A quick video on Roku...

A quick video on Roku...

Yesterday, we mentioned that Altimetry Director of Research Rob Spivey had hosted a webinar for our institutional clients on Friday, where he discussed streaming-device maker Roku (ROKU) and other tech and broadcasting names.

We've discussed Roku before, so we wanted to give you access to the video. Rob was taking our institutional clients through how to analyze the company on our institutional platform.

To watch the video, click here.

We've previously written about the complicated auto-parts industry...

We've previously written about the complicated auto-parts industry...

Earlier this month, we discussed replacement-parts distributor LKQ (LKQ).

We like LKQ because demand for replacement parts tends to stay strong, if not improve, during periods of economic recession.

Just as important, though, is that LKQ is a parts distributor, not a parts maker.

Our sheepishness around parts makers dates back to my consulting days.

When I worked for "Big Four" accounting firm Deloitte, I had the fortune of consulting for several auto-parts makers.

Dana (DAN), a maker of brakes, axles, and other parts, wasn't able to avoid bankruptcy as the U.S. auto industry hit a major snag during the mid-2000s.

TRW Automotive, at the time one of the biggest and most profitable parts makers in the country, saw earnings fall 50% during the same period.

If there's one thing I learned while working with some of these companies, it's that no parts maker is safe...

Except for one.

Fundamentally, it's expensive to design, manufacture, and distribute auto parts. These companies are sensitive to raw-material costs, they're sensitive to the automakers, and they can easily be squeezed in the middle – as car companies seek to take their profits for their own, at the same time, raw material costs can inflate their costs of goods sold.

However, if there's one thing the carmakers will pay for, it's safety. Nobody messes around when it comes to airbags.

My colleagues at Deloitte made a point to highlight how profitable safety can be. At the same time when so many parts makers were failing, the airbag remained a profitable enterprise. I saw it firsthand with auto parts, but the same principle is true elsewhere.

Within the housing industry, for example, homebuilders tend to be sensitive to the broader economy for the same reasons as parts makers and car companies. Given the increasing recessionary fears in the market, all of the major homebuilders look cheap.

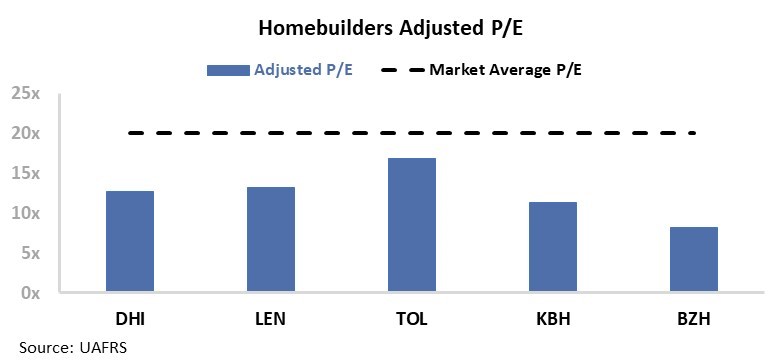

Below is a chart of the Uniform price-to-earnings ("P/E") ratios for the five largest homebuilders – D.R. Horton (DHI), Lennar (LEN), Toll Brothers (TOL), KB Home (KBH), and Beazer Homes USA (BZH). As you can see, they all trade at well below market-average valuations.

Despite all of the homebuilders trading at a discount to market averages, investors do not treat every company exposed to the housing market the same.

Much like the airbag in the auto industry, there's a safety-oriented company in the housing market that does not follow the same trends. You can thank this company for the locks on your home.

Allegion (ALLE) makes a variety of home-based security products, from traditional locks to tech-enabled security devices.

