The real estate market has been blown wide open, with little sign of slowing down...

The real estate market has been blown wide open, with little sign of slowing down...

2020 was a banner year for home prices. As we've said many times over the past 12 months here at Altimetry Daily Authority, climbing real estate prices in a recession are unique... and this has affected spending in other related industries.

We've dubbed this market-shaking event the "At-Home Revolution" and have stressed that these shifts in spending aren't going to end even after the coronavirus pandemic recedes.

As part of the trend, the types of homes in demand have shifted as well. Traditionally, homes near the big cities by the coast have seen the most prominent increases. However, in 2020, suburbs near smaller metropolitan areas like Pittsburgh and Cleveland are seeing the biggest gains.

Historically, millennials have been late to homeownership compared to previous generations. This has had far-reaching effects, such as reduced spending on cars, the decline of suburbs, and even lower government revenue from real estate taxes.

Now, the pandemic has forced the hand of many millennials to buy – causing home prices to surge.

Record low mortgage rates accelerated homebuying for many folks, as interest rates plummeted after action from the U.S. Federal Reserve. However, price increases have already canceled out any benefit for consumers, and prices are still going up.

Normal seasonality in the housing market dictates sales are heaviest in the summer, when parents can get kids into a school system before the next year starts.

However, the rise in home prices didn't end after the busy season. And with summer approaching once again, it's unlikely this trend will change. As CNBC noted earlier this year, prices rose by 8.4% across the nation year over year in October, well after the summer frenzy... It was the largest month-to-month move in more than a decade.

According to the most recent data released by the St. Louis Fed, home prices have risen by almost 10% from February 2020 to the end of the year.

With the At-Home Revolution still ongoing, rising prices and red-hot demand will be a feature of housing for many more months to come.

So beyond just looking for a change of scenery, does this mean folks thinking of an investment property should be buyers too?

So beyond just looking for a change of scenery, does this mean folks thinking of an investment property should be buyers too?

Those who looking to invest in real estate have a lot to think about today...

There's a booming market, along with long-term tailwinds for the move away from cities to suburbs and rural areas. Folks are looking for more space, and remote work is becoming standard at many companies across the U.S.

As the benefits of living in a city fade, some people may be thinking of making real estate investments in areas that others would want to buy in.

This rising sentiment is exactly why we wanted to revisit our 2019 essay on the subject, which drew the most reader responses of any Altimetry Daily Authority that year. Back then, we explained why buying a home strictly as a passive investment is worse than simply putting money into the stock market.

And today, our opinion hasn't changed.

To clarify, we aren't talking about buying a home that you and your family will live in. This also doesn't cover buying a vacation property that you can use for remote work, nor an upgrade to a different part of the country.

Whether or not people should rent or buy the home they plan on living in or using regularly is a separate discussion and revolves around how long they plan to live there, whether they want to make any changes, and more.

When we say buying a home as an investment, we're strictly referring to buying a home as a "passive" investment that the investor plans to rent out as a source of income.

Many bloggers and pundits love to talk about the benefits of passive home investing like it's a no-brainer...

Many bloggers and pundits love to talk about the benefits of passive home investing like it's a no-brainer...

But as anyone who has done it will tell you, the reality of managing such an investment is hard work. There's a cost in time and money that makes "passive" real estate investing into more of a career.

Landlords need to worry about finding and keeping high-quality tenants who won't damage the property. They need to build a network of relationships with service providers who can repair the inevitable wear and tear on the property.

If investors don't want to spend a significant amount of time dealing with these headaches, they can hire a real estate manager... but this would eat directly into any rental income.

Even if you didn't have to worry about any of these things, the economics simply don't make sense...

Even if you didn't have to worry about any of these things, the economics simply don't make sense...

As we mentioned, from February to December last year, home prices were up nearly 10%. However, there was another truly passive investment up almost 3 times that amount – at 26% over the same time frame: simply buying the benchmark S&P 500 Index.

Even during one of the best times for home appreciation in the past 20 years, an investor who spent only a few minutes buying into an S&P 500 index fund outperformed real estate investors.

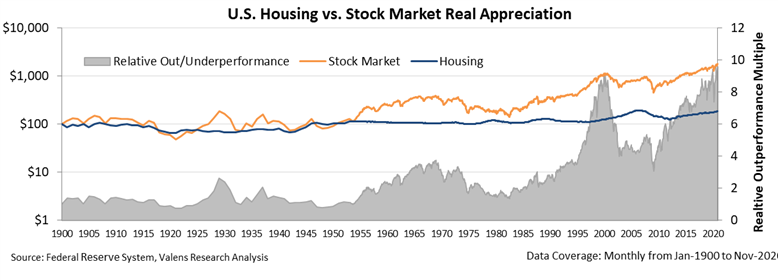

This has applied historically as well. If an investor were to put $100 into the U.S. housing market in 1900, he would have $187.93, adjusted for inflation. However, if that same investor had invested in the stock market, he would have $1,800.01... a return almost ten times higher.

Unlike home ownership, buying the S&P doesn't concentrate risk... and it doesn't require active participation that would eat into returns.

And when considering leverage, investors can also add leverage when buying the market via an S&P exchange-traded fund ("ETF"). Even assuming 80% leverage on a home (using typical mortgage terms of a 20% down payment from the buyer) the return would be around 45%, minus the cost to borrow.

Meanwhile, with just a 1 times leverage on the S&P 500, the return would be a little less than 52%... and with a lot less leverage than the same home investment. Again, this would come with significantly less effort and a lot more diversification, as the investment would be spread across 500 well-performing, large-cap companies.

As we said back in 2019 – and want to reinforce today – this discussion isn't meant to be anti-home ownership, or to say people should only be renting. Homeownership can be a rewarding endeavor for folks looking to switch from renting to buying.

However, if you're sitting on a lump of cash and looking at passive real estate as the place to park your money, it's important to measure your options against a tried-and-true investment into the world's best companies.

Regards,

Joel Litman

March 8, 2021

The real estate market has been blown wide open, with little sign of slowing down...

The real estate market has been blown wide open, with little sign of slowing down...