Earlier this month, I spoke at the CFA Society of India's 10th annual India Investment Conference...

Earlier this month, I spoke at the CFA Society of India's 10th annual India Investment Conference...

This was my first trip to Mumbai... and as far as the conference itself, it was an amazing experience. The audience of more than 500 had a real buzz about it.

I had the honor of speaking a little bit before Nouriel Roubini. He's the famed economist who had an uncanny prediction for the real estate crash and subsequent recession a decade ago.

Today, Roubini clearly believes the U.S. is due for another meltdown. He'll eventually be right... but he's too early in his prediction now. This bull market has a long way to go before that happens.

A chunk of Roubini's argument for a market crash rested on his assessment of the Shiller P/E ratio, or cyclically adjusted price-to-earnings ("CAPE") ratio. Invented by U.S. economist Robert Shiller, it's basically a 10-year moving average of the price-to-earnings multiple of the benchmark S&P 500 Index.

Roubini specifically showed how that ratio is flashing a "red" warning flag. He stated that U.S. stock market valuations are now at the third-highest level in more than 120 years.

First off, that signal has been flashing red for the past four or five years. Look back at the headlines in 2015 and 2016 claiming that the CAPE ratio indicated that we were in a bubble at the time.

And unfortunately, neither Roubini nor Shiller are certified public accountants ("CPAs"). Their argument relies on GAAP accounting data, which they ought to know from our fellow academics to be incredibly misleading.

Roubini is a professor at New York University, where a colleague of mine – Professor Baruch Lev – also teaches. Lev co-authored a great book, The End of Accounting, which we discussed over lunch in New York not too long ago. He has a perfectly worded quote in the book: "Reported earnings are largely detached from reality... it is hard to argue with the evidence."

Yet, somehow the "expensiveness" red flag of the Shiller P/E ratio – and Roubini's overly dependent references to it – seem to ignore this evidence.

Regardless, we received great feedback from the attendees. India, with its active finance and investing interest, was as good a place as any to showcase evidence based on Uniform Accounting.

The fact is that the S&P 500 simply isn't as expensive as Roubini or Shiller might claim. And the U.S. stock market is supported by a strong, high-quality, corporate Uniform Earnings foundation.

The conference aside, I couldn't let a trip to India go without at least a little sightseeing. I had to get out of the hotel property and conference area for at least an afternoon.

One of the places I visited was the Gateway of India, an impressive, colossal monument that looks much like the Arc de Triomphe in Paris.

The Gateway holds strong historic meaning for India. On one hand, it was designed to commemorate the visit of King George V and Queen Mary in 1911 to personally see one of the British Empire's most prized colonies. The size and scope of the monument signified his entrance into such a vast and resource-rich territory for the empire.

On the other hand, it was also the site where the last British troops left India in 1948 after India's independence from colonial rule – symbolically transitioning from an entrance to an exit.

In the 19th century, ideas of nationalism and imperialism drove a small number of European nations to aggressively expand across the world in search of colonial territories...

In the 19th century, ideas of nationalism and imperialism drove a small number of European nations to aggressively expand across the world in search of colonial territories...

However, no state approached the size or power of the British Empire.

After World War I, the empire reached its zenith – holding sway over 412 million people and stretching across more than 24% of the Earth's total land area. With territories such as Canada, Australia, India, and large swathes of Africa all reporting to London, it was said that "the sun never set on the British Empire."

With this great power, the British throughout most of the 19th century enforced what later historians have dubbed the "Pax Britannica," or British peace. With its dominating navy, disciplined army, and burgeoning industrial base, no power could challenge British might. This meant that for 100 years, relative peace lasted between the European powers.

With the acceleration of its rise on the global scale in the aftermath of the world wars, the U.S. has been the inheritor of this legacy. While the U.S. doesn't own imperial territory in the sense that the British Empire once did, American armed forces have military bases across the globe. The sun never sets on the U.S. military, and many people view the current decades of relative peace after World War II as a "Pax Americana."

