Housing prices in the U.S. are up 14.6% from a year ago...

Housing prices in the U.S. are up 14.6% from a year ago...

As we've discussed in the past, the "At-Home Revolution" has essentially poured lighter fluid onto America's housing market and beyond.

The coronavirus pandemic forced people out of crowded cities and into the suburbs. And the housing supply simply hasn't been able to keep up with demand, no matter how many houses are built or resold.

According to the closely followed S&P/Case-Shiller U.S. National Home Price Index, annual gains in the U.S. housing market have reached their highest levels in more than 30 years.

With housing near record lows, the mismatch of supply and demand continues to drive prices higher... and not only in the U.S.

As The Economist reports, an index of average real home prices in 25 developed countries has risen rapidly in over a decade, led by a 22% jump in New Zealand.

These rapid gains have begun to make some investors and policymakers uneasy, with memories of the prior decade's housing crisis still fresh on their minds.

But with strong bank balance sheets and heightened mortgage lending standards, concerns about financial stability risks stemming from the housing market are largely overblown.

That said, this doesn't mean you should put all your money into real estate instead of the S&P 500 Index...

The past year of real estate gains may entice speculative investors – folks looking to buy houses and sit on them for appreciation – into the housing market...

The past year of real estate gains may entice speculative investors – folks looking to buy houses and sit on them for appreciation – into the housing market...

While we understand the thought process, the recent run-up in prices warrants a reminder of how to think about real estate purely as an investment.

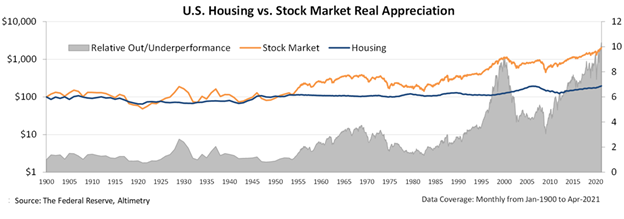

We've said it previously here at Altimetry Daily Authority... As history shows, the U.S. stock market has consistently outperformed real estate in terms of price appreciation.

From April 2020 to April 2021, while housing prices were up 14.6% in the U.S., the Dow Jones Industrial Average logged a gain of 58.3%, the S&P 500 Index jumped 62.8%, and the Nasdaq Composite Index posted a remarkable 83.1% gain.

In fact, returns in the stock market have been around 9 times higher than those in real estate over the past 100 years. That's a wide margin of outperformance...

Keep in mind the risks inherent to real estate investing compared with a simple passive investment in the stock market...

Keep in mind the risks inherent to real estate investing compared with a simple passive investment in the stock market...

First off, most investors in real estate finance their purchases with leverage (i.e., borrowed money) – magnifying both gains and losses. For example, if an investor takes out a mortgage to finance an investment property and pays the typical 20% down payment, the leverage ratio on the investment is 5 to 1.

This means that a 10% increase or decrease in the value of the property will correspond to a 50% gain or loss. This makes for a riskier investment.

Furthermore, investing in real estate also often requires giving up the benefits of diversification.

For example, when you buy a home or property in the New York City area, the value of your investment is beholden to the city and state's economic conditions. If the economy in the Big Apple starts to slow, you may suffer a big loss on your investment. That would be magnified by any leverage used to make it in the first place.

Thus, unlike an investment in the S&P 500 Index – which is composed of a diversified list of businesses that includes real estate – an investment in real estate comes with a greater degree of concentrated risk.

Finally, real estate investment must be thought of as more like a business than an investment.

Owners must commit time to such concerns as finding the right local market to invest in, establishing reasonable financing, hiring service providers – such as property managers, plumbers, and electricians – to fix eventual problems and manage complicated legal and tax issues.

As you can probably imagine, this is no easy task for the novice... thus leaving professional real estate investors with the advantage and most of the potential profit.

Of course, this discussion is totally separate from the personal decision many families make about whether to buy or lease their home. Every family has specific financial and lifestyle factors to consider. For all of these reasons, we caution investors looking to replace stocks with real estate.

Real estate investment can be a lucrative business for folks willing and able to spend the time to obtain the necessary knowledge. But for most investors, there's a strong argument to be made for steering clear of real estate and focusing on the higher-performing stock market.

Regards,

Rob Spivey

July 19, 2021

Housing prices in the U.S. are up 14.6% from a year ago...

Housing prices in the U.S. are up 14.6% from a year ago...