Repo's biggest problem is quite simple...

Repo's biggest problem is quite simple...

There aren't enough people to do the dirty work... to seize the cars, motorcycles, and boats folks can't afford to pay off.

Every year, professionals in the repo industry descend upon the North American Repossessors Summit. They share the latest tools and tricks of the trade, discuss challenges, and look to the future of the industry.

And at the 2023 summit, everyone was talking about the same two words...

Historic demand.

With consumer financial health in decline, repo is still booming this year. Auto repossessions in particular are up 23% year over year through the first half of 2024.

We seem to be approaching a breaking point as consumers struggle to pay off their debts. And as we'll explain, this trend will likely continue for some time...

The average monthly interest payment for a new car is $739...

The average monthly interest payment for a new car is $739...

Even a used car is still a whopping $549 per month, on average. Many people simply can't afford those payments. They're giving up their assets to be repossessed instead.

While that's good news for the repo industry, it's terrible for the consumer. The Federal Reserve is still at least a few months away from cutting interest rates.

And it'll be even longer before consumers feel any relief.

In the meantime, rates are still high. More Americans are being forced into delinquency.

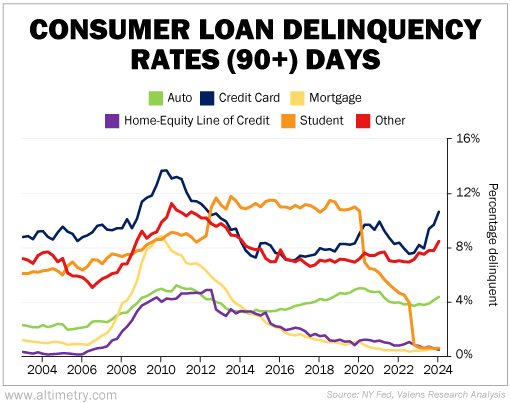

Regular readers are familiar with the following chart. It shows 90-day credit card delinquencies across all major loan classes.

As you can see, delinquencies are back up to their highest level since just after the Great Recession...

Now, delinquencies alone aren't guaranteed to plunge us into a recession. There are a lot of other factors to consider, like inflation, employment data, and corporate credit health.

But investors need to be careful about what kinds of investments they're picking today.

As consumer health declines, the flow of spending decreases...

As consumer health declines, the flow of spending decreases...

More important, that flow is redirected away from "nonessential" spending. That means many consumer companies are going to struggle.

Remember, two-thirds of U.S. GDP comes from consumer spending. Even massive retailers like coffee chain Starbucks (SBUX) and apparel giant Nike (NKE) are feeling the pain... because folks aren't willing to spend.

It'll be tough to find "safe" consumer-retail stocks in the coming months. Starbucks and Nike are just some of the first to deliver the bad news. As long as American consumers are struggling, so will consumer stocks.

Pay attention to delinquency rates... They'll give us an idea of what's coming in the next few quarters.

Regards,

Joel Litman

July 29, 2024

Repo's biggest problem is quite simple...

Repo's biggest problem is quite simple...