Dear reader,

It takes 13 years to paint the George Washington Bridge from end to end.

As more than 50 million vehicles cross every year, around 20 workers clamber up the scaffolding of the 88-year-old bridge, paintbrushes in hand.

In order to qualify with the Port Authority of New York and New Jersey, applicants are required to pass multiple written tests before taking the final height test. These folks have to walk 25 feet across a six-inch steel beam without showing any fear.

The catch? The applicants are 60 stories above the freezing Hudson River.

After 13 years, what does this elite crew have to show for its efforts? A bridge that once again needs to be painted. Corrosive salt from de-icing and sea air blast the paint away as quickly as this daredevil crew can apply it.

And the George Washington Bridge isn't alone... This applies to other bridges across the U.S. On the other side of the country, the Golden Gate Bridge in San Francisco needs constant touch-ups due to "Karl," the bay's salt-laden fog.

All this maintenance requires a lot of paint.

Axalta Coating Systems (AXTA) creates coating for vehicles and commercial applications. The company's offerings protect everything from cars to oil and gas pipelines, and also create electrical insulation. Axalta makes the types of coatings that keep the George Washington bridge standing.

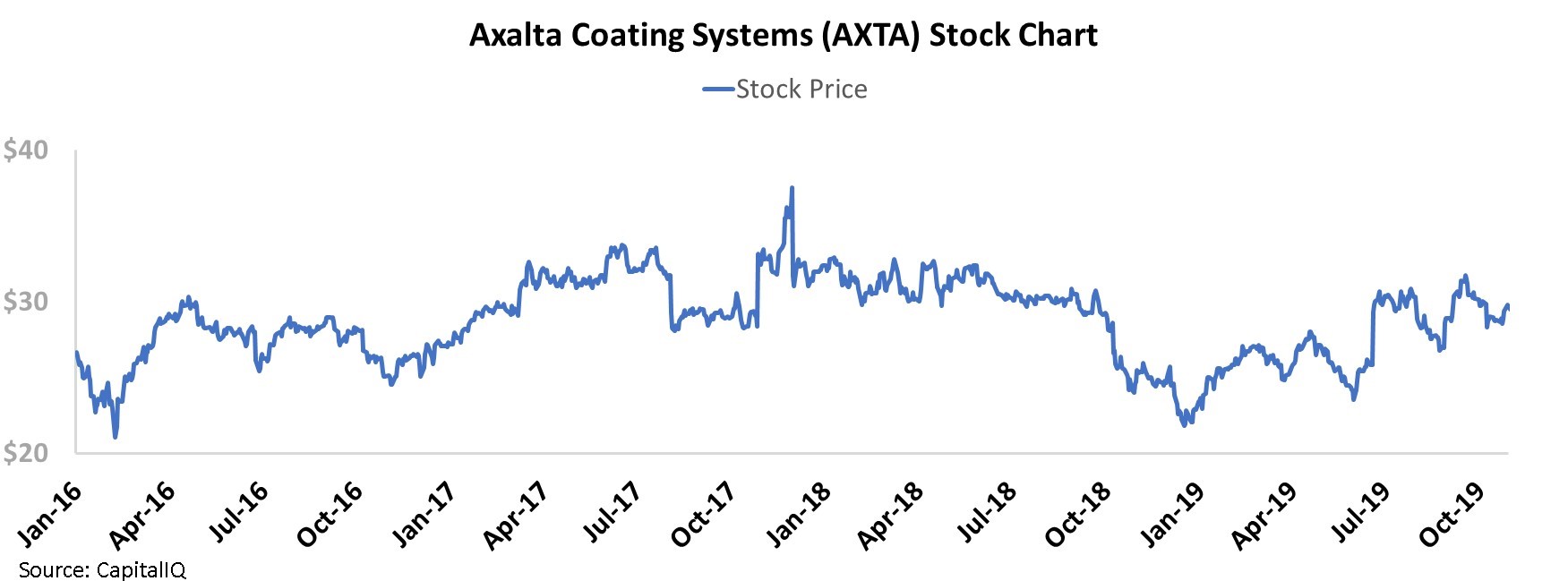

With a low as-reported price-to-earnings ("P/E") ratio of 15.4, Axalta is trading at a discount to market averages of around 20. However, rather than seeing a return to the mean – and therefore a price increase – over the past three years, AXTA shares have stayed in a range between $20 and $40.