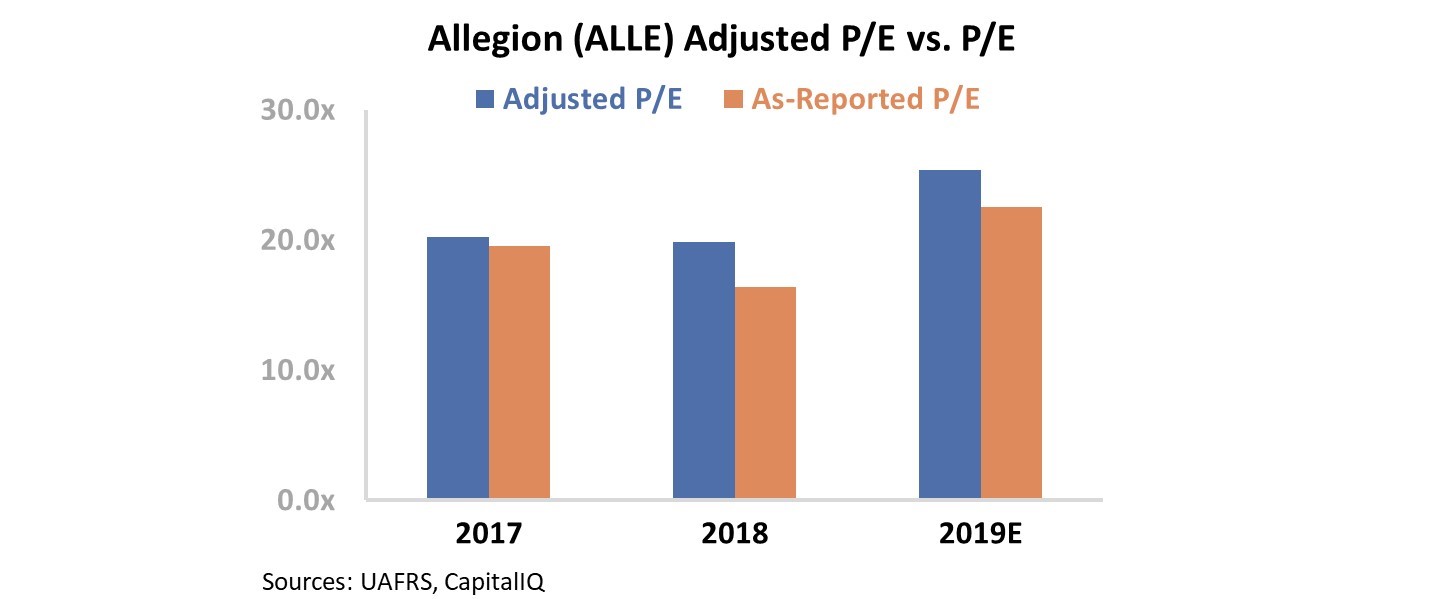

Companies that supply homebuilders have fared much better in the stock market in recent years. While the biggest homebuilders have become cheap relative to the market, you can see in the chart below that Allegion remains at premium valuations.

At a Uniform P/E ratio of 25, the company trades above market-average levels of 20.

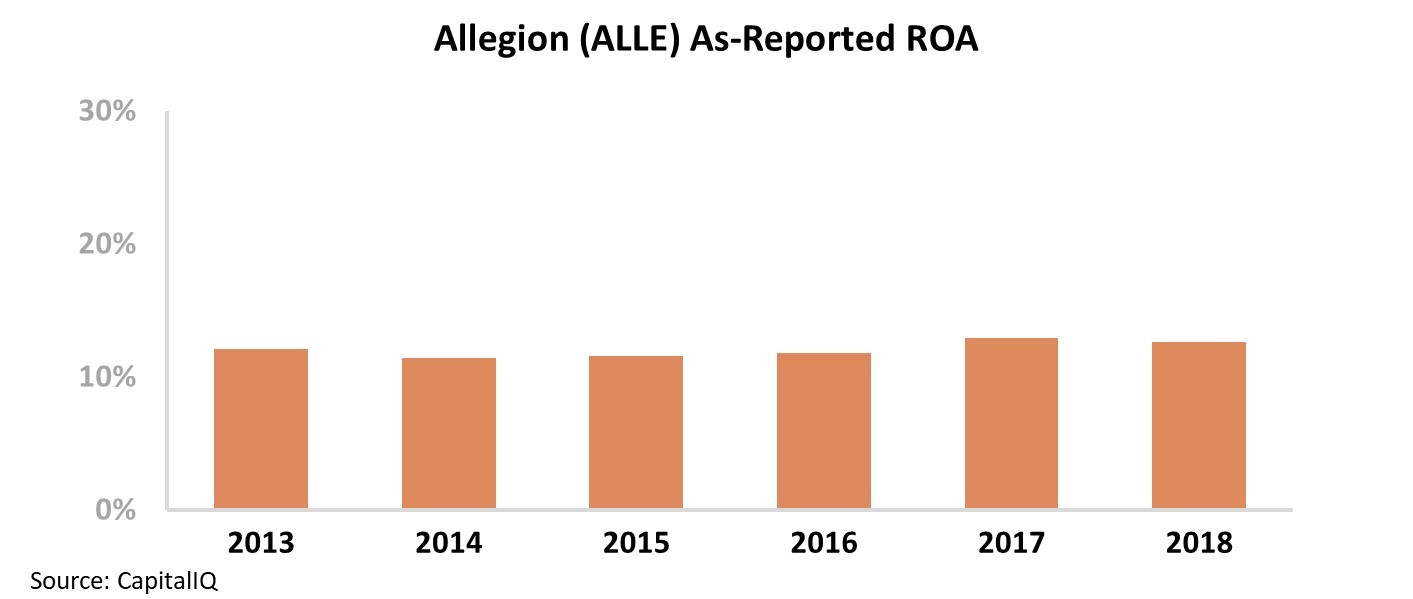

But Allegion looks like a fairly average company on an as-reported basis, with its return on assets ("ROA") in the 12% to 13% range in each of the last six years. Take a look...

