Drug-distribution companies continue to settle with state governments...

Drug-distribution companies continue to settle with state governments...

The U.S. opioid crisis is showing no signs of slowing down. Annual opioid deaths have risen nearly every year since 1999 – from under 10,000 per year back then to nearly 70,000 in 2020.

So it's no surprise that the companies that make these drugs are under scrutiny.

Both federal and local governments blame pharmaceutical manufacturers for not administering these drugs properly... not doing enough to stop illegal distribution... and downplaying the risk of addiction in their marketing.

These were the exact topics of the nationwide opioid settlement in late February. The three biggest drug distributors – McKesson (MCK), Cardinal Health (CAH), and AmerisourceBergen (ABC) – as well as Big Pharma company Johnson & Johnson (JNJ) agreed to settle with states for $26 billion.

They'll pay that amount over 18 years. The money will be used for addiction treatment and preventive services.

However, many activists believe this settlement wasn't large enough. States like Alabama, Oklahoma, and Washington opted out, saying they'd rather fight the companies in court.

In April, Alabama reached a $276 million settlement with the drugmakers. And those same companies reported another settlement with Washington state earlier this month.

In total, the companies are expected to pay $518 million. That's $100 million more than what Washington would have received under the nationwide settlement.

The question now is how much these fines are eating into profitability...

The question now is how much these fines are eating into profitability...

Even though the government fined all four of these Big Pharma companies, it punished McKesson more than the others.

McKesson will have to pay $137 million more than its competitors to both Washington and Alabama... Including the nationwide settlement, the company will pay more than $7 billion.

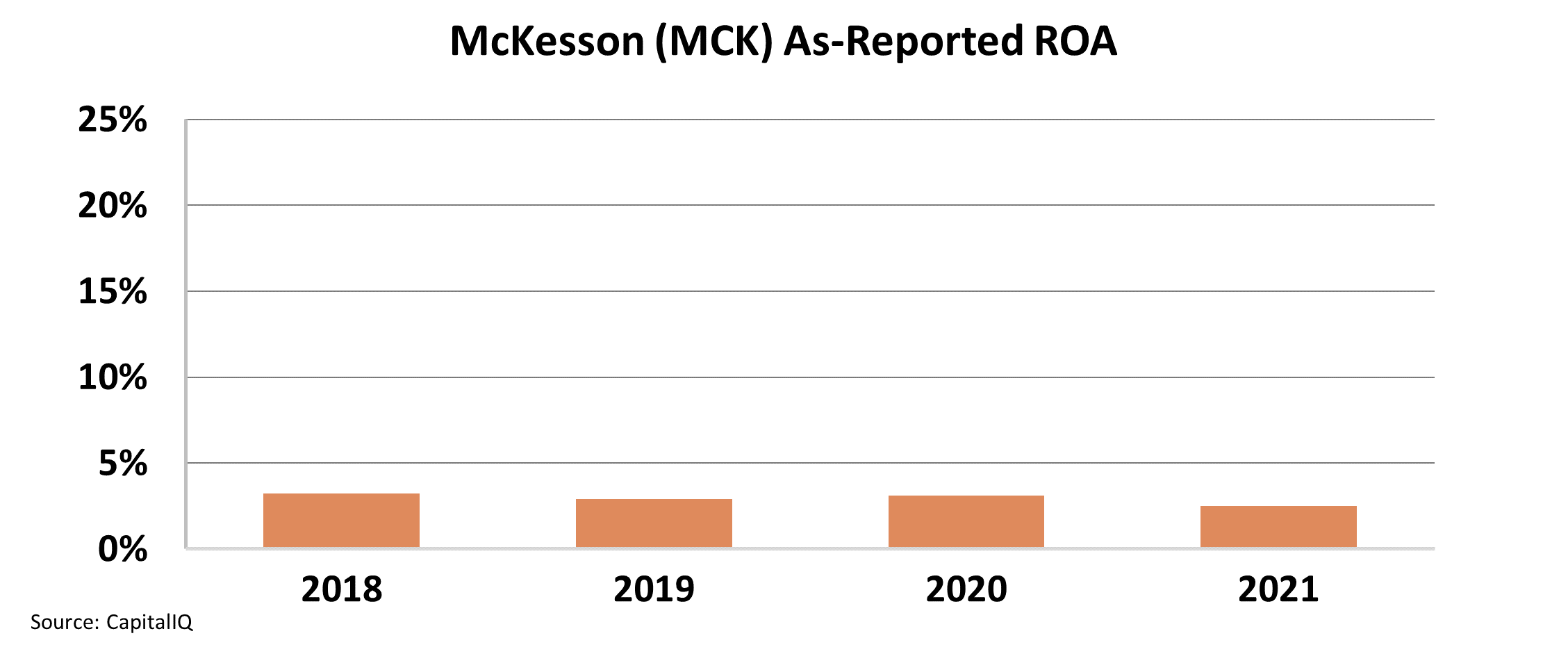

McKesson's as-reported return on assets ("ROA") paints a grim picture. It shows that the company doesn't have much cash coming in to make these massive payments.

