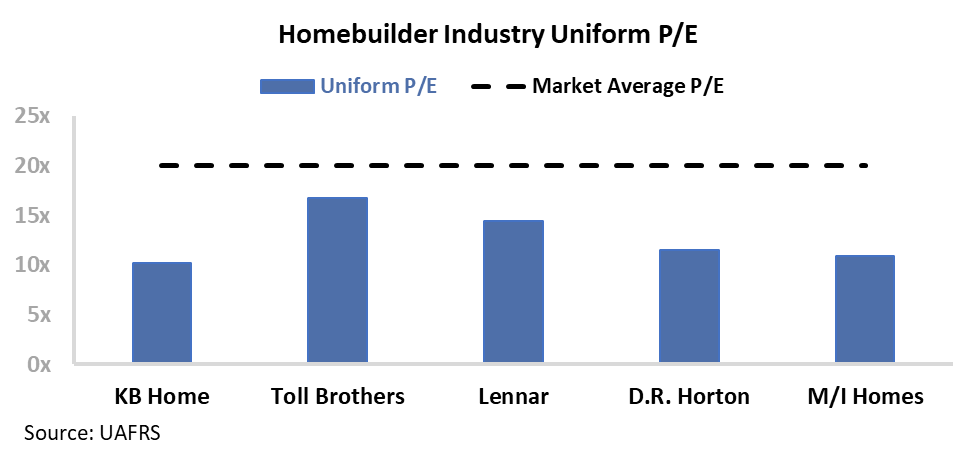

That said, KB Home still trades below market averages. The market-average price-to-earnings (P/E) ratio is around 20 times, and KB Home currently trades at a Uniform P/E ratio of 10.

The same is true for most of the other major players as they struggle to grow demand. As you can see in the chart below, the average homebuilder trades at a Uniform P/E ratio around 12 or 13...

However, even though demand for new houses hasn't fully recovered, Americans still need places to live. Rather than buying a brand-new house, many families are instead focusing on renovating their existing homes. Not only is it much cheaper and easier to renovate, but it helps raise an existing home's value.

At times when the market is betting against homebuilders, it tends to be much more favorable to home-improvement retailers – these companies tend to move somewhat opposite the homebuilding industry.

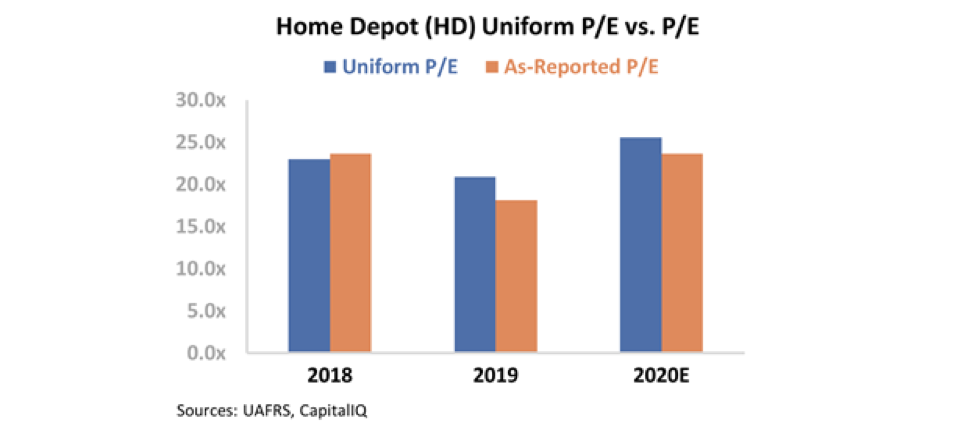

For example, Home Depot (HD) has traded above market averages for several years, reaching a Uniform P/E ratio as high as 26 for this full year's expectations. Take a look...

But not the entire home-improvement retail industry is being treated the same...

Some companies are trading more like the homebuilders themselves because investors perceive them to have more exposure to the homebuilding market than the renovation market.

A great example of this is Mohawk Industries (MHK). The company specializes in flooring products – including tiles, carpeting, and hardwood.

Investors may be concerned due to Mohawk's exposure to the homebuilding industry, since some of the company's revenues come from new constructions. As a result, the market has treated Mohawk more like a homebuilder than like a home-improvement retailer.