However, this global reach is only made possible by modern technology. When issues in North Korea or Iran start to get hot, the technology that matters most to Washington is communication.

This nascent sector of the defense sphere is called "C4ISR," or Command, Control, Communications, Computers (C4), Intelligence, Surveillance, and Reconnaissance ("ISR"). The U.S. creates this information and communication advantage by relying in particular on a vast network of satellites.

While nobody can deny the importance of the aircraft carrier or nuclear submarine in force projection, these technologies are rudderless without satellite communication. Therefore, global rivals such as Russia and China are investing in technology such as anti-satellite missiles and other satellite-destroying methods.

The company that the Pentagon is working closest with to protect its communication is Northrop Grumman (NOC). The defense contractor began as a merger between aircraft manufacturer Northrop and aerospace firm Grumman, which produced everything from ballistic missiles to the lunar module.

Northrop Grumman has spent the past 10 years looking to move away from its traditional aerospace roots and into cutting-edge sectors such as C4ISR. It was able to fully realize this strategy with its acquisition of the defense company Orbital ATK in 2018.

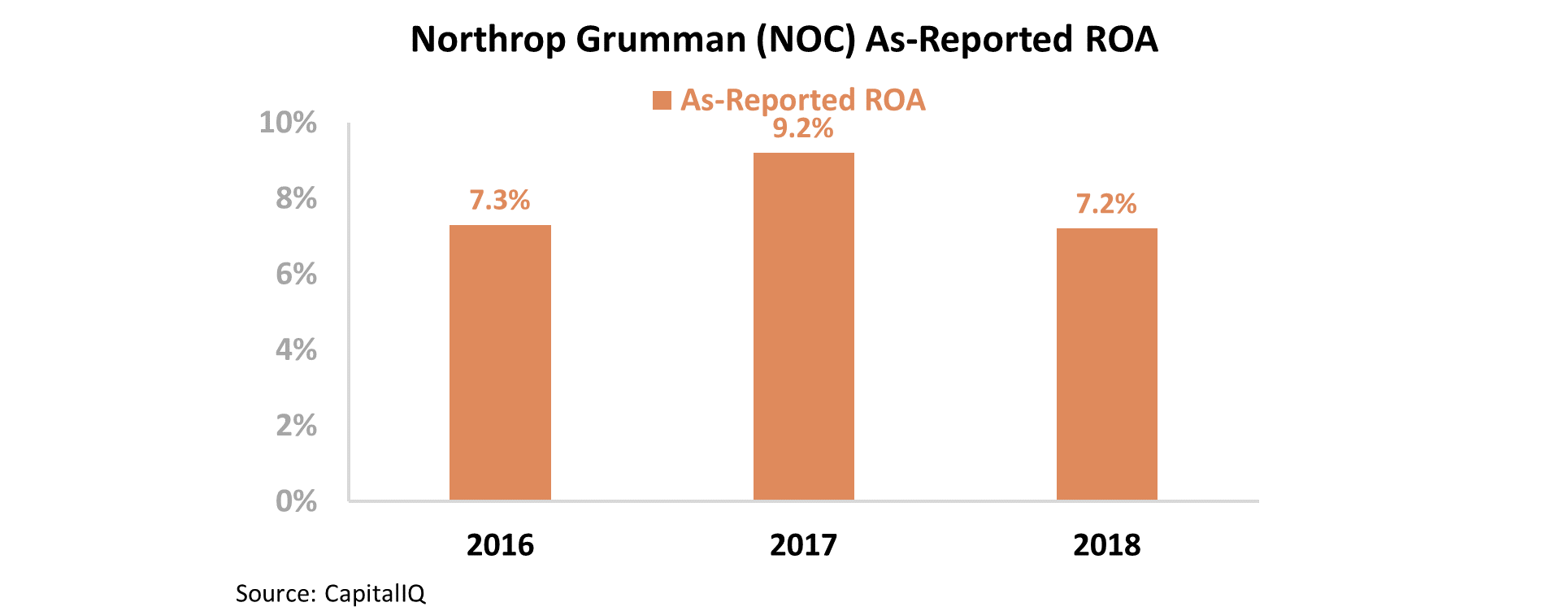

However, over the past three years, it appears that Northrop Grumman has been unable to drive profitability from its recent business moves. Since 2016, its as-reported return on assets ("ROA") has stagnated near 7% to 9% levels – a bad sign for a business looking to expand into a new market.