While Axalta looks cheap, most investors would label the stock a "value trap." It won't necessarily stop being cheap any time soon.

If you recall our previous article on 'Mr. Market,' the markets will overreact to earnings, news, or other stories that can wildly swing stock prices. However, value investors seek to buy companies when they are discounted – beating market returns as the stock appreciates – and as valuations come to match fundamentals.

Despite the potential returns of value investing, there are issues with the strategy, just as there are with any strategy. And these investors' kryptonite is the value trap... This is when a company trades at a cheaper valuation than would be warranted, but for an extended period of time. It might be because the business actually deserves this low valuation due to a lack of innovation or persistent headwinds.

As some investors say, "It's cheap for a reason."

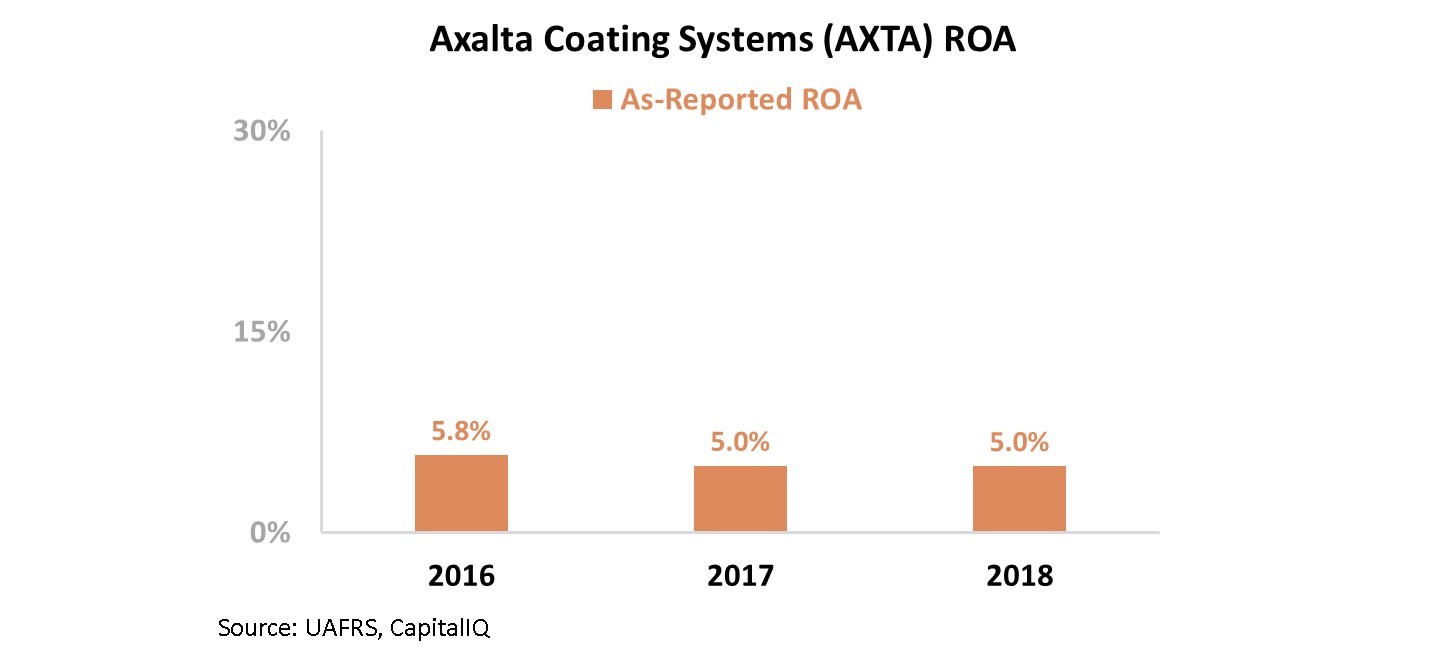

Most investors would think Axalta is a value trap, and would explain the stock's moves based on the as-reported metrics. To Wall Street, this stagnant stock price is because Axalta's as-reported return on assets ("ROA") is low, and has declined from 6% in 2016 to 5% in 2018.

