The modern work environment has changed... and it's time for more companies to catch up.

The modern work environment has changed... and it's time for more companies to catch up.

As the coronavirus pandemic escalated last year, millions of employees shifted to a work-from-home ("WFH") environment. For many folks, the transition was a pleasant development...

Many people enjoyed "killing the commute" and a flexible work environment.

As the pandemic begins to recede here in the U.S., many businesses will likely end up back in some sort of "half-and-half" structure of working from both home and the office. No matter what, some degree of remote work will be here to stay.

However, this shift also created issues with morale and direction for employees. The lack of active, regular interpersonal interaction has also been difficult.

While this is challenging for employees, it has been particularly hard for many managers to adapt...

Before this shift in working style, most managers only saw their employees in the office. So it was easy for some managers to view their employees as robots that just did work.

At the same time, it was easy to feel like they were making connections with the natural socialization that happens at the water cooler, without really having to get to know employees on a deeper level.

Managing folks could often feel like you were managing the employee's work, not the person.

But the pandemic has changed things...

But the pandemic has changed things...

Through widespread adoption of video conferencing, managers now are regularly directly exposed to their employees' personal lives. It's hard to ignore "the person" you're working with when you can see their kids coming in and out of their work area, a pile of laundry that needs to be folded, and pictures of loved ones and holidays on the walls.

For managers, this has humanized employees. It has created a whole new level of engagement.

And with employees out of the office, managers also need to make greater efforts to fully train employees. New hires can't be expected to easily absorb office culture, "learn by osmosis," and pick up the tools the team uses to conduct their analysis organically.

Keeping employees engaged, connecting with them holistically, and helping them stay up to speed without the natural connected-ness of the office can make a manager a great leader in this changing work environment. The pandemic will make it clear who's really capable of managing... and who isn't.

This means that video conferencing will be a critical tool for keeping employee engagement up...

This means that video conferencing will be a critical tool for keeping employee engagement up...

In particular, Zoom's (ZM) platform was essential to support this shift last year. No matter what degree of remote work employers implement, video conferencing will continue to be an integral part of the new ways of managing people.

That hasn't exactly been a surprise to the market. Since everyone has left the office, the need for Zoom's services has rocketed higher. The company's stock has jumped by nearly 5 times since December 2019...

This isn't the first time we've examined Zoom...

This isn't the first time we've examined Zoom...

Back in late December, we warned Altimetry Daily Authority readers that the market had sky-high expectations for Zoom. As a result, after big outperformance in 2020, the stock was primed to disappoint investors this year.

Since then, ZM shares have fallen more than 25%. So today, as we get a better idea of how the work environment will look as the pandemic recedes, let's revisit what the market expects for Zoom... and what that means for the stock.

Just like we did back in December, we can use our Embedded Expectations Framework to see market expectations. As we explained then, this uses a stock's current price to determine what returns the market expects. This way, we eliminate the "garbage in, garbage out" problem with assumptions made using as-reported financial metrics.

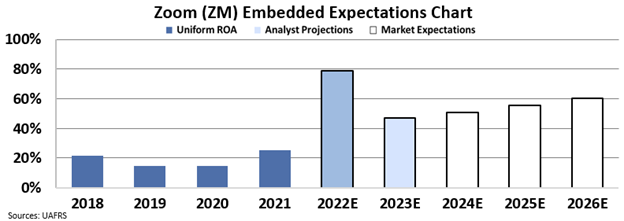

In the chart below, the dark blue bars represent Zoom's historical corporate performance levels in terms of return on assets ("ROA"). The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift in the next five years.

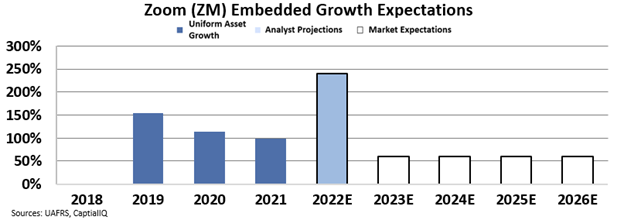

In the next chart, the dark blue bars represent Zoom's historical corporate performance levels in terms of asset growth. The light blue bars are Wall Street analysts' expectations for the next two years... while the white bars are the market's expectations for how Zoom's asset growth will shift in the next five years.

Based on what the market is already pricing Zoom to do in the future, investors shouldn't be rushing to buy the company's stock.

Even after its dramatic drop, the market is still pricing Zoom for more than 50% growth per year over the next five years.

This means Zoom would have to more than double in size roughly every 18 months. The company would need to be about 8 times its current size in five years to meet market expectations!

At the same time, the market is expecting Zoom's Uniform ROA to remain impressively high – at more than 60% by 2026.

The only kind of companies that generate that kind of profitability year in and year out are monopolists who dominate their markets. Considering how competitive the video-conferencing space is at the moment – with alternatives like Microsoft's (MSFT) Teams and Alphabet's (GOOGL) Google Hangouts – expectations for Zoom still appear far too high.

As a result, when we look through the Uniform Accounting lens, the recent drop in share price doesn't look like an opportunity to buy ZM shares at a discount. Despite how the company's platform has helped change the work environment, investors are better off avoiding Zoom.

Regards,

Joel Litman

May 5, 2021

The modern work environment has changed... and it's time for more companies to catch up.

The modern work environment has changed... and it's time for more companies to catch up.