As-reported ROA has historically hovered around 4%, which isn't even at cost-of-capital levels...

These numbers make McKesson look like it's already running on incredibly thin margins. After 12 years of multimillion-dollar settlement payments, it's hard to imagine the company will have anything left.

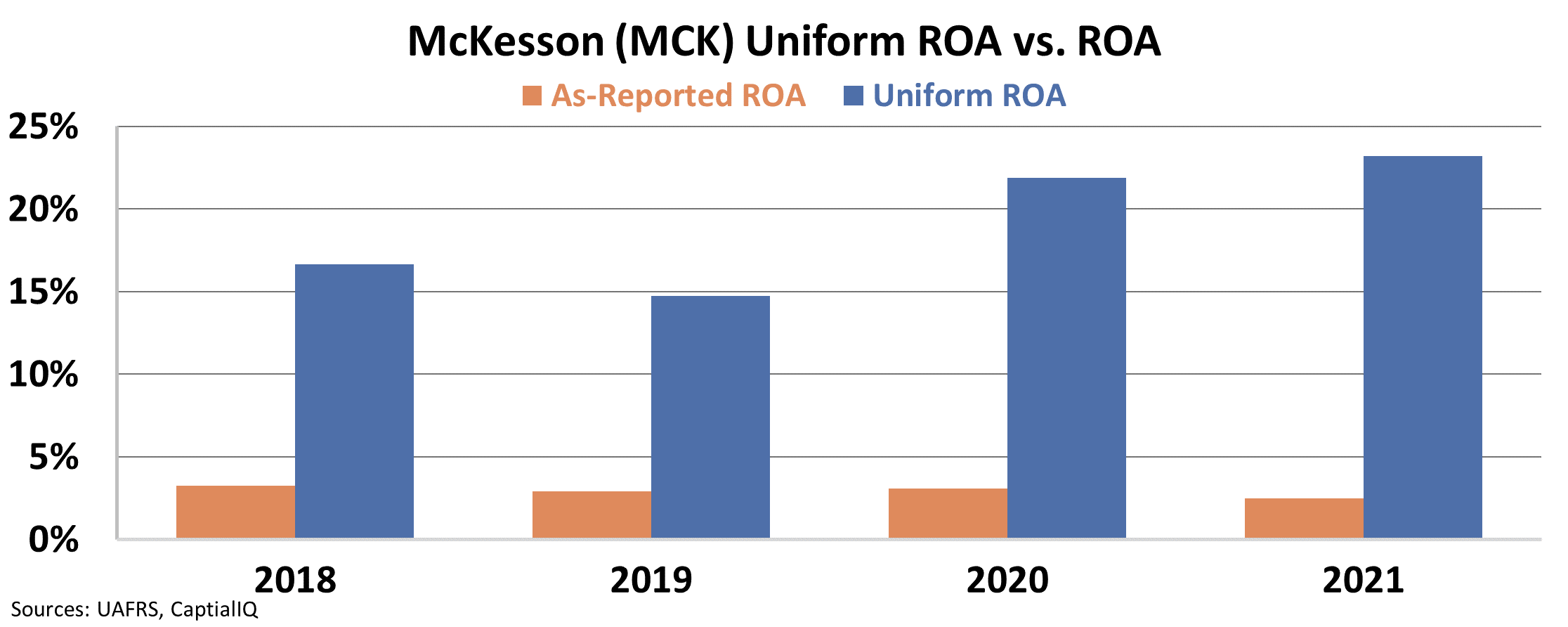

Based on the as-reported data alone, you might think that McKesson will have a hard time recovering. However, Uniform Accounting clears up the numbers...

When we make the necessary adjustments using Uniform Accounting, we see an entirely different story. In fact, McKesson is minting money and increasing its profitability year over year.

McKesson's Uniform ROA was above corporate averages in 2019, sitting at 15% – and that was its lowest annual profitability in the past decade. The company quickly recovered from this position, reaching a Uniform ROA of 22% in 2020 and 23% in 2021.

Not only does as-reported data falsely show that the company is unprofitable... it also doesn't acknowledge that despite pressure on opioid producers, profitability continues to improve.

Despite the settlements, many people are angry. They say these companies are getting away with profiteering off a crisis the government believes they engineered, but didn't resolve.

And when you take a look at the real data, you can easily see why. Using Uniform Accounting, it's clear that $7 billion worth of settlement payments won't put McKesson's financials in any danger.

If you're looking for a way to profit from the health care space, you can do so without investing in the companies allegedly responsible for the opioid crisis. After all, it's not just the opioid producers who have thrived these past few years. Much of the pharmaceutical industry has, too...

As I wrote in April, Wall Street is worried about this industry – but the companies that make the right investments have plenty of runway for growth.

Regards,

Joel Litman

May 25, 2022

Drug-distribution companies continue to settle with state governments...

Drug-distribution companies continue to settle with state governments...