A new twist has put Michael Burry's AI warnings back in the spotlight...

A new twist has put Michael Burry's AI warnings back in the spotlight...

Burry has spent the past month arguing that the AI boom is built on shaky ground.

He says the biggest hyperscalers – like Meta Platforms (META), Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN), and Oracle (ORCL) – are making their earnings look stronger than they really are.

He announced short bets against AI consulting business Palantir Technologies (PLTR) and chip giant Nvidia (NVDA).

And last week, after plenty of buildup, he unveiled a new newsletter on social media platform Substack... which he kicked off with plenty more thoughts on the "glorious folly" of AI.

But it didn't end there. Over the weekend, Nvidia issued a rare public response to some of Burry's claims. Its seven-page memo to Wall Street analysts refuted the use of circular financing or any revenue-boosting schemes.

Last week, we gave our own take on why these changes to the hyperscalers' accounting standards made sense.

Today, we'll conclude with the final piece of the puzzle – what Uniform Accounting has to say about earnings and Big Tech.

Burry's argument makes for a strong headline...

Burry's argument makes for a strong headline...

He points out that hyperscalers used to assign their servers and chips an average life of 3.6 years back in 2020. Today, it's closer to 5.7 years.

Under generally accepted accounting principles ("GAAP"), longer asset lives mean lower annual depreciation expenses... and higher reported earnings.

Burry doesn't buy the big increase. He believes it will understate depreciation for AI leaders by a combined $176 billion over the next three years.

But we've seen no proof of his theory.

Depreciation is a "noncash expense." It doesn't represent money going into or out of the business.

Without getting too in the weeds, under Uniform Accounting, we treat depreciation a little differently. We use a multiyear average to calculate approximately how much money a business needs to spend each year to replace its old assets.

We call this number "economic depreciation." It helps us make sure there are no "games" going on (like the ones Burry is worried about).

If economic depreciation is higher than as-reported depreciation, it tells us companies aren't properly accounting for depreciation in their calculations. We'd see a big drop in returns in that case.

But that hasn't happened.

Instead, AI returns are going up...

Instead, AI returns are going up...

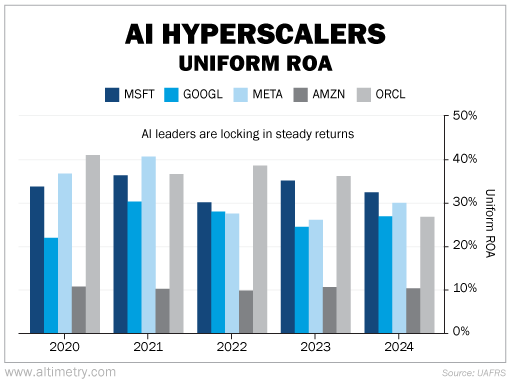

Just take a look at the following chart. It shows Uniform return on assets ("ROA") for five of the biggest hyperscalers over the past five years.

And as you can see, there's no clear downtrend.

Microsoft's Uniform ROA has oscillated. But it's within a few percentage points of where it was five years ago. The same is true for Alphabet.

While Meta's returns are a bit lower since 2022, it's mostly to do with the company's failed metaverse project. And Amazon's Uniform ROA hasn't budged.

Check it out...

Oracle is the only hyperscaler whose Uniform ROA has fallen significantly since 2020. If asset-life games were hitting returns, we'd see a clear downtrend across the board.

Instead, we're seeing steady performance... during a period of heavy spending as companies build out their AI infrastructure.

This is why it's better to skip the drama... and follow the data...

This is why it's better to skip the drama... and follow the data...

Burry has every reason to cause investor panic. He has short positions open against two prominent AI companies. And he wants folks to sign up for his new blog.

But we're not seeing what he claims to see. Uniform ROA hasn't drifted any higher or lower, on average, despite changes to asset life.

There will be plenty of ups and downs as this tech build-out continues. We expect investors to get jumpy here and there. That doesn't mean you should question the foundations of the AI revolution.

Profitability is holding up. And that bodes well for future quarters.

Regards,

Joel Litman

December 2, 2025

A new twist has put Michael Burry's AI warnings back in the spotlight...

A new twist has put Michael Burry's AI warnings back in the spotlight...