European defense spending is entering a new era...

European defense spending is entering a new era...

International governments spent decades counting on the U.S. military for protection – and to keep their own budgets low. But those days are coming to an end.

As we discussed yesterday, European nations are rapidly ramping up military investment. Some, like Lithuania and Estonia, have already committed to raising defense spending above 5% of GDP. Sweden, which joined NATO in 2024, raised its defense budget by 37% last year.

Others will soon follow as NATO redefines its defense obligations. The real question now is... who will benefit?

Governments won't just be hiring more troops or expanding bases. The bulk of this spending will go into weapons, missile systems, and advanced military technology.

And one overseas contractor is uniquely positioned to capitalize on this shift.

Swedish defense manufacturer Saab (SAAB-B.ST) specializes in high-tech military systems...

Swedish defense manufacturer Saab (SAAB-B.ST) specializes in high-tech military systems...

With NATO committing to significant long-term military investment, member states will need new providers outside the U.S.

Saab has a proven track record and deep ties to European defense ministries. It has supplied fighter jets, radar systems, and missile defense technology to multiple NATO countries for decades.

And it has secured long-term contracts with nations like Poland, Germany, and the Czech Republic.

Saab is well positioned to supply these countries with the next generation of military technology. Its Gripen fighter jets are among the most cost-effective and versatile on the market.

While one Gripen jet costs about the same as an F-35 from U.S. contractor Lockheed Martin (LMT)... its operating costs for the military are less than a quarter of the F-35's.

Plus, unlike U.S. defense giants that rely on Pentagon contracts, Saab's primary focus is on European markets. Roughly 66% of its sales come from Europe.

Saab will rake in cash as Europe ups its defense spending...

Saab will rake in cash as Europe ups its defense spending...

Shares of the arms manufacturer are up more than 50% in the past year. So it's clear investors have some idea of Saab's potential.

But they're only scratching the surface.

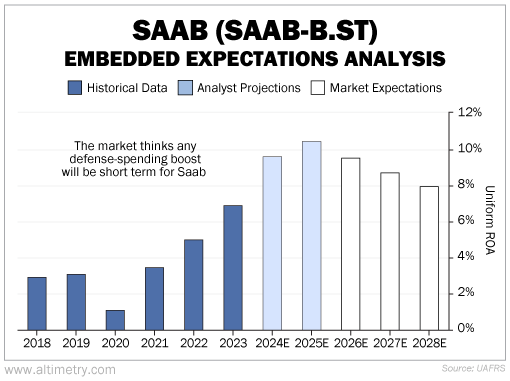

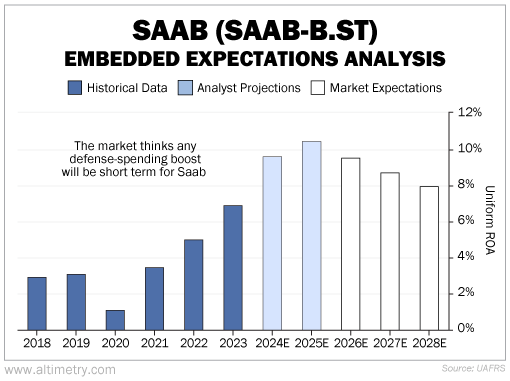

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Saab's Uniform return on assets ("ROA") has averaged around 4% in the past five years.

Wall Street analysts expect that number to reach 10% by 2026... approaching the 12% corporate average.

But when we look further out, the uptrend falls apart. Investors think returns will stabilize at 8% by 2029.

Take a look...

Investors think Saab's profitability will surpass historical averages. But that's about it. They then expect returns to slip back toward recent levels.

Folks, Saab stands to far outperform the market's current expectations...

Folks, Saab stands to far outperform the market's current expectations...

Poland is planning to double the size of its army by 2028. Germany is committing more than $100 billion to defense upgrades. Plenty of other NATO members are getting ready to bump up their defense budgets.

Saab should be one of the biggest winners of this surge. It's already well established among European nations. It's even more cost efficient than some U.S. counterparts.

Investors don't expect much from this business going forward. Shares could soar when Saab proves them wrong.

Regards,

Joel Litman

March 4, 2025

P.S. Sweeping changes could be coming to defense... and plenty of other industries. You see, Trump isn't just pushing for a few budget cuts...

He's taking a sledgehammer to the entire system.

We're already seeing this trend play out in the president's first 100 days. But we'll be feeling the effects for far longer than a few months – and so will a select handful of overlooked stocks. Click here for the full story.

European defense spending is entering a new era...

European defense spending is entering a new era...