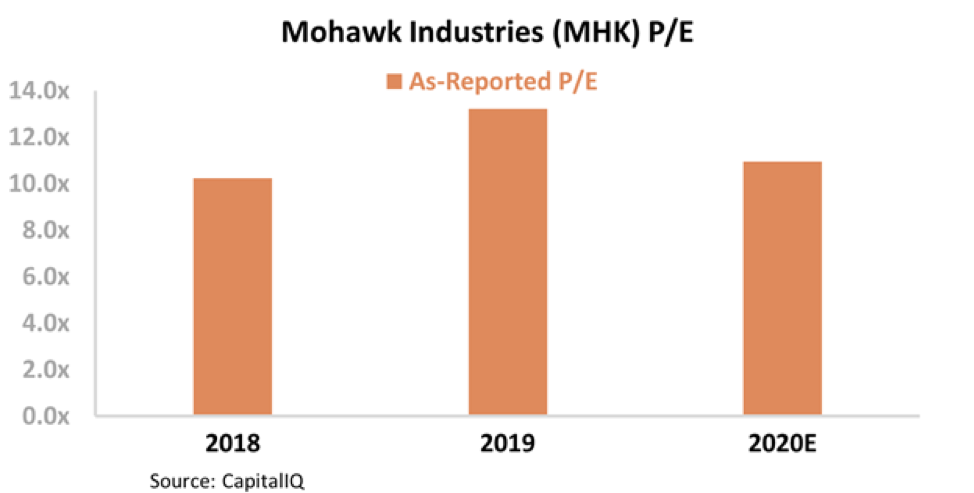

The company's as-reported P/E ratio has ranged between 10 and 14 in recent years – a significant discount to the market. Take a look...

That said, investors seem to be missing the point...

Only 16% of Mohawk's revenues come from newly built residential homes. An additional 58% of its revenues come from residential replacements, and the remaining 26% is from less volatile commercial projects.

Considering how little of Mohawk's revenue is related to homebuilders, investors may be applying too heavy of a discount, thus treating the company as if it were a homebuilder itself.

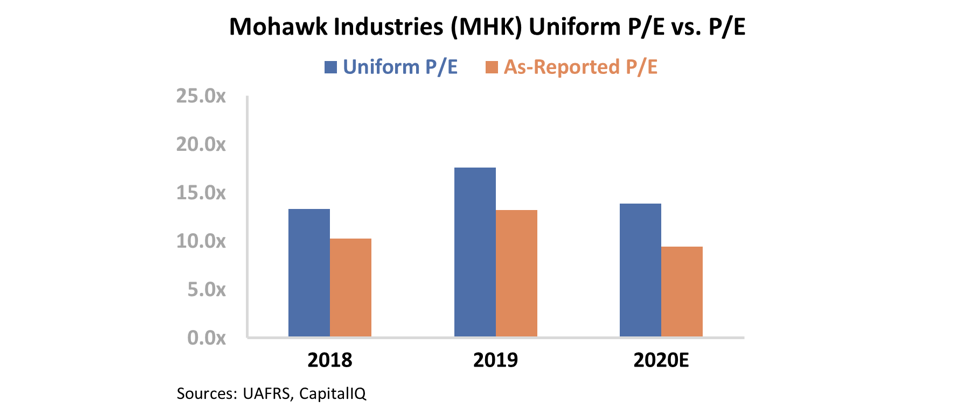

That said, once we look at Mohawk through a Uniform Accounting lens, we can see the real story...

With Uniform metrics, we're able to adjust misleading figures from the as-reported financial statements – like goodwill, operating leases, and one-time special items. After applying these adjustments, we can see that Mohawk's valuations are higher. The company actually trades at a Uniform P/E ratio of 14. Take a look...

These valuations might still appear cheap, but consider this in context...

Despite "pure play" home improvement-retailers like Home Depot trading above market averages, Mohawk has exposure to new homes and renovation projects – meaning it deserves to trade somewhere in between the as-reported numbers and the market average.

While current valuations are still below market averages, they're more in line with what we would expect fair value to be.

Don't get fooled into thinking the market is irrational or that a company is cheaper than it really is. As-reported metrics give bad signals that can lead to poor investing decisions.

Regards,

Rob Spivey

March 19, 2020

Here's some perspective on the potential longer-term structural impact of the coronavirus outbreak...

Here's some perspective on the potential longer-term structural impact of the coronavirus outbreak...