Editor's note: If you're not worried about the U.S. consumer, you're not paying attention...

All eyes are on the economy after the Federal Reserve's recent rate cut. Everyone wants to know the market's next move... but it's too early to be certain.

While we wait for rate cuts to play out, another troubling economic trend is still going strong. Today, we're updating one of our favorite essays from Chief Investment Strategist Joel Litman about consumer debt.

We originally published this essay a year ago. But as you'll see, these days, the U.S. consumer is looking shakier than ever...

Breaking records isn't always a good thing...

Breaking records isn't always a good thing...

And the U.S. economy is here to prove it.

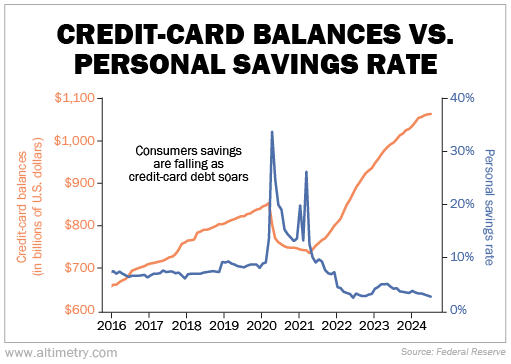

Last month, consumers passed a truly impressive $1.14 trillion... in credit-card debt. Higher interest rates are one reason for this. The average credit-card interest rate was around 16% pre-pandemic. Today, that number is around 25%.

That's tied for the highest rate in the 30 years since the Federal Reserve started tracking rates.

It's not just higher interest rates, though... It's also years of rampant consumer spending.

Credit-card debt has been on a roller-coaster ride since the pandemic started. It sat at about $850 billion in February 2020. By April 2021 – after three rounds of stimulus checks and folks spending far less money while staying home – balances fell below $750 billion.

Three and a half years later, spending has surged back with a passion. Credit-card debt is up more than 52% since the 2021 low.

America's new record is a sign that the consumer is finally losing steam. Today, we'll explain why that could put further pressure on the economy... and why more pain could be on the way.

The U.S. government threw the kitchen sink at the pandemic-era economy...

The U.S. government threw the kitchen sink at the pandemic-era economy...

It provided $4.6 trillion in stimulus to help folks keep money in their accounts. As a result, the personal savings rate shot up like a rocket ship.

Then, the world reopened. Folks returned to their old habits... and spending ramped up with a vengeance. They turned their lockdown-induced energy toward industries like travel, restaurants, and retail.

Ed Bastian, CEO of air carrier Delta Air Lines (DAL), noticed the trend. In 2023, he asked his team to measure pent-up spending in areas like food, travel, and hotels over the previous three years. They estimated it was about $300 billion.

The economy benefited from all that "revenge spending"... for a time. However, a spending spree of that magnitude can only last for so long.

Since the start of 2022, personal savings rates have been low. They're close to levels we saw from 2005 to 2007, before the Great Recession.

And credit-card debt is back with a vengeance. Balances are now at all-time highs.

Take a look...

When folks have less money saved up, they're not able to spend as much on non-necessities.

We're entering the biggest shopping period of the year... so this upcoming quarter will tell us a lot about the state of the consumer.

That said, don't expect much encouragement...

Consumers are getting worried about the future...

Consumers are getting worried about the future...

They're expected to slow down spending across almost every spending category this quarter. And with the student-loan "on ramp" period wrapping up, consumer balance sheets could take an even bigger hit soon.

The Federal Reserve cut rates two weeks ago... but rate cuts take time to work their way through the economy. In any event, it's a sign that the Fed is starting to worry about an economic slowdown.

And considering consumer spending is the engine of the U.S. economy, all of this is a huge warning sign.

You wouldn't know it if you just followed the stock market. The S&P 500 is up 20% this year. Such strong returns make it seem like nothing's going wrong.

Folks, the U.S. consumer can't spend like this for much longer. This is a time to exercise caution.

A fall in consumer spending could mean serious problems for the U.S. economy. And it could bring fear right back into the stock market.

Regards,

Joel Litman

September 30, 2024

P.S. The stock market's next move is a giant question mark. And if you're only focused on stocks, you're doing your portfolio a grave disservice...

One of my all-time favorite investing strategies is heating up right now. It's an opportunity completely outside of equities – meaning you don't have to worry about the stock market's ups and downs.

And the best part is, it involves far less risk than stocks... plus a legally promised income stream while you wait to lock in gains.

I believe this could be the single best investment in the world over the next three to five years. New subscribers who act now can access our research for 50% off the regular price, plus $8,400 worth of free tools and bonuses. Get started right here.

Breaking records isn't always a good thing...

Breaking records isn't always a good thing...