Aluminum prices are surging again in China, but not for the usual reasons...

Aluminum prices are surging again in China, but not for the usual reasons...

Since China threw construction into overdrive two decades ago, its economic policy decisions have dramatically impacted the prices of many of the world's most important raw materials.

The country has ramped up investment in its infrastructure and built massive megacities, which led to unprecedented levels of economic growth. It's also causing demand for industrial metals and energy to soar.

Prices for copper, aluminum, coal, and iron ore – an input for making steel – reached all-time highs, leading many to dub the early 2000s as a commodity "supercycle."

While in the past, this vociferous demand for commodities was due to a rapidly growing economy, today, it looks like China is affecting commodity prices once again. But for a very different reason...

During its booming growth period, China invested heavily in adding to its own commodity production capacity. But the country doesn't want to rely on imports from the rest of the world to fuel its rise...

As a result, China is now one of the largest producers of nearly every industrial commodity, meaning disruptions in the country that alter supply or demand have a major effect on global prices.

This has been happening recently with aluminum, one of the global economy's most important metals, used in everything from beer cans to airplane manufacturing.

What you may not know about aluminum is that one of its most important inputs, along with bauxite and alumina, is electricity... And the industrial process for making the metal is power-intensive.

That's why outside of China, you only see aluminum produced in low-cost power regions such as Quebec in Canada, with its hydroelectric power plants, or in Iceland, which has an abundance of geothermal energy.

Currently, China is rationing power in more than half of the country's 23 provinces. Low coal supply and strong demand, along with the central government's push for stricter emissions targets, have led to the country's rolling power outages – especially in energy-intensive industries such as aluminum and cement.

The price of aluminum has skyrocketed higher over the past year, up from $2,500 per metric ton as recently as late July to around $2,900 today.

Higher aluminum prices could mean dollar signs for non-Chinese producers...

Higher aluminum prices could mean dollar signs for non-Chinese producers...

While commodity price spikes are yet another example of the same kind of short-term inflation that we talked about on Monday, it could mean big profits for domestic aluminum makers that have struggled to compete with China for years.

One example is Century Aluminum (CENX), a Chicago-headquartered aluminum producer operating in Kentucky, South Carolina, and Iceland.

While Century Aluminum operates at an extraordinarily low cost in its Iceland smelting plant, which is fueled by cheap geothermal power, most of its assets are in the higher-cost U.S. The company has struggled to make any money over the past decade.

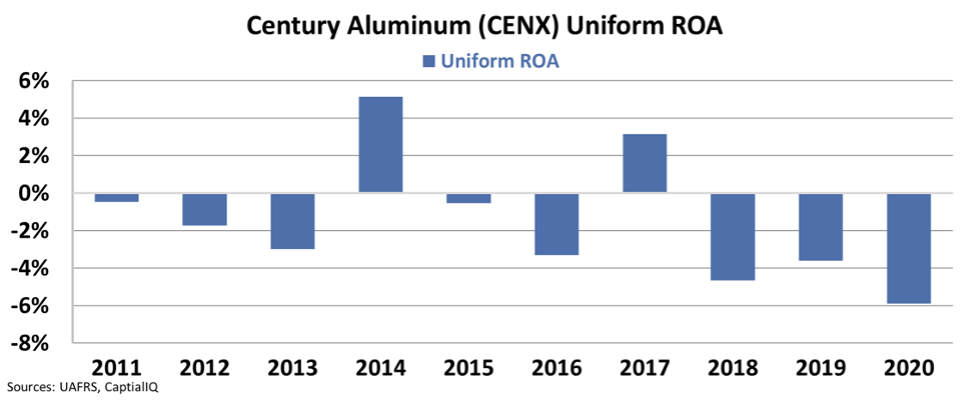

Looking at Uniform Accounting, we can see that Uniform return on assets ("ROA") has, in fact, only been positive in two out of the past 10 years. This makes it look like domestic aluminum producers simply can't compete with China.

Is Century Aluminum a good stock to buy?

Is Century Aluminum a good stock to buy?

