One of the markets surging the most during the 'At-Home Revolution' has been housing...

One of the markets surging the most during the 'At-Home Revolution' has been housing...

People are spending more time in their homes and apartments this year due to restrictions on mobility. This has led to more folks moving out of cities and into bigger homes in the suburbs.

This exodus has created a booming market for realtors and homebuilders. According to a forecast from industry website Realtor.com, this growth will carry well through 2021.

The site predicts single-family housing starts will rise 9% and median sales prices will rise 5.7% this year. With the influx of demand, prices are rising in tandem.

Realtor.com only predicts one part of home buying to return to normal... The pandemic has thrown off typical seasonal patterns for buying homes. Spring and early summer are normally the most common times to purchase a home, but the pandemic blew up this pattern. Demand surged throughout the summer and fall and even into the winter.

However, Realtor.com expects the typical seasonal demand pattern to return in 2021.

Additionally, the site anticipates millennials to continue driving the housing market demand. The oldest millennials will turn 40 in 2021, with youngest around 24. This is historically the age range for people to purchase their first home. And while many millennials had been deferring this decision, the demand will likely continue surging now that they're looking to move away from cities.

Furthermore, low interest rates have made getting mortgages easier. Nearly 75% of millennials have said low rates will enable them to make a change to their home search.

Ultimately, the At-Home Revolution has led to a sustainable surge in home demand. People are continuing to move out of cities and into the suburbs thanks to big trends like working from and spending more time overall at home.

This surge has been a big tailwind for Beazer Homes USA (BZH)...

This surge has been a big tailwind for Beazer Homes USA (BZH)...

Beazer is a home construction company based out of Atlanta, Georgia. It's the 11th-largest homebuilder in the United States and has operations in more than a dozen states.

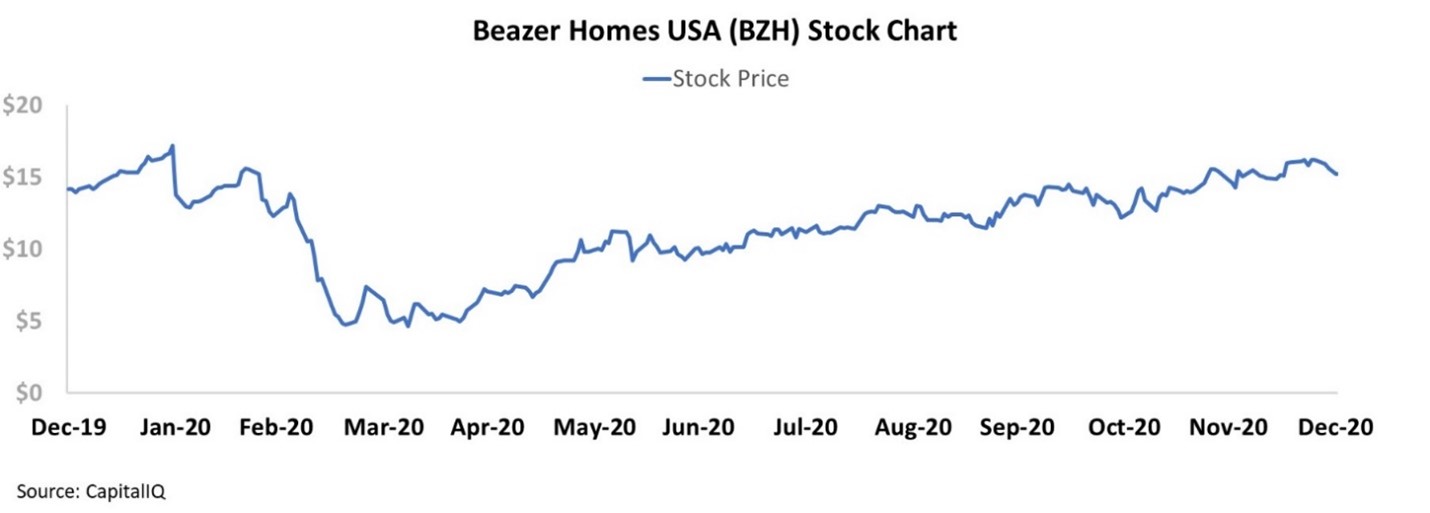

Beazer has seen profitability surge during the pandemic due to demand for new homes. And BZH shares have followed suit, rising from a low of $4 in March to a recent peak of $16...

But despite this stock surge since the March lows, credit-ratings agencies are still skittish when rating the company's debt. Moody's gives Beazer a high-yield "B3" rating. This indicates a nearly 25% chance of default over the next five years.

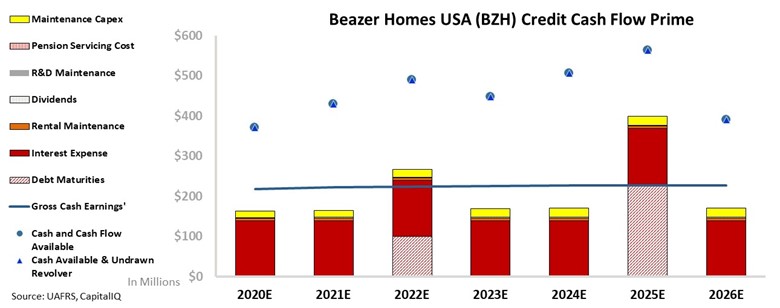

This rating seems overly pessimistic... so using our Credit Cash Flow Prime ("CCFP") analysis can give us a sense of Beazer's true credit risk.

In the chart below, the stacked bars show the company's obligations each year for the next five years. We compare this to its cash flow (blue line) and cash on hand at the beginning of each period (blue dots).

The bottom bars are the hardest for Beazer to "push off" – costs such as debt maturities and interest expense. The higher bars are obligations that are more flexible, like maintenance capital expenditures ("capex") and share buybacks.

As you can see, the CCFP shows that Beazer has a healthy cash balance and multiyear runway before its debt matures.

Beazer's cash flows are expected to exceed operating obligations in every year going forward. Additionally, even with the modest 2022 and larger 2025 debt maturities, the company's cash flow and cash on hand should exceed all obligations.

This healthy profile makes Beazer appear much safer than a 25% risk of default. And that's even before factoring in how its profitability and cash position could benefit from the continued surging homebuyer demand.

Therefore, we give the company name an investment-grade "IG4" rating. This implies a less than 2% risk of default within the next five years... and it's a far lower percentage than rating agencies have implied.

Ultimately, Uniform Accounting and the CCFP highlight how Beazer bonds are much safer than rating agencies believe. The company has a long runway before any potential cash shortfalls and should continue to see demand surge as people look to move out of cities.

Regards,

Rob Spivey

January 5, 2021

One of the markets surging the most during the

One of the markets surging the most during the