The energy tides are turning...

The energy tides are turning...

Global oil prices shot higher almost the second Russia invaded Ukraine. Investors realized that the Russian oil and gas supply wasn't long for the international market.

Brent crude – the international standard – traded above $100 per barrel for much of 2022. Prices are still around $90 per barrel today.

OPEC didn't do much to help. It kept producing about the same amount of oil when it could've ramped up production to stabilize prices.

But the U.S. jumped at the opportunity...

President Joe Biden released almost half of the country's strategic petroleum reserve to lower prices. He ordered oil companies to start producing as much as they could.

By the time OPEC got around to increasing its own production, it was too late. America had established itself as the superpower in oil and gas (O&G).

And yet, investors don't seem so sure U.S. energy dominance will continue...

The U.S. is the outright production leader in oil and natural gas...

The U.S. is the outright production leader in oil and natural gas...

And it's not even close. Russia produced around 700 billion cubic meters of natural gas last year. The United States produced more than a trillion cubic meters.

A big reason for our O&G supremacy has to do with "fracking" – injecting rocks with a mix of solids and liquids that create fractures to free the trapped oil and gas. It's a lot more efficient than traditional extraction methods.

Fracking helped propel the U.S. to become the largest exporter of natural gas in 2022. U.S. energy companies are now nearing the high levels of profitability they saw before 2009.

Meanwhile, Russian natural gas sales fell 41% a year later as Europe looked for new sources. And since their high point in 2023, Russian oil imports are down by 800,000 barrels per day.

The numbers don't lie... U.S. energy is on the rise.

The numbers don't lie... U.S. energy is on the rise.

And yet, investors think this bump will fade in short order.

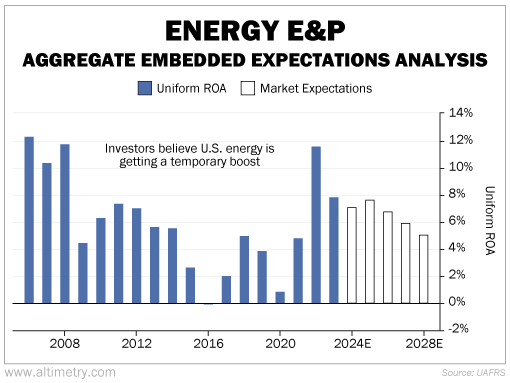

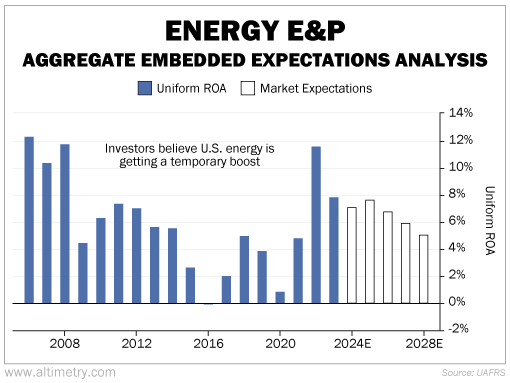

We can see this through our aggregate Embedded Expectations Analysis ("EEA") framework.

Our aggregate EEA starts with the average stock price of all U.S. exploration and production (E&P) companies. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well U.S. E&P companies have to perform in the future to be worth what the market is paying for them today.

Back in 2008, Uniform return on assets ("ROA") for the energy industry hovered right around the 12% corporate average. That number dropped to practically nothing by 2016... and stayed low through the pandemic.

Then the Russia-Ukraine war shook up the global energy landscape. U.S. energy is rebounding in a way we haven't seen for more than a decade.

And yet, the market is pricing industry Uniform ROA to fall back to just 5% by 2028.

Take a look...

Investors aren't giving U.S. energy the credit it deserves...

Investors aren't giving U.S. energy the credit it deserves...

The E&P industry has done way better over the past few years. Thanks to geopolitical instability, more countries than ever are relying on U.S. energy... and we expect that to continue.

The U.S. now has the world's biggest oil supply. We're the leading natural gas exporter. Returns for the E&P industry should improve from here, not weaken.

Investors are still pricing U.S. E&Ps like we're heading back to a period of weak energy demand. We expect these businesses to keep impressing the market... creating a great opportunity for investors.

Regards,

Joel Litman

April 18, 2024

The energy tides are turning...

The energy tides are turning...