I recently came across a fantastic piece in The Economist about a firm's board of directors...

I recently came across a fantastic piece in The Economist about a firm's board of directors...

It discusses the role board members should be playing for public companies and cultural institutions. The piece mentioned some of the rules British arts administrator Sir John Tusa wrote about in his book, On Board: The Insider's Guide to Surviving Life in the Boardroom.

Tusa explained about multiple rules and practices members should follow in the pursuit of good governance. One is to take time when hiring those in executive roles. The relationship between a CEO and chairman of the board is vital... So, prior to hiring, the two should look to build a rapport.

Tusa also states the chairman of a board needs to be on the same side as the CEO until there's no option not to be. Bad chairmen too often try to impose their own views, but they should be facilitating communication with the CEO and the rest of the board.

As the article from The Economist discusses, this communication is vital, since board members are too often left in the dark. The role of non-executive board members usually isn't well-defined, so they can end up being glorified figureheads.

However, a diligent chairman and insightful question-asking by board members can keep everyone informed and useful. This active role can be dangerous, as board members are stuck between a rock and a hard place. Either they ask too many probing questions and don't receive an invitation to come back on the board... or they're stuck in the dark.

For investors, understanding the dynamics of a board and management is important...

For investors, understanding the dynamics of a board and management is important...

This is in terms of how they work together, their shared outlook, and their strategy and intentions. While often under-prioritized in investing, the relationship between a company's board and its management is a necessary piece of the puzzle.

One insightful way we gain a window into management's outlook is through measuring insider buying. This allows us to see how management teams are voting with their wallets.

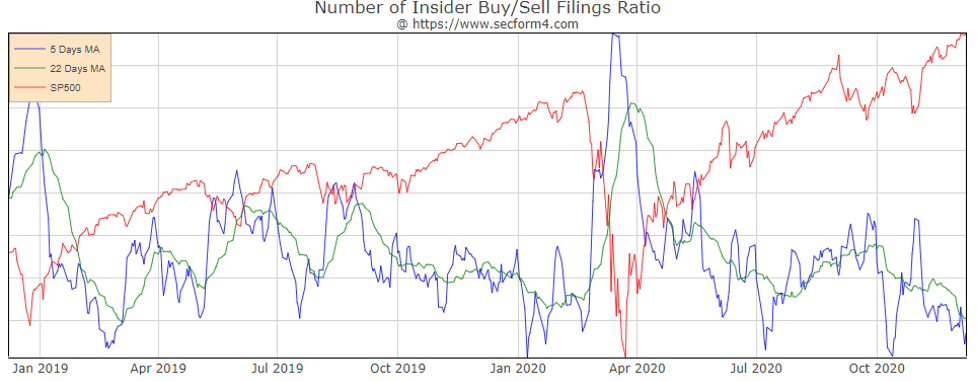

We looked at this topic back in October. At the time, the ratio between insider buying and selling was beginning to rebound, brushing the top of long-term average levels. It rose at the beginning of the coronavirus pandemic, then collapsed before hitting a short-term peak.

But with the election behind us and in the wake of the recent vaccine announcements, it's crucial to take a look at this important metric again. Management teams now have more clarity on 2021 than they did back in October.

As you can see in the chart below from SecForm4.com, the ratio between insider buying and selling has been volatile in recent months. The measure skyrocketed before the election and fell right after. Since then, the ratio has been declining again to below long-term average levels.

Keep in mind that management teams are value investors. Therefore, we saw them funnel money into their companies' stocks at sharply discounted levels when the pandemic began. Executives who knew their companies had the liquidity and positioning to survive the pandemic were salivating at the opportunity to buy equity at such depressed valuations.

This is part of the reason why insider buying has moderated in recent months. With the benchmark S&P 500 Index at all-time highs, some valuations are far less attractive... so it's not surprising to see insider buying cooling off. However, management members are confident enough to still hold material amounts of their own companies' equity.

It's also worth noting how strongly equity markets have rallied this year. And with the election uncertainties behind us, management teams may have incentive to sell stock for tax purposes, to diversify their holdings, or for any number of other reasons.

But if they were concerned about outlook or thought their companies' stock prices were too high, it's likely that insider selling levels would be even higher than they are now.

We're seeing buying moderating... but we aren't seeing a mass sell-off, even as the market pushes higher. Given management members aren't panicking and bailing out of their stock, we continue to suggest investors follow suit and stay optimistic about the future of the market.

Regards,

Joel Litman

December 21, 2020

I recently came across a

I recently came across a