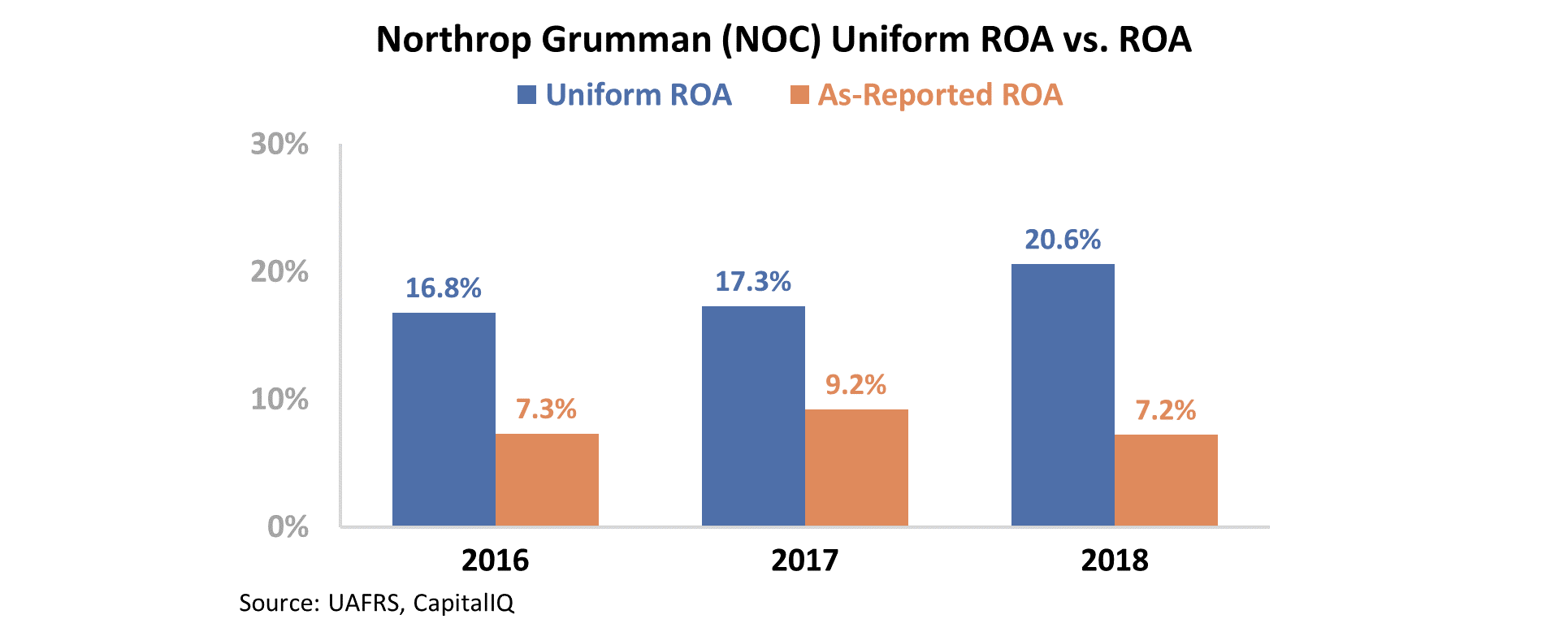

For Wall Street, it would be easy to write off Northrop Grumman as a struggling player in a cutthroat industry. However, this perspective is fueled by incorrect data coloring investors' judgement.

