Many called 2021 the 'year of the individual investor'...

Many called 2021 the 'year of the individual investor'...

It started when retail investors organized on social media platform Reddit to improve their investing skills.

Then, they joined forces to bid up beaten-down stocks. This strategy worked for a lot of them... They rushed into companies like video game retailer GameStop (GME), pumping it up from about $4 per share to above $80 per share in only a month.

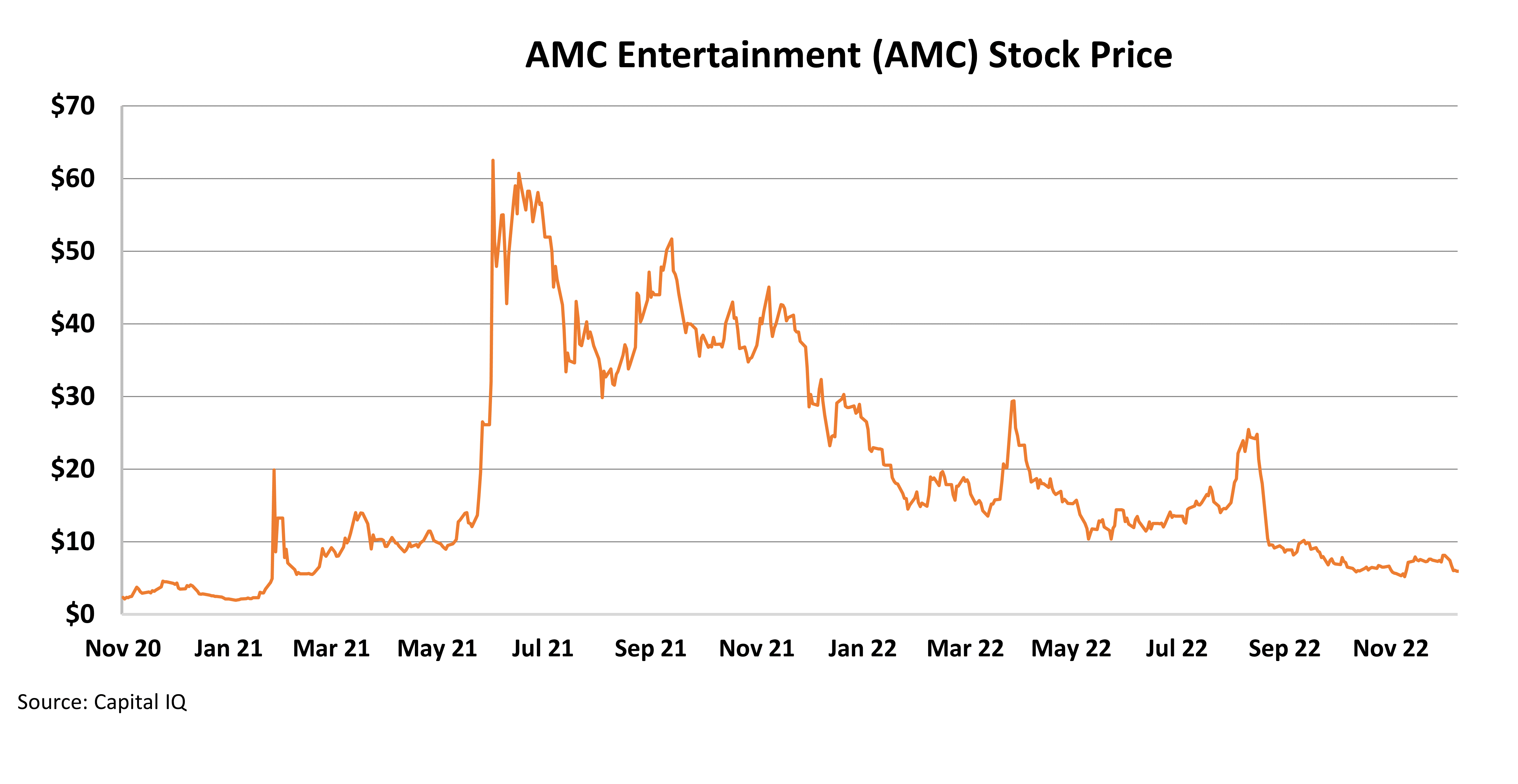

And they did the same with entertainment giant AMC Entertainment (AMC), which soared more than 540% from early May to early June.

The Reddit crowd made their rounds in the market in 2021. Investors finished the year crowing about their crypto and tech investments.

It's true that these assets did well. Only it had more to do with the fact that everything went up.

As I'll explain today, these same folks have moved on to a new favorite investment. And it might spell trouble for their portfolios...

It wasn't just 'meme stocks' that soared last year...

It wasn't just 'meme stocks' that soared last year...

It was the entire market.

Bitcoin rose about 49%. And the Technology Select Sector SPDR Fund (XLK), which tracks a basket of top tech stocks, jumped 34%.

Amateur investors could only keep pumping one investment for so long. This year, they changed their tune.

