The entire auto industry is worried about a potential drop in prices for used cars...

The entire auto industry is worried about a potential drop in prices for used cars...

As Bloomberg reports, a surge of used-car inventory is building up, and it could dramatically depress prices for used cars.

This may initially sound like a positive for consumers. It means cheaper cars, which means more cash for consumers to spend elsewhere.

But many parts of the auto industry rely on robust prices for used cars. Manufacturers naturally benefit from stronger used-car prices – it's more logical for people to buy new cars when used ones are expensive, since the savings from buying used aren't that significant.

It also means that leases are cheaper for consumers. If cars drop less in value the longer they're driven, that means that when a lease matures, the car dealer will expect to be able to sell the used car for more.. so the lessee doesn't have to pay for as much depreciation. The lease payment drops.

However, another part of the auto industry also has direct exposure to the price of used vehicles: rental-car companies. These businesses are getting punished from multiple directions in the midst of the coronavirus shutdown.

Of course, with fewer people traveling, demand for rentals has fallen sharply... which means less revenue. On top of that, if the rental-car companies choose to sell down inventory that they aren't using, they'll receive less in cash for those sales.

But far more important than their ability to sell the cars is how the drop in used-car values impacts their ability to issue debt to buy new cars in the future.

Their borrowings are generally directly tied to the expected recovery value they can get on used cars after they sell them. The lower that value, the less debt the rental-car companies can use to buy cars... and the higher the interest rates they have to pay on their debt to buy cars.

If the used-car market continues to be disrupted in the near term, these companies are worth watching. They already had significant leverage, and may get into more trouble than the automakers themselves.

Cash isn't the king it used to be...

Cash isn't the king it used to be...

It feels cliché to say... but in today's business climate, data is the new currency.

Think about some of the biggest tech companies in the world, such as social media giants Facebook (FB) or Twitter (TWTR)... They don't sell subscriptions for their services.

Instead, they're able to make money by collecting invaluable data around their users' preferences, habits, and activities.

Another great example is how Google parent Alphabet (GOOGL) and e-commerce titan Amazon (AMZN) are willing to practically give away their "smart home" speakers, Google Home and Alexa.

Google was giving away free Google Home Mini devices to music streaming company Spotify Technology (SPOT) subscribers last fall. It wasn't an act of goodwill... It's because your data is worth far more than the $50 Google lost on the transaction.

Amazon is guilty of this too... on its annual Prime Day sale, the company deeply discounts all of its smart home goods to cost (or less).

With that in mind, we can't always value companies based solely on their cash-generating activities. In today's environment, we need to factor in the value of data to properly assess certain businesses.

Companies like Facebook and Alphabet wouldn't look so valuable without considering their massive stockpiles of user data and analytics.

Even credit-ratings firms are valued more for their analytics than their legacy capabilities.

In the December 13 Altimetry Daily Authority, we wrote about index provider MSCI (MSCI) – one of the largest financial-analytics firms in the world. The company is so highly valued because it's able to transform its massive amounts of financial data into better stock indexes.

With that in mind, consider Verisk Analytics (VRSK)...

Part of what makes the risk-assessment firm so special is its wealth of data and analytical tools, which have allowed it to build its business model for the "currency of the future."

Verisk primarily deals with providing predictive analytics and decision-making support to the insurance, energy, and financial-services industries.

The company's data – collected through its 30-plus acquisitions and 50-plus years of working with insurance and financial-services companies – are massively valuable to its clients.

Verisk is able to provide predictive models and forecasting software based on the latest underwriting and market data, which in turn allows its clients to make better decisions.

That said, looking at Verisk's profitability trends, it appears the company's investment into data hasn't paid off...

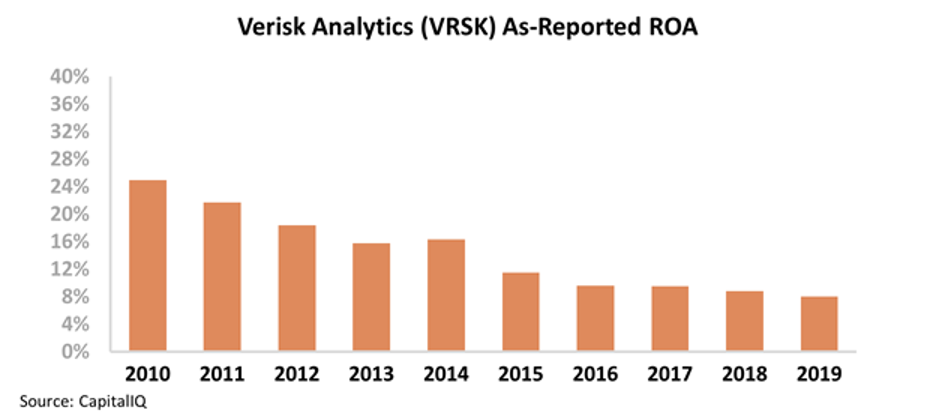

Over the past decade, Verisk's return on assets ("ROA") has consistently faded from robust levels around 25% in 2010 to just 8% in 2019. Just a year or two more of this trend, and the company's ROA will be below long-term averages.

However, as-reported financials fail to capture how the value of data has changed over time.

In reality, the way Verisk has invested in its advanced analytics – including its high-profile acquisition of data-intelligence firm Wood Mackenzie in 2015 – has reaped massive benefits...

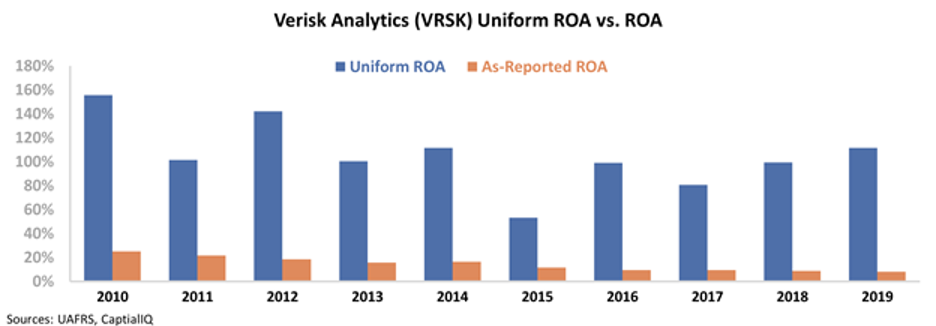

Looking at Verisk's profitability through Uniform Accounting – which adjusts for misleading accounting standards around the treatment of goodwill, research and development (R&D), and operating leases – we can see that the company's returns have been much stronger than as-reported metrics would suggest.

Additionally, Verisk's real profitability trends over the past five years are the exact opposite of its as-reported trends. As you can see below, the company's Uniform ROA hasn't fallen below 50% over the past decade. And since it acquired Wood Mackenzie, Verisk's Uniform ROA has rebounded to levels around 100%. Take a look...

This is a massive divergence... and it highlights a huge weakness with as-reported financial statements: They fail to capture the value of less-straightforward assets like data... and they can make companies like Verisk look far weaker than they actually are.

Once the market understands Verisk's real performance, expectations for future returns are likely to adjust higher also.

Regards,

Joel Litman

April 17, 2020

The entire auto industry is worried about a potential drop in prices for used cars...

The entire auto industry is worried about a potential drop in prices for used cars...