The coronavirus pandemic has crushed many industries...

The coronavirus pandemic has crushed many industries...

None have taken a greater hit than the airline sector. Demand cratered in April, and the recovery has continued to stall. Experts see air travel for 2020 at only 60% to 70% of last year's level, at best. Some estimates don't see demand returning to pre-pandemic levels until 2024.

This lower demand isn't the only pressure to airline profitability. Carriers also need to take steps to reduce the spread of coronavirus. Many airlines have kept middle seats empty to comply with social distancing rules. Additionally, they've updated ventilation systems to make it difficult for the virus to spread on flights.

These factors have caused revenue and profits to tumble this year. Even with government stimulus, the airlines have laid off tens of thousands of employees in an effort to cut costs.

Airlines have also reduced the number of flights offered. This has led to a massive number of planes moving into storage.

And storing an airplane isn't as easy as just parking it on the tarmac... Airplanes are complex machines and have specific needs, even while mothballed.

The storage space can't be too hot or too cold. Planes also need constant maintenance to ensure they can fly again in the future. This means that specialty airplane parking lots are filling up at a record rate.

For example, as Bloomberg recently highlighted, one remote Australian lot holds more than 100 jets and is looking to expand its capacity again this year. An employee anticipates this number will eventually expand to 200.

This lot and many others expect to be operating at extended capacity for months to come, if not for even longer.

The airlines' struggles are spilling over into other industries that rely on airlines and air travel...

The airlines' struggles are spilling over into other industries that rely on airlines and air travel...

One of those is aircraft leasing. Many airlines don't want to shoulder the burden of buying and owning planes. Instead they lease their aircraft from dedicated leasing companies.

Today, AerCap (AER) is one of the largest aircraft leasing companies. The company owns roughly 1,000 planes and leases them to multiple airlines.

Last year, we examined the company from an equity perspective and determined it was more expensive than as-reported metrics had let on. Since then, AER shares have fallen roughly 30%.

So today, in light of the industry headwinds, let's take a closer look at AerCap's debt. The main concern for debt investors is whether the company will have the cash flows to pay off obligations.

To continue to remain liquid, AerCap needs the airlines to continue honoring contracts.

If airlines begin to break the contracts, AerCap could lose a significant amount of revenue. With airlines looking for ways to cut costs, this is a big issue.

Moreover, 50% of AerCap's book value comes from wide-body jets. These are planes that seat up to 10 passengers in a row, compared to six in a narrow-body aircraft. They tend to fly higher-volume and longer routes. Because of this, demand for wide-body jets has declined even more severely than demand as a whole through 2020.

Companies like Boeing (BA) are already planning on making fewer of this style of aircraft over the coming years. That means wide-body jets will have a particularly slow recovery and are more likely to have their contracts broken.

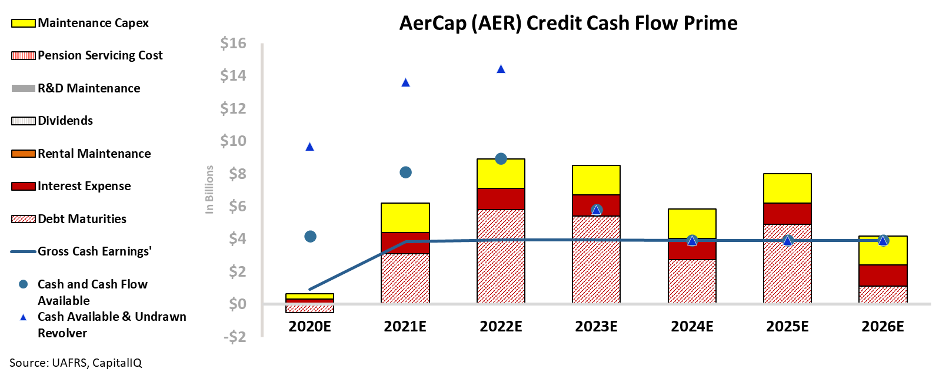

And yet, even with these significant headwinds, credit-ratings firm Moody's (MCO) gives AerCap a "Baa2" rating – an investment-grade credit. However, looking at our Credit Cash Flow Prime ("CCFP"), it's clear that AerCap is set up for some tough years ahead...

In the chart below, we break down this difficulty. The stacked bars are AerCap's obligations each year for the next seven years. We compare this to the company's cash flow (blue line) and cash on hand at the beginning of each period (blue dots).

The bottom bars are the hardest obligations for AerCap to "push off" – costs such as debt maturities and interest expense. The higher bars represent more flexible obligations, like maintenance capital expenditures ("capex") and share buybacks.

As our CCFP shows, AerCap will likely lack the cash to pay off all its obligations between 2023 and 2026.

And it's not just that AerCap won't be able to pay off its obligations in those years... It's which obligations AerCap may struggle to pay off.

With AerCap's multiple debt maturities over the coming years, there are several years where cash flows and cash on hand won't just fall short of controllable spend like capex... They'll fall short of interest expense or debt maturities. These are much harder obligations to push off.

To pay them off, AerCap will likely need to refinance. However, considering that its assets aren't in high demand, the company may be forced to refinance at unfavorable rates.

Due to these consistent debt maturities, we give AerCap a "HY1" (equivalent to "Ba2") rating. Although only two notches lower than the Moody's rating, it takes AerCap out of the investment-grade space and puts it in the riskier, high-yield category.

By using Uniform Accounting and sorting through the "noise," we can see the company's true debt profile. Once we break down AerCap's obligations, it's clear that the company is on shaky footing.

Regards,

Joel Litman

December 2, 2020

The coronavirus pandemic has crushed many industries...

The coronavirus pandemic has crushed many industries...