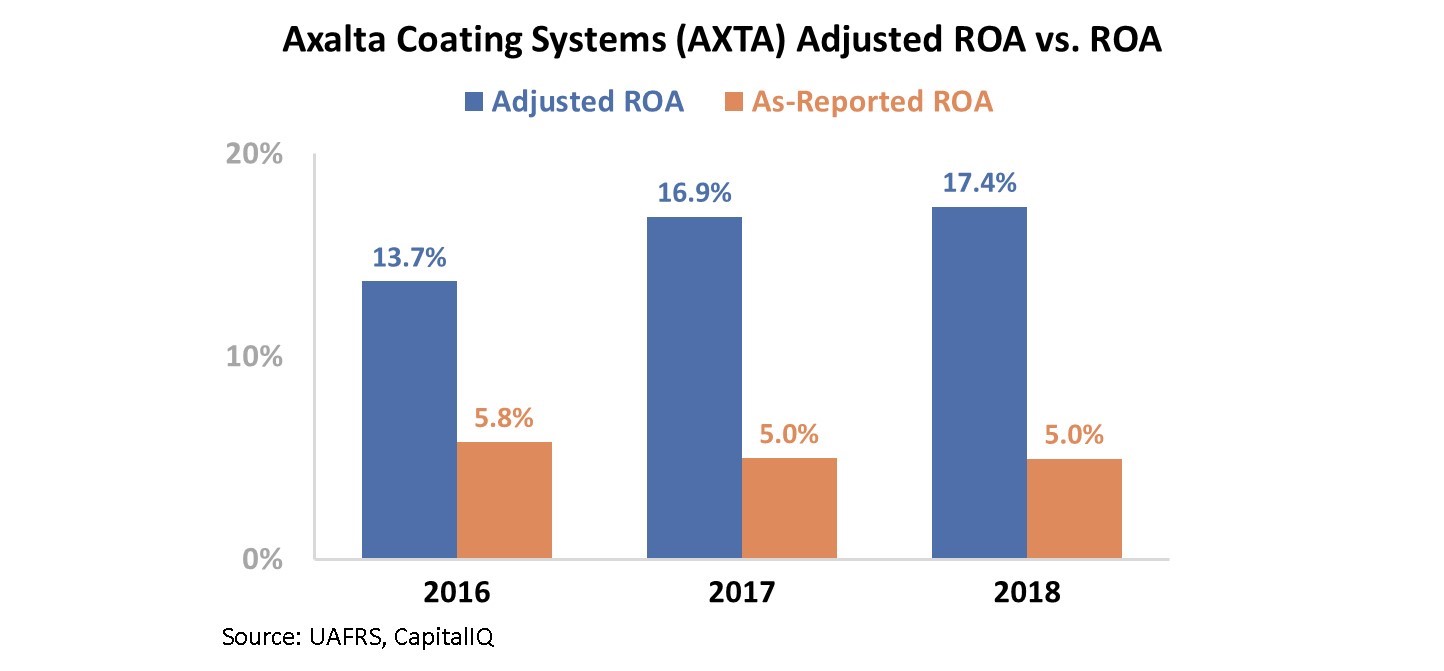

However, these results do match the company's true returns. Due to the distortions like incorrect treatment of goodwill, GAAP understates the real ROA for Axalta. Once we make our Uniform Accounting adjustments, we can see how Axalta's Uniform ROA actually improved each year after 2016. Take a look...

By cleaning up the "noise" inherent in as-reported accounting, we are able to see the underlying trends of a company. Axalta isn't a low-return business... It is inexpensively valued, with an adjusted P/E ratio of 16.6. Returns have been improving... and are forecast to continue doing so.

Considering the positive trend for Axalta, it's unlikely the company will stay this cheap forever. As fundamentals trend higher – and as investors start to realize these fundamentals are better than they thought – the market is likely to react. The stock will be a value trap no longer.

Rather than being a stock deserving of its cheap P/E ratio, Axalta has been improving, potentially justifying a higher valuation. This is only clear once the distortions from as-reported GAAP accounting are removed.

Regards,

Joel Litman

November 8, 2019