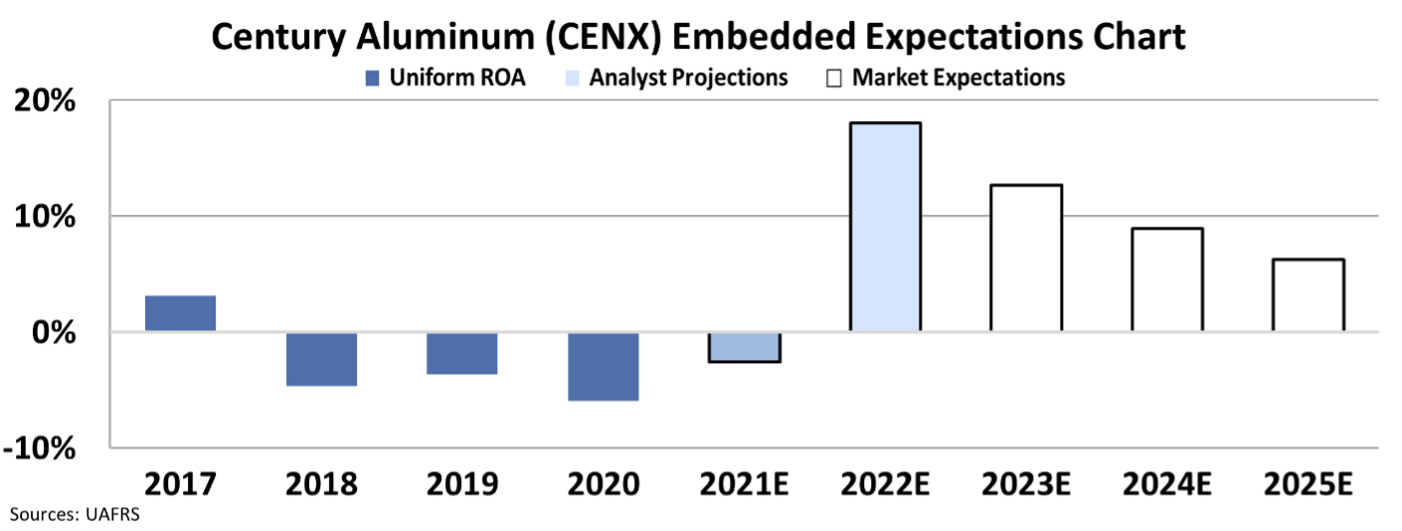

With aluminum prices rising, there may be an opportunity for Century Aluminum to start generating profits again. Wall Street analysts who cover the company are forecasting Uniform ROA to turn positive in 2022.

A positive inflection might get investors excited about Century Aluminum. That said, anyone chomping at the bit should take a pause. It looks like the market has already figured out the aluminum price tailwinds for the company.

Fortunately, by utilizing our Embedded Expectations Analysis ("EEA") framework, we can get a good sense of exactly what the market is pricing Century Aluminum to do.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, with our Embedded Expectations Framework, we use the current stock price to determine what returns the market expects.

In the chart below, the dark blue bars represent Century Aluminum's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift over the next five years.

We can see that the market is already pricing Uniform ROA to stay positive at around 6% levels moving forward. That's something Century Aluminum has not maintained a single time over the past decade. At these levels, the company looks fully priced for aluminum price inflation.

So even though Chinese aluminum producers are struggling with energy shortages and power cuts, investors shouldn't rush to U.S. alternatives because prices are rising.

Without looking at the real numbers, it's difficult to decipher which companies will break out of the pack and unlock real value...

Without looking at the real numbers, it's difficult to decipher which companies will break out of the pack and unlock real value...

It's these hidden corners of the stock market where you can make double- and triple-digit gains.

In our Altimetry's Microcap Confidential newsletter, we put our Uniform Accounting analysis to work to identify stocks that are primed to be big winners...

And while Century Aluminum may not be a buy, we did identify another global materials producer with upside in our Microcap Confidential portfolio. In fact, this company has yielded double-digit gains since our initial recommendation two months ago...

You can learn more about our Microcap Confidential newsletter by watching my brand-new presentation. In the video, I detail a different stock in the portfolio... but one that is on course for triple-digit gains by December 31. Watch the video by clicking right here.

Regards,

Joel Litman

October 27, 2021

Aluminum prices are surging again in China, but not for the usual reasons...

Aluminum prices are surging again in China, but not for the usual reasons...