We warned you that trouble could be brewing in real estate...

We warned you that trouble could be brewing in real estate...

It started in December, when the Blackstone Real Estate Income Trust ("BREIT") announced that it was limiting withdrawals. That told us folks were starting to get nervous about their real estate holdings.

Then, last month, the University of California system injected $4 billion of liquidity into BREIT.

It was an attempt to calm investor worry. But as we said at the time, falling rents and a possible recession could still spell trouble for BREIT's specialty, multifamily homes.

Even supposedly "safe" portfolios like BREIT are feeling the pressure. The fund's struggles could be the canary in the coal mine for the private-equity-backed real estate industry.

As we'll explain today, investors are starting to catch on. They're realizing that more parts of the real estate market might be at risk. And that means this sector has a long road ahead...

Many folks thought the risk in real estate was contained to office space...

Many folks thought the risk in real estate was contained to office space...

But it's becoming clearer that other highly regarded real estate segments are under pressure, too.

The largest commercial real estate asset managers face $20 billion of withdrawal requests from investors. That's the biggest list of withdrawal requests since the Great Recession.

Investment bank UBS (UBSG.SW) faces a $7.2 billion withdrawal queue in its Trumbull Property Fund. That's 40% of the whole fund.

Other financial powerhouses like JPMorgan Chase (JPM), Morgan Stanley (MS), and KKR (KKR) are also seeing big withdrawal requests. KKR's Real Estate Select Trust faces requests that total 8% of its assets.

This is a different situation from BREIT, which is mostly residential real estate.

Even today, an economic downturn would hurt that part of real estate the least. After all, folks will always need a place to live.

BREIT sold off because investors were chasing the only market area with liquidity. Commercial real estate is in a much tougher position...

For much of the past year, the focus was on office properties...

For much of the past year, the focus was on office properties...

And these types of properties face two strong headwinds.

The first is that the COVID-19 pandemic completely changed the way we work. Companies realized they don't need massive traditional office spaces. Many downsized as they embraced hybrid work.

The second is the declining number of employees as a result of big layoffs. This means companies need less space for the rest of their workers.

Some investors thought that's where the risk ended. It looked like other commercial areas, such as warehouses and data centers, were resilient.

With the rise of Internet retail, we couldn't build warehouses fast enough. The same was true for data storage. We use more data every year, and it needs to be stored somewhere.

These areas seemed immune to market pressure. But that's no longer the case...

Cloud-computing companies are rethinking their growth strategies. E-commerce giant Amazon (AMZN) – a huge buyer of both warehouses and data centers – just laid off 18,000 workers.

Over the past year, it has become clear that Amazon bought too much warehouse space during the pandemic. Amazon Chief Financial Officer Brian Olsavsky said the company needs to right-size its capacity to let demand catch up with its warehouse size.

A lot of tech companies are in similar positions. The tech industry has been full of layoffs and cost-cutting. And that could come with lower demand for data centers.

Demand isn't the only factor crushing valuations, either...

Demand isn't the only factor crushing valuations, either...

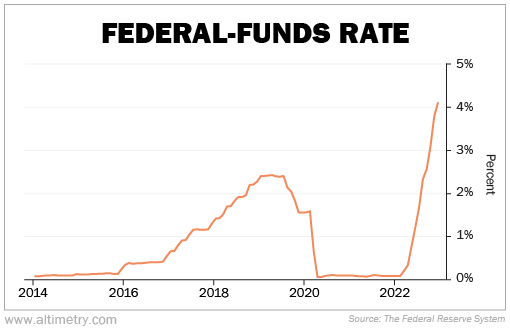

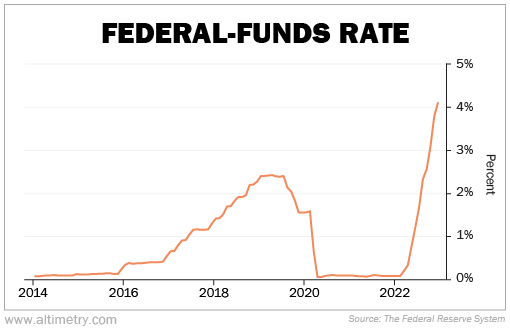

Interest rates are another major concern.

The Federal Reserve has raised the federal-funds rate (the interest rate it controls) historically fast. And that makes financing real estate a lot costlier. Take a look...

It's a bad time to lose customers. Real estate companies that own warehouses and data centers are dealing with pressure on both sides.

That's a recipe for lower valuations.

Investors are heading for the hills. Everything that has happened so far shows commercial real estate is a risky place to be invested right now.

Keep an eye on commercial real estate as this situation plays out. Look out for any news. And consider how it might affect the industry as a whole.

We expect redemption requests to keep climbing in the coming months. Any small development could lead to a huge shock in the financial markets.

We've warned investors to stay away from real estate for months. And as time passes, we're only becoming more confident in our assessment.

This still seems like the early stages of what could be a tough time for real estate investors. Even the parts of the market that people thought were safe... likely aren't.

Regards,

Rob Spivey

February 8, 2023

We warned you that trouble could be brewing in real estate...

We warned you that trouble could be brewing in real estate...