A world-class fund manager is showing the catch-22 of 'socially responsible' investing...

A world-class fund manager is showing the catch-22 of 'socially responsible' investing...

TCI Fund Management was the highest-earning hedge-fund manager for its investors in 2019, bringing in $8.4 billion in returns. And Christopher Hohn, the company's billionaire manager and founder, is taking his activist playbook into a new world...

TCI recently announced that it's focusing on using its investing muscle to push companies to reduce their carbon footprint. While activists applaud the fund manager, they also complain about TCI's portfolio – which includes Heathrow Airport operator Ferrovial and Canadian Pacific Railway. Airplanes are massive emitters of carbon dioxide and Canadian Pacific's trains are major transporters of oil sands products.

The push and pull highlights one of the issues with trying to mix maximizing investor returns and environmental, social, and governance ("ESG") goals.

TCI holds these names because it's attempting to enact change in the companies by pushing them to improve disclosures and change their business practices. But at the same time, by owning these companies, TCI is still supporting their business practices.

It's unclear how successful Hohn and TCI will be in the endeavor... but it's another example of the complexities regarding this recent investing trend.

Dealing with IT can be frustrating...

Dealing with IT can be frustrating...

Despite the magic of modern technology, all of us can admit that it's a double-edged sword.

For as convenient as technology has made our lives, we also have to put up with greater security risk, constant communication, and the worst of all – IT issues.

When I run into technology issues, it reminds me of the proverb, "best-laid plans," which originated as a line from Scottish poet Robert Burns' "To a Mouse": "The best laid schemes of mice and men go often askew."

From our phones to smart TVs to wireless charging, our technology is great in theory but rarely flawless in practice.

The same goes for technology at the corporate level. Of course, computers, word processors, and digital spreadsheets have revolutionized the way companies do business. However, they have also required companies to spend billions of dollars on technology in addition to hiring huge IT departments for support.

Most large businesses have to pay teams to provide 24/7 support services – monitoring server farms, answering IT support tickets for other employees, and web continuity and security.

If these terms make your head spin, you're in good company... Despite most people not fully understanding what IT does or finding it mundane, these support functions are critical to keep businesses running around the clock.

One of the major problems with IT is that it can be difficult to outsource the majority of the work for the same reasons. There are security concerns, IT needs differ greatly from company to company, and it adds a level of bureaucracy.

However, some firms are looking to change all of this...

One example is ServiceNow (NOW), which focuses on modernizing how companies think about IT. The company was founded on the idea that most IT problems could be solved with cloud-based solutions rather than the traditional IT infrastructure most businesses use.

ServiceNow began by solving some of the least "sexy" parts of IT support – help desk management, incident report processing, and security operations.

With these solving the most basic problems in IT, it could be easy to pass off ServiceNow as a commodity business.

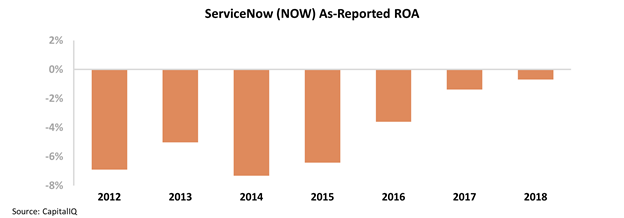

The company's historical performance suggests something similar. Since it went public in 2012, ServiceNow has never had a positive return on assets ("ROA"). Despite generating $2.6 billion in revenue in 2018 (the most recent full fiscal year), the company's ROA was still negative 1%... This is consistent with a competitive and highly commoditized business.

But clients would say the opposite is true for ServiceNow. The company has built itself into a leader in outsourced IT management by packaging hundreds of additional features that most IT teams would be unable to perform by themselves.

Over the past decade, ServiceNow has continued adding to its features by acquiring smaller IT companies to build its capabilities in areas like artificial intelligence, disaster recovery, and natural language processing.

All of these features have transformed ServiceNow from a commodity IT help desk into an indispensable resource for its clients.

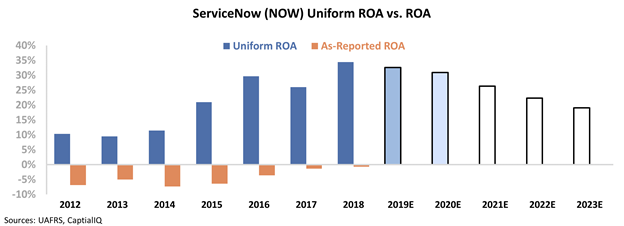

And while as-reported metrics may not show this, we can see ServiceNow's true profitability once we look at the company using Uniform Accounting...

GAAP accounting features a number of misleading rules that make financial analysis difficult. These rules impact ServiceNow – specifically around the treatment of non-cash stock option expense and expensing versus capitalizing research & development (R&D) costs – and cause the company to look far less profitable than it actually is.

The chart below highlights ServiceNow's historical corporate performance levels in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in 2019 and 2020 (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, ServiceNow has been profitable ever since it became a public company. Not only that, but its focus on adding more value-add services has increased its ROA nearly every year, from 10% in 2012 all the way to 34% in 2018...

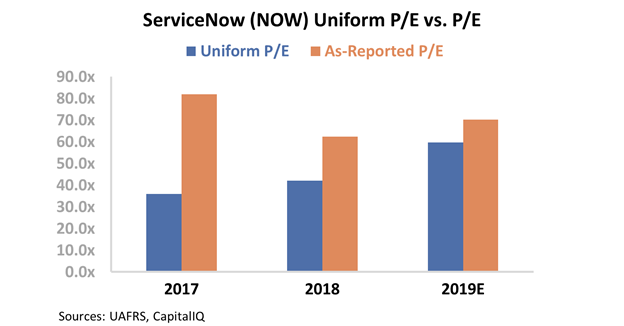

And given how differently GAAP and Uniform Accounting treat ServiceNow's ROA, it should be no surprise that we see completely different signals for its valuations...

The company's as-reported price-to-earnings (P/E) ratio has hovered around 65 to 80 times earnings over the last three years, which is far too high for a negative-profitability company. On the other hand, when looking at a business that has grown its ROA threefold over the past several years, a Uniform P/E ratio of 60 may not be unreasonable...

It can be frustrating missing out on interesting opportunities because of incorrect signals... especially when the as-reported numbers are distorting a company's ROA so inaccurately – as is the case with ServiceNow. But with Uniform Accounting, you have a better chance to get ahead of the curve.

Regards,

Joel Litman

January 30, 2020

A world-class fund manager is showing the catch-22 of

A world-class fund manager is showing the catch-22 of