Due to the distortions inherent in GAAP reporting, it looks like Northrop Grumman's returns are under pressure from its aggressive mergers and acquisitions (M&A) campaign. Once we apply Uniform Accounting adjustments – namely accounting for goodwill – we can see the picture that the market is missing.

Rather than profitability hovering slightly above cost of capital, Northrop Grumman's Uniform ROA has been significant... and improving. It jumped from 17% in 2016 to 21% in 2018. Take a look...

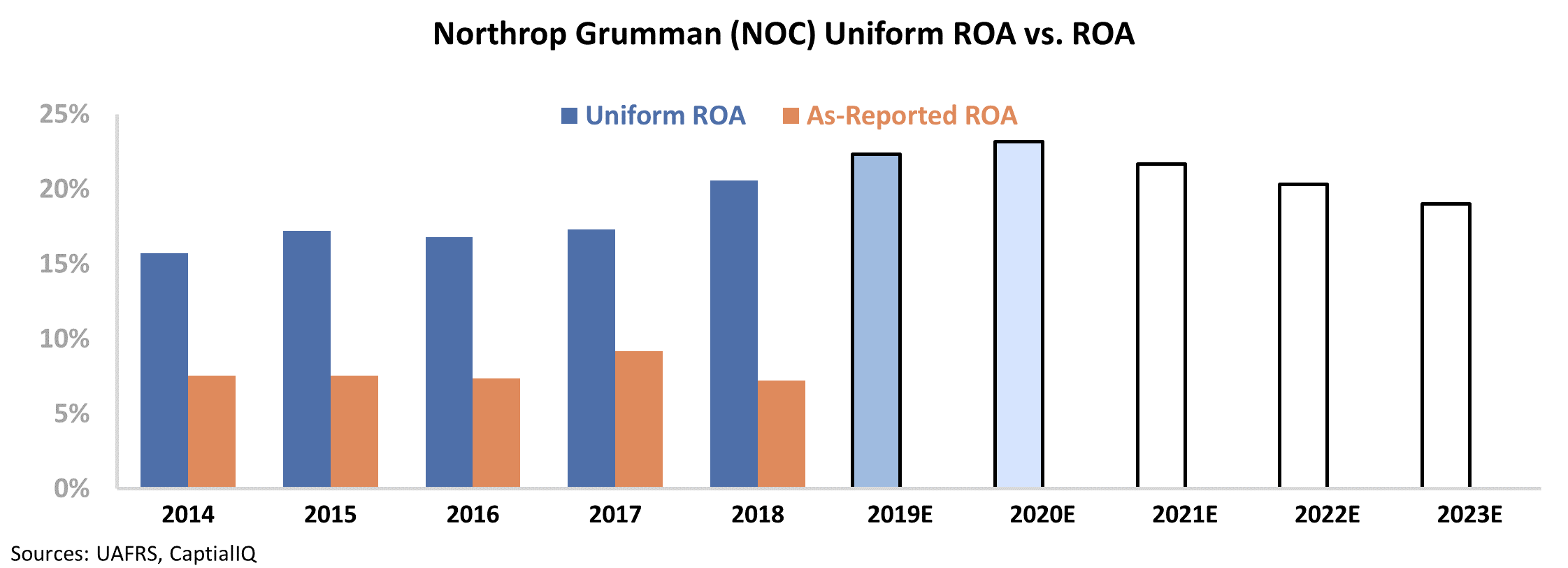

However, due to GAAP distortions, the market doesn't anticipate this trend to continue...

The chart below highlights Northrop Grumman's historical corporate performance in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do for full year 2019 and this year (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, the market expects a reversal in recent profitability trends – falling to 19% by 2023 – rather than continued improvement.

The distortions of GAAP accounting have blinded the market to the success of Northrop Grumman's move into the vital C4ISR defense segment. But if the company continues to execute on its plan to provide the U.S. armed forces with global communications, investors may start to realize the market's mistake.

Regards,

Joel Litman

January 24, 2020