Something strange happened in early 2020...

Something strange happened in early 2020...

And we're not talking about a novel virus infecting millions and shutting down the world. At least, not exactly...

You see, after the first full quarter of lockdowns, companies started publishing their pandemic-era results. And to everyone's shock... corporate America looked fine.

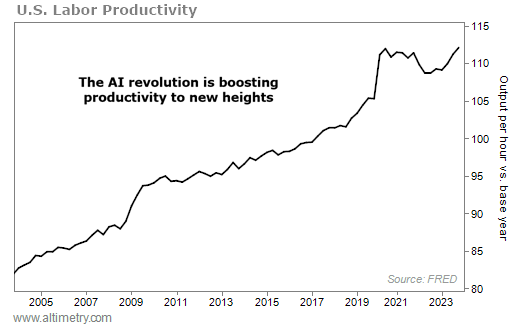

If anything, "work from home" seemed to make the economy stronger. Labor productivity rose 7.5% year over year to an all-time high.

As we'll explain, productivity is a huge reason why both the economy and the stock market rallied so fast after the initial COVID-19 panic. Over the long term, the stock market tends to follow labor productivity closely.

However, while new trends like AI are boosting productivity in 2024... they won't be enough to stave off a recession.

Labor productivity stayed strong through 2021...

Labor productivity stayed strong through 2021...

Folks were still working well from home. And the rest of the economy opened back up. Productivity rose 0.5% YOY... which drove U.S. GDP 5.9% higher to its best year since the 1980s. The S&P 500 rallied 27%.

The next year was a different story. Folks started heading back to the office in 2022. Along with rising interest rates, this change forced productivity down 1.7% YOY in the fourth quarter.

AI adoption has the potential to be a huge catalyst for labor productivity. While 2023 was only the early innings, it already seems to be making a difference.

Productivity increased in each quarter of 2023. And it reached an all-time high in the fourth quarter. Take a look...

Clearly, AI is doing what it promised... It's helping make workers more efficient. And that's what investors have paid attention to over the past year.

Top tech companies like the "Magnificent Seven" have driven most of the market's gains since the start of 2023. We haven't even begun to understand all the ways AI will make our economy more efficient.

However, all of that is in the long term. AI can't save the economy from what's right ahead.

Beneath the surface, companies are still struggling with debt as interest rates remain high...

Beneath the surface, companies are still struggling with debt as interest rates remain high...

We haven't seen a wave of defaults... yet. But it's unlikely that AI will save near-distressed companies. When they start to go under, they'll drag the rest of the economy with them.

It's no secret that we're bullish on the U.S. stock market over the next decade-plus. However, that optimism doesn't change the risk that's right in front of us.

Companies are going to struggle with defaults in the next few quarters. A wave of bankruptcies is bound to slow down recent labor-productivity gains.

Stay alert... because investor sentiment can switch quickly.

Regards,

Joel Litman

March 18, 2024

Something strange happened in early 2020...

Something strange happened in early 2020...