GameStop shares remain 20 times higher than they were before the Reddit craze. But shares of AMC are back where they were before the mania began.

Take a look...

Many other high-growth companies with no earnings to speak of were favorites at the start of last year. So were a lot of cryptocurrencies.

And many of them are down big from when individual investors got in... like bitcoin, which has fallen 65% this year. XLK has dropped 25%. And the S&P 500 as a whole is down 17% year to date.

Now, amateur investors are turning to a new market darling.

The Reddit community has its sights set on 'junk' bonds...

The Reddit community has its sights set on 'junk' bonds...

Retail investors may be down, but they're not out. A recent Bloomberg article explained that these folks, burned by crypto and other investments, are looking for "pockets of opportunity" in distressed debt.

Junk bonds are also called high-yield bonds. They offer equity-like returns to debt investors.

But there's a catch. They're considered riskier than other bonds because they're not "investment grade." That's why junk bonds have higher yields. The companies that issue them are more likely to default.

The Reddit community seems to be downplaying the risk here.

You see, debt is usually considered safer than equity. Debtholders get paid before shareholders in a bankruptcy. And investment-grade debt – the kind issued by the biggest and safest companies – tends to be pretty safe.

But junk bonds don't fit that mold. These are the bonds of companies that could be at risk of bankruptcy. There are a lot of promising opportunities in distressed-debt investing... and plenty that you should avoid. If you don't know what you're doing, it's easy to get burned.

As a former investor for a cross-capital hedge fund, I'm worried...

As a former investor for a cross-capital hedge fund, I'm worried...

These investors likely don't understand the pitfalls of debt investing in general. And they especially don't know much about high-yield investing.

Assets like equities and cryptos are highly liquid. That means there's a lot of volume. You can trade in and out of them on a whim.

And there's not much of a difference between the price you're willing to sell for and the price buyers are willing to pay. (These are called the "ask" and "bid" prices.)

Bonds couldn't be more different... especially high-yield ones.

When the credit market froze up in 2008, the spread between the highest bid and the lowest ask surpassed $5. In other words, say we paid $67.50 for a bond. If we decided the bond was a ticking time bomb a minute later, we'd have had to sell it for $62.50.

That's the equivalent of a 7% transaction fee.

We're not saying all junk bonds are money pits. Done correctly, these can be lucrative investments... and they're less susceptible to day-to-day market volatility.

But as unbelievable as it is, this example doesn't even touch on the tangled game that many retail investors are playing.

A lot of them are incorrectly labeling bonds as high yield. They're really investing in speculative, distressed bonds and hoping for home-run payouts.

This brings us to another point about debt instruments...

This brings us to another point about debt instruments...

They're legal documents.

Once you reach the point where bonds are yielding more than 10%, fundamental analysis no longer matters. When yields get to 10%, 15%, and beyond, that often means the market has its sights set on bankruptcy.

All that matters is what the lawyers of all the big players think they can get out of restructuring or bankruptcy.

I already explained that debtholders get paid before shareholders in a bankruptcy. But the breakdown goes a step further...

Most of the bonds that the Reddit crowd is buying are what's called "unsecured." These have lower seniority than secured bonds, which tend to be held by banks and big investors.

This means in a bankruptcy, retail investors will likely be the last debtholders to get paid. And that's if any money remains up for grabs. They could end up with a big, fat zero.

That doesn't mean investors should stay away from all high-yield bonds...

That doesn't mean investors should stay away from all high-yield bonds...

The credit market is different from the stock market. Most folks aren't familiar with the ins and outs.

If you know what you're doing, investing in corporate debt can be safer than stocks. As I already mentioned, bonds are less susceptible to daily market volatility.

And as long as the company doesn't go bankrupt before your bond matures, it's legally obligated to pay you in full on a predetermined date.

But there are also a lot of risky high-yield investments out there. To be successful in the bond market, you have to be willing to put in the legwork.

That's exactly what Mike DiBiase and Bill McGilton do at our corporate affiliate Stansberry Research.

Each month in Stansberry's Credit Opportunities, they perform detailed analysis to guide you through investing in safe, high-yield bonds... And they share their thoughts and research on the credit market as a whole.

I caught up with Mike recently, and he said he's gearing up for a big bond prediction in the weeks to come. As soon as it's available, we'll be sure to pass it along to Altimetry Daily Authority readers. Be sure to keep an eye on your inbox later this month.

In the meantime, don't get the idea that all bonds are "safe" – no matter what the Reddit crowd tries to tell you. Most of these folks don't know what they're talking about when it comes to junk bonds.

Amateur investors have their eyes on risky distressed debt... the type that can be even more of a gamble than stocks. They're being foolish. Sooner or later, most of them will learn their lesson the hard way.

Do your research before pouring your money into new investment vehicles. There are plenty of promising opportunities out there. But you owe it to yourself to put in time and effort before you jump in.

Regards,

Rob Spivey

December 13, 2022

Many called 2021 the 'year of the individual investor'...

Many called 2021 the 'year of the individual investor'...