A forklift at a California port slides under a white, bulging bag the size of a small car...

A forklift at a California port slides under a white, bulging bag the size of a small car...

The crew lifts it, swings it over steel, and lowers it into a container like it's loading grain.

The bag is stuffed to the brim with sand. And that sand is headed for the red dirt of the Beetaloo Basin in Australia... a shale-rock gas reservoir roughly the size of Belgium.

Liberty Energy (LBRT) calls these bags "super sacks." In late 2024, it shipped about 45 million pounds of frack sand across the Pacific to Australia.

Traditional oil drilling doesn't work on this kind of basin. Only hydraulic fracturing – injecting a mix of fluids and sand to free trapped oil – is strong enough.

Also called "fracking," the process is a U.S. invention. And increasingly, it's becoming a U.S. export.

While fracking is well established in America, it's still in the early stages overseas...

While fracking is well established in America, it's still in the early stages overseas...

Most foreign energy producers are more focused on proving they can frack... rather than investing in better technology.

That's why energy businesses are importing sand from 10,000 miles away. Even if it's more expensive in the short term, the local industry isn't ready to invest in a local supply.

At the same time, North American fracking has stagnated. The number of fracking wells in the U.S. has held steady around 12,000 for the past three years... down from an all-time high of 19,000 in 2014.

This creates a problem for domestic suppliers. It's getting harder to drive growth on our oil soil.

Global fracking changes the story. Bahrain has brought in Texas-based oil and gas producer EOG Resources (EOG) to drill early-stage unconventional wells. Algeria is running pilots with international oil services companies Halliburton (HAL) and SLB (SLB).

It starts with pilot programs. But if the international market has the same success with fracking as North America, which currently holds 83% of global market share, we have several years of boom to look forward to.

This is where Cactus (WHD) comes in...

This is where Cactus (WHD) comes in...

Cactus makes wellheads – the pieces that sit on top of a well. They sit at the surface as the pressure boundary between the well... and everything happening above ground.

These wellheads are some of the best in the business. Cactus' products are considered the "gold standard."

There's a lot of technology that goes into wellheads. So for new countries trying to grow their fracking footprints, it's better to buy the leader than spend years developing their own expensive tools.

Cactus already has a small presence in areas like Australia and the Middle East. So it's in a prime position to grow internationally.

And yet, investors aren't all that interested.

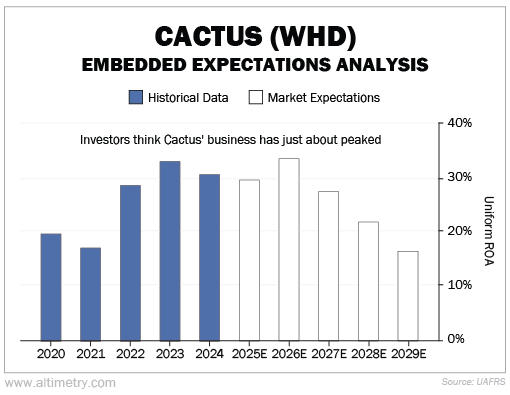

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Cactus minted returns above 20% from 2022 through 2024. While last year's numbers aren't finalized, it looks set to continue the trend.

But investors expect its Uniform return on assets ("ROA") to fall to just 17% by 2029.

Take a look...

Investors don't expect this international fracking boom to contribute to Cactus' profitability. They actually expect the company to do worse from here.

And that sets Cactus up for easy outperformance...

And that sets Cactus up for easy outperformance...

This domestic supplier is becoming a global one. Investors have spent years treating U.S. fracking as a late-cycle story in which growth is only getting harder. Fracking-related stocks like Cactus have flown under the radar.

But these companies are finally getting a lifeline. Cactus sits in a sweet spot for global fracking demand. If international shale projects push toward full production, operators will lean on U.S. expertise to get there faster.

That's exactly where Cactus earns its keep. Today's export wave can reignite the company's growth engine.

Regards,

Joel Litman

January 27, 2026

A forklift at a California port slides under a white, bulging bag the size of a small car...

A forklift at a California port slides under a white, bulging bag the size of a small car...