Apple's (AAPL) latest promise sounds impressive... at first...

Apple's (AAPL) latest promise sounds impressive... at first...

About a month ago, the tech giant pledged to invest $500 billion in the U.S. over the next four years. It intends to create 20,000 new jobs and expand domestic manufacturing, AI research, and silicon engineering.

But here's the thing – Apple has made nearly the same promise before.

During President Donald Trump's first term, the company also pledged 20,000 new U.S. jobs and substantial domestic investments. Its operational footprint and global strategy remained pretty much unchanged four years later.

So you'll forgive us for being skeptical about this new announcement...

To fulfill a $500 billion commitment, Apple's total assets would need to expand by more than 1.5 times...

To fulfill a $500 billion commitment, Apple's total assets would need to expand by more than 1.5 times...

The company currently holds about $300 billion in Uniform assets worldwide. That kind of short-term asset growth would be unprecedented for a business of Apple's scale – even during its periods of strongest expansion.

Apple has never attempted investment of this magnitude before.

It costs a lot of time and money to build new factories and research facilities. Heavy investments like this also tend to reduce profitability. That's partly because it takes a lot of upfront capital to construct new manufacturing plants, expand research capabilities, and scale infrastructure.

Large-scale spending tends to weigh on Uniform return on assets ("ROA"). Even a company as big as Apple will run out of worthwhile investments.

And investors aren't prepared for that kind of risk.

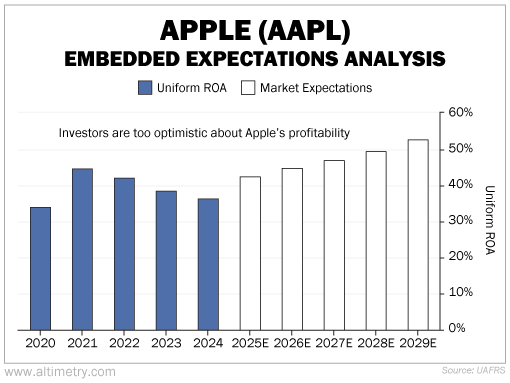

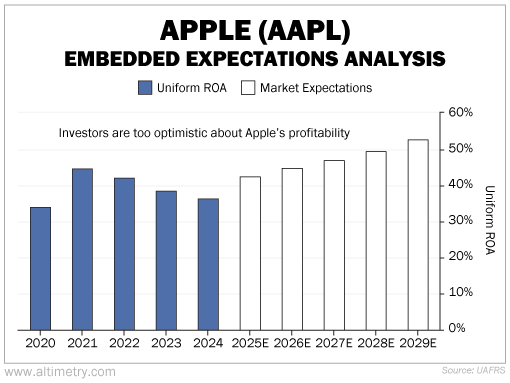

We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Apple's Uniform ROA was as high as 45% in 2021 – close to four times the U.S. corporate average.

Investors expect that number to rise over the next five years... reaching 53% by 2029.

Take a look...

Investors aren't weighing any of the risks of this so-called investment spree. It's more likely to hurt returns than to help them.

Apple's announcement might reassure the market temporarily...

Apple's announcement might reassure the market temporarily...

But without concrete evidence of meaningful change, we see it as strategic optics rather than genuine transformation.

Compounding our belief is growing fear over Apple's reliance on China. If anything, this pledge seems more like a way to ease investor concerns in the face of rising geopolitical tensions.

When Apple made its 2018 promise, much of the spending it committed to had already been planned under prior capital expenditure budgets. Instead of a transformational shift, the company largely followed its existing road map.

So we're skeptical that the current $500 billion pledge represents genuine new investment. It may simply be rebranded spending that was already in the pipeline.

If past trends hold, Apple may be in for more business as usual – not the transformational shift it's advertising on the surface.

Regards,

Joel Litman

March 18, 2025

Apple's (AAPL) latest promise sounds impressive... at first...

Apple's (AAPL) latest promise sounds impressive... at first...