Our May 5 issue on "Taking Stock of the Recent Pullback in the Biggest 'WFH' Winner" received many reader-submitted questions and feedback.

Zoom Video Communications (ZM) became an essential part of the working world amid the coronavirus pandemic. Even established video-calling software like Teams by Microsoft (MSFT) and Alphabet's (GOOGL) Google Meet were brushed aside by Zoom's perfectly timed initial public offering ("IPO").

From its IPO in May 2019 to the end of 2020, Zoom soared up to around 440% and became a market darling that year. Even in 2021, as COVID-19 vaccines had begun rolling out and some of the country had returned to the office, Zoom's valuations soared above rational levels.

That's why we wrote that Zoom was flying too close to the sun. Since May, the stock has fallen 32%, even when the S&P 500 Index has climbed around 10% over the same period.

Altimetry readers who followed our advice were able to dodge this portfolio torpedo. Here's how we spotted some of the warning signs...

Zoom's platform was essential to support this shift last year. No matter what degree of remote work employers implement, video conferencing will continue to be an integral part of the new ways of managing people.

That hasn't exactly been a surprise to the market. Since everyone has left the office, the need for Zoom's services has rocketed higher. The company's stock has jumped by nearly 5 times since December 2019...

This isn't the first time we've examined Zoom...

This isn't the first time we've examined Zoom...

Back in late December, we warned Altimetry Daily Authority readers that the market had sky-high expectations for Zoom. As a result, after big outperformance in 2020, the stock was primed to disappoint investors this year.

Since then, ZM shares have fallen more than 25%. So today, as we get a better idea of how the work environment will look as the pandemic recedes, let's revisit what the market expects for Zoom... and what that means for the stock.

Just like we did back in December, we can use our Embedded Expectations Framework to see market expectations. As we explained then, this uses a stock's current price to determine what returns the market expects. This way, we eliminate the "garbage in, garbage out" problem with assumptions made using as-reported financial metrics.

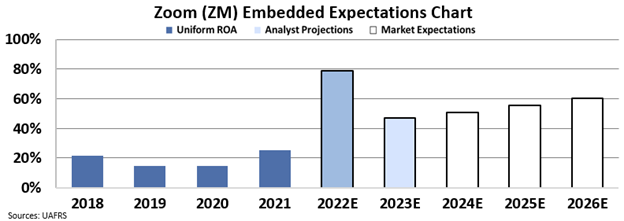

In the chart below, the dark blue bars represent Zoom's historical corporate performance levels in terms of return on assets ("ROA"). The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift in the next five years.

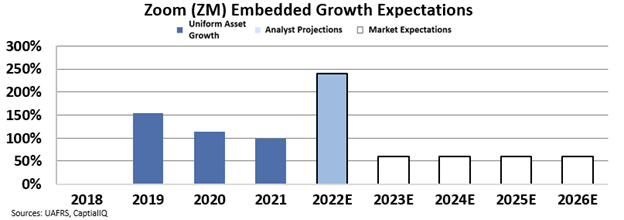

In the next chart, the dark blue bars represent Zoom's historical corporate performance levels in terms of asset growth. The light blue bars are Wall Street analysts' expectations for the next two years... while the white bars are the market's expectations for how Zoom's asset growth will shift in the next five years.

Based on what the market is already pricing Zoom to do in the future, investors shouldn't be rushing to buy the company's stock.

Even after its dramatic drop, the market is still pricing Zoom for more than 50% growth per year over the next five years.

This means Zoom would have to more than double in size roughly every 18 months. The company would need to be about 8 times its current size in five years to meet market expectations!

At the same time, the market is expecting Zoom's Uniform ROA to remain impressively high – at more than 60% by 2026.

The only kind of companies that generate that kind of profitability year in and year out are monopolists who dominate their markets. Considering how competitive the video-conferencing space is at the moment – with alternatives like Microsoft's Teams and Alphabet's Google Meet – expectations for Zoom still appear far too high.

As a result, when we look through the Uniform Accounting lens, the recent drop in share price doesn't look like an opportunity to buy ZM shares at a discount. Despite how the company's platform has helped change the work environment, investors are better off avoiding Zoom.

Where does Zoom stock stand today?

Where does Zoom stock stand today?

Zoom's stock is down 32% since we issued the above warning, and expectations for the company are still astronomical. Investors have stuck with their growth expectations. For Zoom to be valued fairly, it will still need to grow 8 times its current size, while maintaining an even loftier 87% Uniform ROA.

The company's lifespan seems to get extended every time there's a new surge in COVID-19 cases. But here at Altimetry, we still think it's only a matter of time until the market comes to its senses...

Regards,

Joel Litman

December 29, 2021

P.S. While investors are caught up on high-flying stocks like Zoom, we continue to uncover hidden gems that the rest of the market is overlooking. That approach has led us to find exceptional triple-digit winners!

And you can get access to all our services – Microcap Confidential, High Alpha, Hidden Alpha, and The Altimeter – for just one lifetime price as a lifetime "partner."

But you'll have to act quickly... Our special price for becoming a lifetime partner ends on December 31. It's the last chance to get it before the price goes up on January 1.

You can find out more about this opportunity by clicking right here.

This isn't the first time we've examined Zoom...

This isn't the first time we've examined Zoom...