The GLP-1 craze is sweeping the nation... and the investment world.

The GLP-1 craze is sweeping the nation... and the investment world.

Led by biopharma giants Novo Nordisk (NVO) and Eli Lilly (LLY), these popular drugs have created a frenzy of competition that's only making the market bigger.

As we covered yesterday, Novo Nordisk and Eli Lilly are focused on making the treatments even more accessible. They're working on making monthly injections instead of weekly... and even creating oral pills that eliminate the need for needles altogether.

But with only two major players in the market, demand is still outpacing supply. And smaller companies are seizing the opportunity to carve out their own piece of the pie...

Hims & Hers Health (HIMS) is a fast-growing e-pharmacy known for its convenient telehealth solutions...

Hims & Hers Health (HIMS) is a fast-growing e-pharmacy known for its convenient telehealth solutions...

The company works as a direct-to-consumer e-pharmacy. Customers can go through a virtual consultation and get prescriptions mailed to their homes.

While it has been focused on hair loss and erectile dysfunction for years, Hims & Hers is now expanding into weight management. And the timing couldn't be better...

Six months ago, the company launched its own version of Novo Nordisk's Wegovy. While the drug would normally be protected from competition by its patent, Hims & Hers was able to start producing its own because of the shortage.

Analysts expect weight-loss treatments could drive $145 million in revenue for the business this year alone – a massive boost for a company that had less than $150 million in revenue back in 2020.

Hims & Hers is on track to reach more than $1.4 billion in revenue this year... growth of nearly 10 times in five years.

This isn't just a short-term win, either...

This isn't just a short-term win, either...

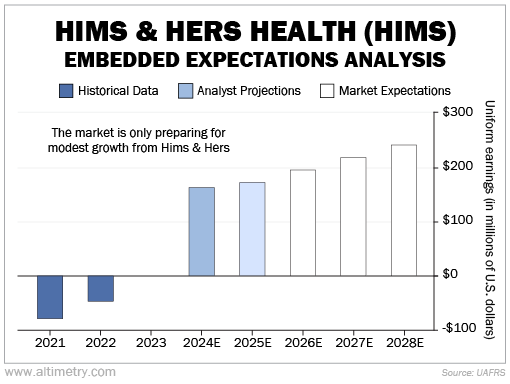

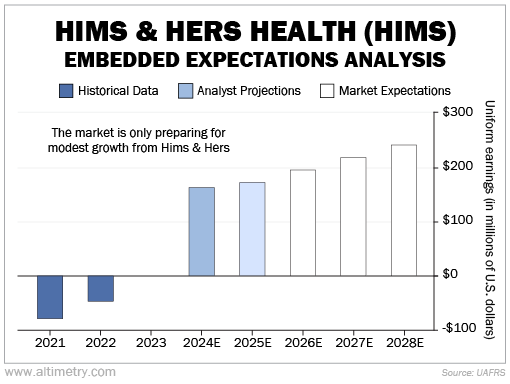

Hims & Hers is positioned for long-term success in the GLP-1 market. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Wall Street expects Hims & Hers to jump from negative $1.6 million in earnings last year to positive $172 million by 2025. That's an enormous spike in only two years.

And yet, the market is only valuing it for modest growth going forward... reaching $240 million by 2028.

Take a look...

This is a similar story to the one we shared about Eli Lilly yesterday – only on a much smaller scale.

If Hims & Hers can secure even a small share of the expanding GLP-1 market, we're looking at significant upside potential... much more than what investors have priced in.

Competition is usually a risk for investors...

Competition is usually a risk for investors...

But it's the best thing to happen to the weight-loss industry. Demand for GLP-1s is breeding innovation at breakneck speed.

Ten companies have at least 15 new weight-loss drug candidates in the approval pipeline through the rest of the decade. All of them use slightly different drug formations. Some can be administered in different ways, like via the standard injection or oral application.

It also means each of them stands a chance of treating other ailments. Each new use for GLP-1s grows the entire market.

And right now, it seems like there's no end in sight to how big this market can get.

Regards,

Joel Litman

November 20, 2024

The GLP-1 craze is sweeping the nation... and the investment world.

The GLP-1 craze is sweeping the nation... and the investment world.