While certainly stable, these returns are not particularly inspiring. However, the as-reported financial data miss a big part of the story. You see, Allegion has acquired a number of smaller home-security companies, which leads the business to have a lot of goodwill on the balance sheet. This can make companies like Allegion look less efficient with their assets than they really are.

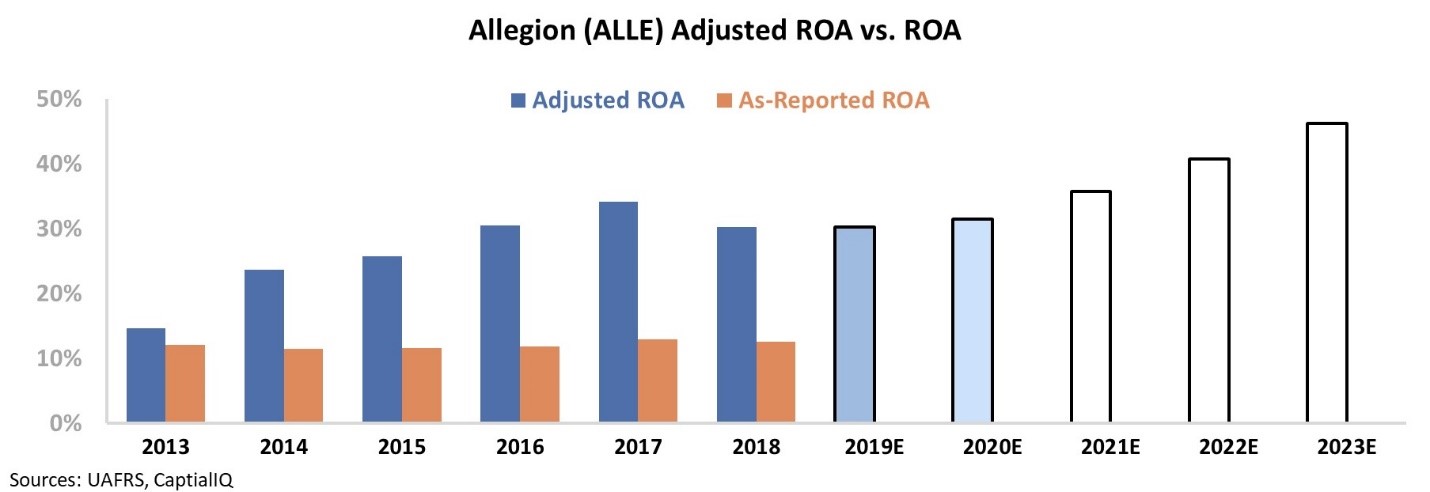

Once we apply our Uniform Accounting metrics – adjusting for accounting issues around the treatment of items like goodwill, operating leases, and stock option expenses – we can see why Allegion may truly be the airbag manufacturer of the housing market.

The chart below explains the company's Uniform historical corporate performance levels in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars). Take a look...

Instead of a company with average and level returns, Allegion is a strong and improving business.

This also is more in line with current valuations.

Even though companies like Allegion directly supply homebuilders and have a lot of the same exposure, the market is pricing the suppliers for success and the homebuilders for failure.

Clearly, the market is right about either the homebuilders or Allegion... but not both. It is unlikely that we're going to see strong demand for Allegion's services and products if we're not also seeing a strong secondary housing market, renovations, and importantly, home starts – which drive homebuilder demand.

Regular readers know our opinion on where we are in the economic cycle, and what that might mean for which one is right. We still have plenty of tailwinds, and the markets appear too pessimistic about the homebuilders.

Without Uniform Accounting, it might be difficult to make the connection between market valuations and corporate performance.

Regards,

Joel Litman

November 19, 2019

P.S. We just released the latest issue of our new research service, Altimetry's High Alpha. In it, we discuss a stock with triple-digit upside potential ahead as the market's concerns about this company blow over... giving us an opportunity to get in at an attractive price. You can get access to High Alpha – and our latest recommendation – right here.

A quick video on Roku...

A quick video on Roku...