As we said on Thursday, consolidation will be important for corporate survivors...

As we said on Thursday, consolidation will be important for corporate survivors...

The coronavirus pandemic has created a challenging economic environment... but certain companies will make it through the crisis and emerge stronger than ever – it's a theme we've termed "Survive and Thrive."

The winners have healthy balance sheets and are looking to put their capital to work... and the main way management teams do this is through acquisitions. Although mergers and acquisitions (M&A) slowed down during the pandemic, it looks like activity may be picking up.

This could be happening for a few reasons... The first is related to the pressure of the pandemic easing off, but without the return to normalcy. CEOs and other C-suite executives were constantly putting out "fires" when the pandemic began. Now, we're seeing more certainty in the economy... but many of these executives are still working at home and going stir-crazy.

With more time for reflecting on the big picture, management teams are looking at long-term ways to improve their companies. M&A activity is one way to accomplish this.

Additionally, many companies have seen their stock prices soar since the market trough in March. Specifically, prices of tech stocks have jumped well above pre-pandemic levels. These lofty valuations make for valuable currency in an acquisition.

For example, Salesforce (CRM) took advantage of its high stock price when it announced its acquisition of Slack (WORK) two weeks ago. In addition to paying Slack shareholders in cash, these folks will also receive Salesforce shares – worth roughly double what they were earlier in the year.

And finally, low interest rates are also likely contributing to an uptick in M&A activity. This makes borrowing money to pursue acquisitions cheaper... and therefore more attractive.

But even with the surging fundamentals for acquisitions, M&A activity is still down for the overall year...

But even with the surging fundamentals for acquisitions, M&A activity is still down for the overall year...

This is in large part due to cancelation and postponement of transactions when the pandemic first hit. With so much uncertainty, it was nearly impossible for companies to predict performance... meaning executives had to call off M&A plans.

Businesses were worried about their own ability to continue paying off debt obligations. They couldn't afford to spend capital on acquisitions, even if opportunities looked attractive.

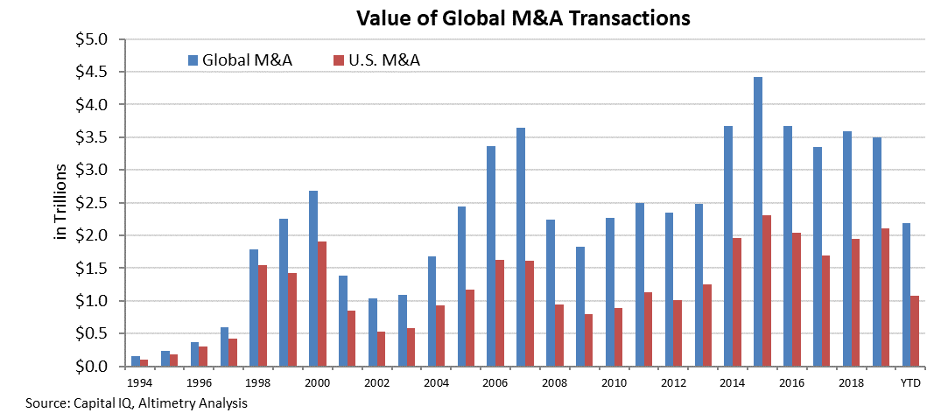

Both global and U.S. transactions are near levels not seen since the financial crisis in 2008 and 2009. The M&A market took off in 1998 and has been relatively hot since then – despite the dips in the early and late 2000s. Specifically, between 2014 and 2019, both global and U.S. levels were robust and at or near all-time highs. It now looks like this elevated stretch of activity is coming to an end...

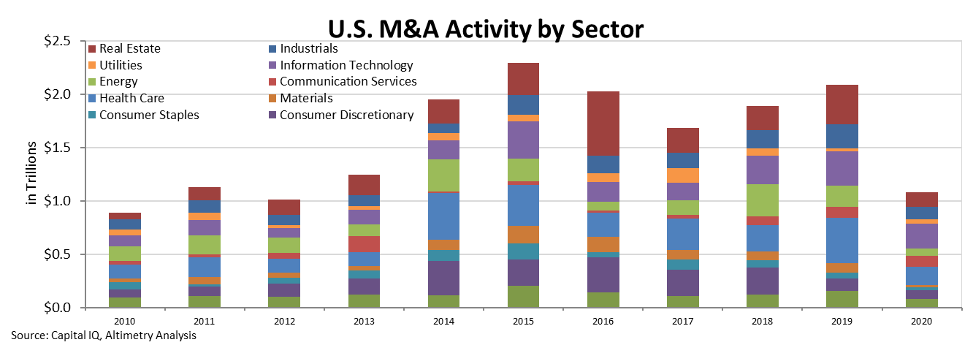

However, the decline hasn't been uniform. Certain sectors have seen activity crumble, while others are near normal levels.

The tech sector has seen an increase in transaction volume. Many of these companies have benefited from the "At-Home Revolution" as folks work and spend more time at home, so stock prices in this corner of the market have roared higher. Some of these firms, like Salesforce, are looking to strike while the iron is hot.

As such, M&A transactions are returning to normal levels. The third quarter of 2020 saw the third-highest quarterly nominal M&A transaction value for the tech sector over the past decade.

But other areas like health care and real estate have not seen the same uptick in activity. Year-to-date transaction value for health care is roughly one-third of last year's, while the transaction value for real estate is roughly half of the 2019 figure.

While these sectors are seeing fewer M&A transactions now, this may not continue going forward. As we mentioned earlier, the Survive and Thrive theme has created winners that are looking for opportunities. The pandemic has changed the landscape of these sectors – the winners are looking for possible firms to acquire and the losers need help.

This means industries like health care and real estate might now be on the catch-up. As executives get more comfortable with their cash flows, they might want to use that and easy debt to engage in M&A activity.

It will be important to watch for companies that will be acquirers in the coming months. The ones with strong balance sheets and elevated stock prices will be on the lookout for smaller firms to "roll up"... and will likely be the consolidators in these industries.

Regards,

Joel Litman

December 14, 2020

P.S. The pandemic has created big changes – in market sectors and overall society. And that means investors need to be selective. Some companies might appear to be Survive and Thrive candidates... but they ultimately may not have the strong fundamentals to make it through the crisis.

In Altimetry's Hidden Alpha, my team and I have identified the stocks set to take advantage of this environment and are primed for high upside ahead... Learn more here.

As we said

As we said