The big energy players are getting bigger...

The big energy players are getting bigger...

The Russia-Ukraine war has empowered energy companies. Most of Russia's energy production has been taken off the global market... and the world has been reeling as it struggles to keep things stable.

Global oil producers had to ramp up production to fill the gap. And in that chaos, the market began to view energy companies in a positive light for the first time in years.

Energy stability took priority over environmental, social, and governance ("ESG") pressures. As energy prices soared, so did profits... And oil majors like ExxonMobil (XOM) and Chevron (CVX) embarked on a shopping spree.

Last month, Exxon announced one of its largest transactions ever – a $60 billion acquisition of Pioneer Natural Resources (PXD). Chevron secured a $53 billion deal for Hess (HES) not long after.

These are massive acquisitions... which has investors a bit confused. After years of negative pressure on these oil giants, folks just aren't convinced spending billions of dollars is going to be worth it.

Today, we'll take a closer look at these deals... and whether they stand any chance of creating value for Exxon and Chevron shareholders.

Let's start with Exxon...

Let's start with Exxon...

When the oil giant bought Pioneer, it expanded its footing in the Permian Basin... the premier U.S. oil basin. If you're going to buy more oil and gas assets, the Permian is the place to do it.

Exxon already owned about 550,000 acres in the Permian. And Pioneer owns 850,000 acres. So the move upped Exxon's already considerable exposure. It's now the largest player in the Permian.

That's great for Exxon... and even better for investors.

Over the past decade, Exxon's Uniform return on assets ("ROA") hasn't been great. It didn't creep above 5% until 2022, when it jumped to 11%.

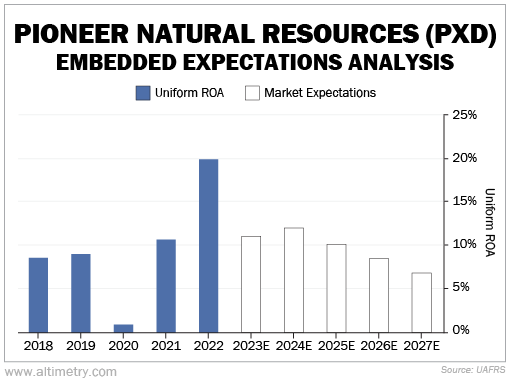

Pioneer, on the other hand, has recorded solid returns – even before Russia invaded Ukraine. Excluding 2020, its Uniform ROA already hovered around 9%. It rose as high as 20% last year.

Better yet, Exxon got Pioneer for a steal. We can see this through our Embedded Expectations Analysis ("EEA")...

The EEA starts by looking at Pioneer based on Exxon's acquisition price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well Pioneer has to perform in the future to be worth what Exxon paid for it.

At a $60 billion purchase price, Exxon only needs Pioneer to generate returns of about 6% per year for the deal to pay off...

With the exception of a global pandemic, nothing has stopped Pioneer from clearing that hurdle in the past.

In other words, Exxon knows what it's doing. Investors should be pleased with this deal.

Chevron is a much more challenging story...

Chevron is a much more challenging story...

The Hess purchase brings Chevron a ton of exposure to Guyana... a promising, albeit less developed, energy market.

Guyana hardly produced any energy before 2019. So while it might become an energy powerhouse in the future, this is a riskier bet.

Plus, Hess and Chevron combined still won't be the biggest player in Guyana. That crown goes to Exxon.

It's hard to justify the Hess acquisition... and even more so when you look at its recent performance.

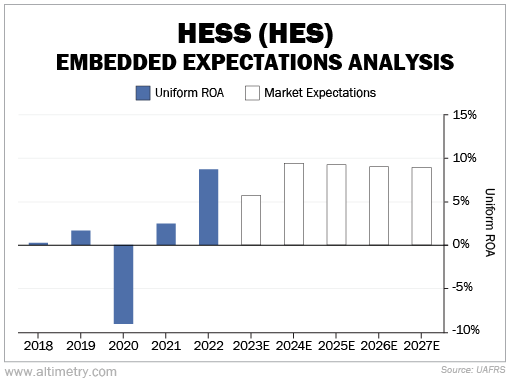

Before 2022, Hess looked even worse than Exxon. Its Uniform ROA was consistently 3% or below... and it only rose to 9% in 2022.

And yet, to offset Chevron's $53 billion purchase price, Hess needs to generate a nearly 10% Uniform ROA in the future.

Take a look...

The Hess acquisition paints a much starker picture than Pioneer. Chevron's big bet seems much more like a gamble than a smart use of earnings.

Be careful betting on energy...

Be careful betting on energy...

It makes sense that the big companies are trying to get bigger so ESG initiatives won't hurt them as much. However, it's only a matter of time before many of them have to start backpedaling.

Exxon has done a great job consolidating power in the Permian basin. Not all of its competitors have what it takes to make it long term. Chevron's gamble is much more speculative... and it requires oil prices to stay about as high as they were in 2022.

That's not a bet we'd want to make. Investors looking at the post-acquisition Chevron might want to think twice.

Regards,

Joel Litman

November 2, 2023

The big energy players are getting bigger...

The big energy players are getting bigger...