At first, Edward Murphy's rocket-sled experiment seemed like a genius idea...

At first, Edward Murphy's rocket-sled experiment seemed like a genius idea...

Murphy was a U.S. Air Force captain in the 1940s. After World War II, he was assigned to test how G-forces affect the human body. So he planned an elaborate test at Edwards Air Force Base in California.

The test involved strapping a soldier to a sled... mounting rockets to accelerate it beyond 200 mph... and stopping the rocket on a dime. They called the rocket sled "Gee Whiz."

Everything was set to go. The project's commander, Lieutenant Colonel John Stapp, volunteered to strap in. An assistant wired sensors to his shoulder straps to measure the G-forces.

The experiment went perfectly... until it yielded no data.

Not one of the sensors picked anything up. Murphy took a closer look and realized all four sensors were wired backwards, rendering them useless. Frustrated, he exclaimed, "If there's any way these guys can do it wrong, they will."

Over time, Murphy's irritated observation morphed into what's now known as Murphy's law – the notion that if anything can go wrong, it will.

In this volatile market, Murphy's law should be a crucial consideration for any investor. As I'll explain today, the same lessons that keep projects running smoothly can also keep your portfolio on the right track.

A lot of factors are working against you in investing...

A lot of factors are working against you in investing...

One of the most obvious is the emotional urge to buy high and sell low. It's human nature to worry when your investments go down. In fact, fear and uncertainty tend to peak when the market hits a low... right when it's the best time to buy.

We also have to contend with entities like hedge funds that have access to more information than us. For instance, Citadel is one of Robinhood Markets' (HOOD) biggest customers. It buys all of Robinhood's user-trading data, and it uses that to make better investing decisions.

As individuals, it's impossible to compete with the big guys in terms of information access. There's another big factor, though. It's the reason why, since 2010, less than 50% of actively managed funds beat their benchmarks.

In short, they don't consider what could go wrong.

You see, good returns aren't all about picking winners. They're just as much about avoiding losers.

Regular readers know we publish a quarterly "Do Not Buy List" for subscribers to our Microcap Confidential advisory. It consists of stocks that have failed our fundamental forensics checklist... meaning we wouldn't touch them with a 10-foot pole.

The microcaps on our Do Not Buy List are the worst of the worst. And by staying away from them, we can better prevent Murphy's law from taking a foothold in our portfolio.

Many active managers pick plenty of winners. Even so, their process needs to include a way to eliminate stocks that can torpedo their portfolios.

Before investing, run through all the possible scenarios...

Before investing, run through all the possible scenarios...

Here's a helpful exercise to make sure you feel confident in any investment decision.

You may have heard of conducting a "post-mortem analysis" after closing a trade. You're essentially looking at whether or not it worked out... and what you would do differently next time.

The point is to examine what you got right and wrong – timing-wise, emotionally, and analytically – and use that to inform future decisions.

That's a great start. However, it doesn't help you prevent the types of issues that crop up with Murphy's law.

Doing a "pre-mortem analysis" can. By this, I mean you should figure out what could go wrong with your investment before you put your money in.

Take Do Not Buy List stock Canoo (GOEV). Canoo calls itself an electric-vehicle ("EV") maker. And it went public at the perfect time – in late 2020, as the EV market was really taking off.

Canoo sounded exciting on paper. It claimed it was developing a subscription model for its EVs... and that it already had a $1 billion sales pipeline of folks who had put down deposits.

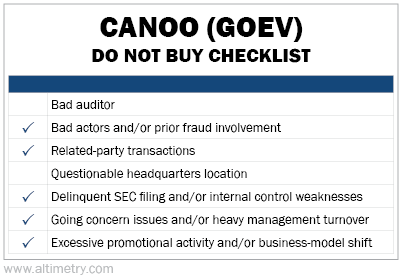

Despite these lofty aspirations – or perhaps because of them – it wasn't hard to imagine what could go wrong for the company. After running through our fundamental forensics checklist, the problems became even more clear.

Take a look...

As you can see, Canoo triggered nearly all of our Do Not Buy warning signals.

CEO Tony Aquila had a history of putting his own interests before shareholders'. His previous company, Solera, alleged that he ran off with Solera's private jet to raise money for the future Canoo.

And between 2020 and 2021, Canoo reimbursed him for $2.3 million in air-travel expenses.

That was only the tip of the iceberg. We're not surprised that the stock is down 72% since we warned readers to stay away last September.

This is the sort of analysis you should do with every investment... before you put your money in.

This is the sort of analysis you should do with every investment... before you put your money in.

A pre-mortem forces you to take a step back and double-check that you're not investing emotionally.

It ensures you're not missing anything major that could blow up in your face, like investing in a fad right at the market top.

Reviewing a position after you close it is a good learning exercise. Doing so before you invest is a critical capital-preservation strategy.

Wishing you love, joy, and peace,

Joel

June 2, 2023

At first, Edward Murphy's rocket-sled experiment seemed like a genius idea...

At first, Edward Murphy's rocket-sled experiment seemed like a genius idea...